Estate or, succession planning is perhaps the most neglected part of financial planning. Our desire on departing from this world is to leave behind inheritance for dear ones or for causes dear to us. In the absence of a succession plan, we would be leaving behind a mess and possibly disputes instead of inheritance. Writing a will is perhaps the simplest way of doing this. But there are many ways of putting in place a succession plan. As an instrument of succession planning, a trust helps to pass on wealth even during one’s life time. In fact a trust could be set up in combination with a will, say to manage the funds set aside for charity or take care of specific needs of a mentally challenged child. Wealthy families go in for Family Settlement Agreements, partnerships or even limited liability companies in lieu of a will. But chalking out the contours of a trust (as laid out in the trust deed) or a family settlement agreement or setting up limited liability partnerships/companies, requires legal expertise and could cost money. Also, unlike a will, a trust and a family settlement agreement have to be registered. The following sections discuss the mechanics of setting up a will. They are, however, followed up by articles on setting up trusts and on issues owners of businesses should keep in mind while crafting a succession plan.

The simplest and cheapest way of bequeathing one’s estate is through a will. But a has to be comprehensive, unambiguous and precise and complete, since, a will has to “speak from the grave”.

Given that increasing number of our clients preserve a lot vital information and documents electronically it would be necessary for the will to provide links and passwords to e-mail ids, folders and e-lockers with Insurance and property documents, recipes and patents among others.

Estate planning would also have to consider and provide for certain contingencies, such as loss contractual capacity because of loss of mental faculties or severe physical debility. In the event of simultaneous death of both parents with minor children, a natural guardian may not be available to take care of the children and guardianship in such cases has to be testamentary or certified. It is therefore advisable that such parents write out a ‘letter of guardianship’ along with the will.

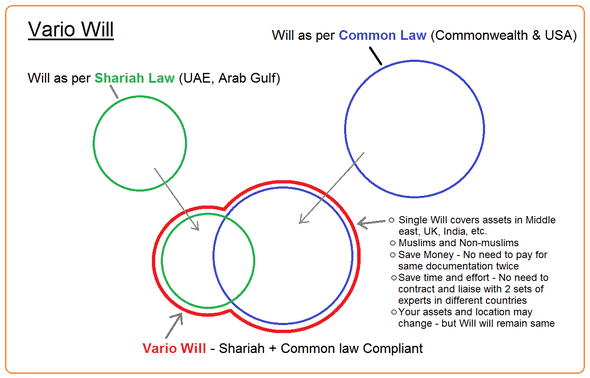

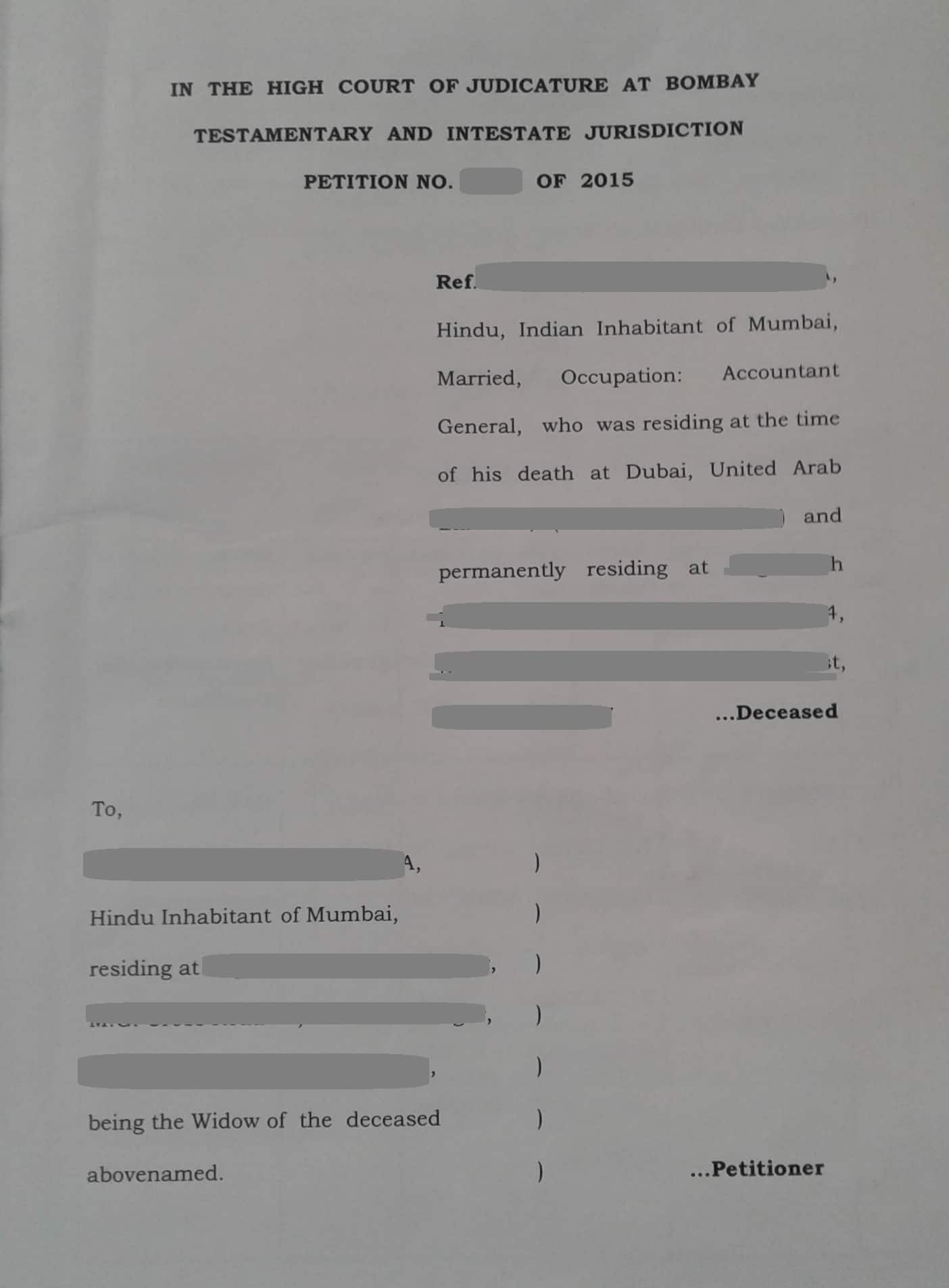

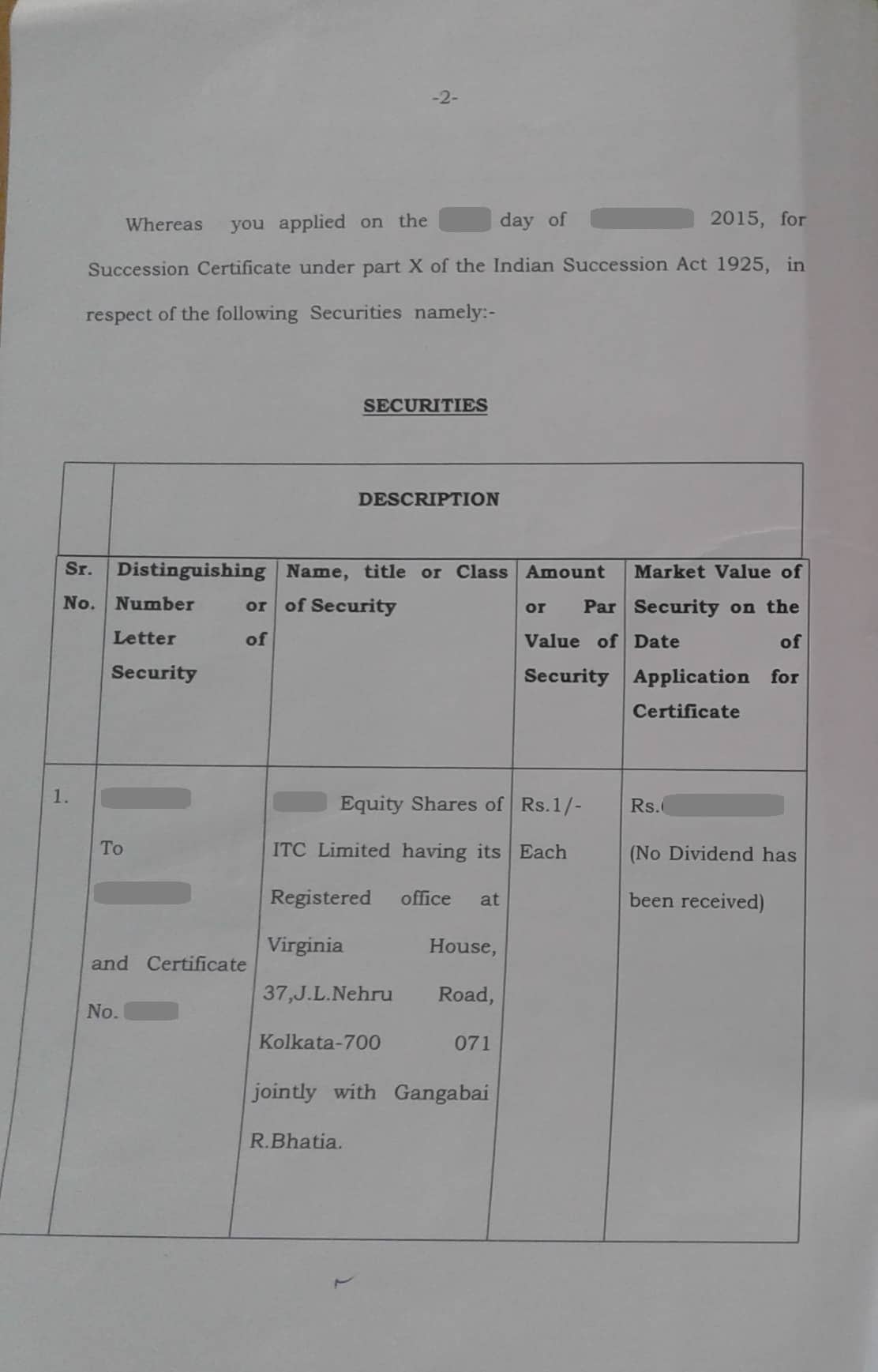

A will has to be tailored as per law of the place/country of residence.The following sections provide some more details on the issues touch upon above.