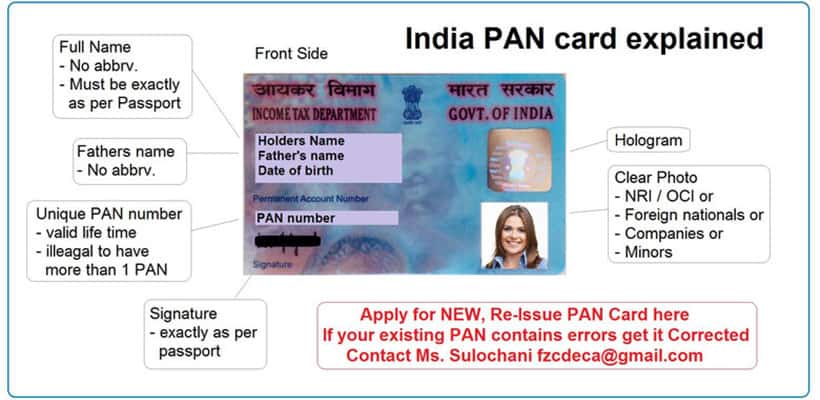

Permanent Account Number (PAN) refers to a ten-digit alphanumeric number, issued in the form of a laminated card, by the Income Tax Department in India.

PAN – Permanent Account Number

In case of PAN for foreign companies email us apostiled or attested copy of company registration / license, company bank statement, not older than 3 months, with at least 1 transaction, bearing address of company.

For PAN card for NRI, OCI :

Email passport copy, visa page (if available) & address page. We will check and confirm back

Make payment.

Guaranteed delivery | On time delivery | Worldwide delivery

Pancard for NRI, Company, New, Reissue, Modify

- General Info: New PAN Card, Duplicate or Reissue of lost Pancard, Correct, Rectify, Modify, Update, Change of name, address, photo, email etc. PAN card for Foreign passport holders with or without OCI or PIO and PAN for Company. We are authorized agents serving clients worldwide. We co-ordinate with Income tax department, tin nsdl, uti online.

- Who can apply, from where? individuals with Indian passport, foreign passports, NRI, OCI, PIO, minors, HUF, foreign companies. Card will be delivered in India or Overseas wherever you are eg: UAE (Dubai, Abudhabi etc), US (New york, Boston, LA, Orlando etc), UK (London, England etc), Canada, Australia (Perth, Melbourne, Sydney, Brisbane), Qatar, Oman, Saudi, Kuwait, Oman, France, Singapore, Malaysia, South Africa, Netherlands, New Zealand etc

PAN status verification, acknowledgement, AWB tracking Center

- To Check Status : Status 1 , Status 2 , Status 3

- To Check Complaint Status : Complaint Status 1, Complaint Status 2

- Track Delivery : Track India, Track All World

Why use Arunanjali PAN Service agency

GUARANTEE delivery | ON TIME delivery | Govt. Tracking No. | Correct AO number and inputs as per IT Dept (Govt.) guidelines by trained officer | Serving customers worldwide | Certified pan card agents & dealers.

Most NRI’s do not have the time or expertise to find the correct form (there are 3 different form to download in pdf, 49a, 49aa, modification), find out correct AO codes, fill in details correctly,process without errors, follow up with IT department, answer IT dept queries, ensure receipt of Acknowledgement number, Dispatch AWB and delivery status verification, without assistance. Arunanjali does all this for you and helps you to obtain a PAN card with ease.

Caution: If you already have a PAN but your address, photo or email has changed, or if your name / sign / AO number is incorrect, please get it corrected to avoid legal complications