Retirement Planning

- May 6, 2024

- Posted by: Arunanjali Securities

- Category: Business

There are countless people who saunter through life and muddle through many a crises and when overwhelmed by challenges, scream for help from all and sundry or seek solace from the good book which says: “Look at the birds of the air: They do not sow or reap or gather into barns; your heavenly Father feeds them. Are you not of more value than they?” (Matthew 6:26). Few would, however, concede that they have utterly failed in being prudent and diligent in planning for the future. But then devil can quote the Bible and as Devil’s Advocate one might as well make a counter point by quoting from the Proverbs: “The plans of the diligent lead to profits as surely as haste leads to poverty” (Proverbs 15:22).

So what do we do? Muddle through life or anticipate and plan to face likely challenges as best we can? This is a choice we have to make, at least those of us who would strive to have a purposeful life. A necessary, though not sufficient, condition to ensure a purposeful life is to have adequate financial resources to take care of our needs and of those around us, particularly in our sunset years. This would call for delineating goals to be achieved at various stages of life and of course, even beyond life (through a succession plan for instance). One such goal could be to build a retirement corpus which would involve careful calculation of savings and the quantum and mode of investment required to meet that goal. The figures that flow from such a planning exercise are not from the magical abacus of some financial magus, but from a simple formula to compute compound interest that we all grappled with in our school days, which is F = P(1+r) , where F is the future value, P is the present value (principal), r is the rate of return (generally annual) and n is the number of compounding periods (generally in number of years). Anybody with access to the now ubiquitous smart phone or a laptop could compute the outcomes of the above formula through apps or MIRR functionality on the spreadsheet, with ease.

Data Inputs:

Age: 30 years. Retirement age: 60. Current monthly expenses: Rs 50,000. Likely average annual inflation: 6%.

Likely monthly expenses 30 years from now, after factoring in inflation as above: Rs 2,87,175 resulting in an annual expense of Rs 34.46 lacs.

To fund the above annual expenses, one would require an investment corpus of Rs 3.45 crores assuming a rate of return of 10% p.a.

Steps to Achieve The Goal: While the size of the corpus of Rs 3.45 crores may appear daunting, a consistent and disciplined approach as suggested below could make accumulation of such a sum a viable proposition even for the average investor.

| SIP (Systematic Investment) per month in Nifty Index Fund | Rs. 6500 |

| Return (10 year rolling return for Nifty since 1999) | 14% |

| Total amount invested over 30 years | Rs. 18 lacs |

| Corpus (accumulated amount) at the end of 30 years | Rs. 3.5 crores |

Post Retirement Challenges: A closer scrutiny will, however, show up some flaws in the preceding, what appears to be a complete plan. For one, there is the question of post retirement inflation. If we assume that inflation is likely to persist even after retirement, at 6% per annum, it would mean that in the very first post retirement year, a provision will have to be made to meet additional 6% of Rs Rs 34.46 lacs which is over Rs 2 lacs and this will keep increasing each subsequent year. This would require a higher retirement corpus, which might warrant either higher SIP investments, or a longer saving period or, a combination of both. One way to overcome this problem would be to increase the SIP every year, in keeping with the generally increasing income level during one’s active career, or by cutting down expenditure. The results of such disciplined savings and investment, even with affordable sums would be quite encouraging.

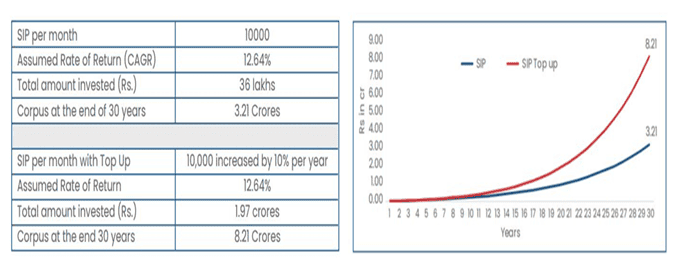

Let us reckon with a slightly higher monthly SIP of Rs 10,000 to be increased by 10% every year. Although over the last 44 years BSE Sensex has given a compounded annual return of over 16%, let us err on the safer side and adopt a more conservative rate of return of 12.64% which is the 10 year rolling return for BSE Sensex between 01.06.13 and 30.05.23. The results of such an investment plan are summarized below.

It can be seen that the monthly SIP of Rs 10,000 with annual top up of 10% generates Rs 5 crores in excess of what regular (without top up) would have achieved. The excess amount if invested at a return of 10% would generate Rs 50 lacs additional annual cash flow which would be adequate to cover both inflation and longevity risks.

L’chaim!