Primary Market – Out of the Cocoon & Fluttering

- December 23, 2023

- Posted by: Arunanjali Securities

- Category: Business

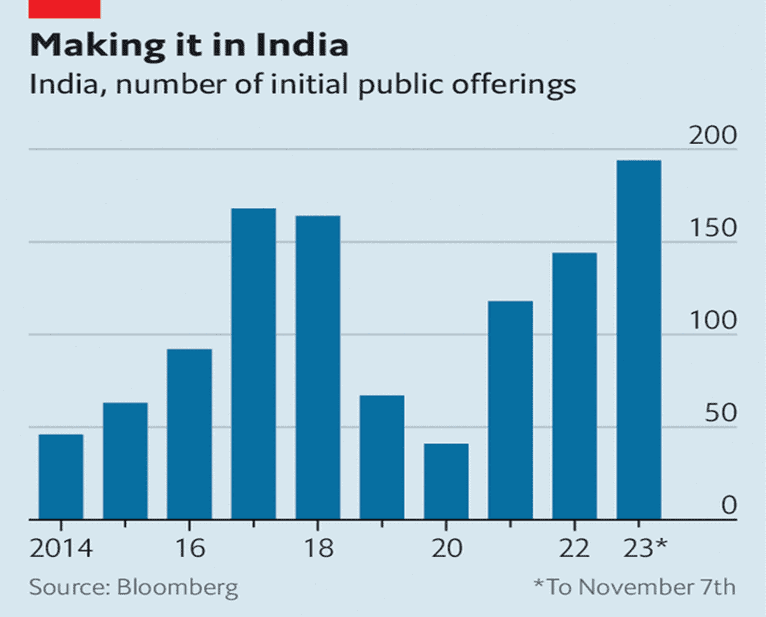

Gradually, unobtrusively the Initial Public Offer (IPO) market in India is undergoing quite a few changes and most of them for the better. The quarter ending September 23 has been the best ever since 2014

New companies entering capital market is essential for a vibrant, innovative and growing economy. Some of the well known bigtech companies straddling the globe today are all relatively young. Microsoft and Apple are both less than 50 years old, Google and Netflix are about 25 years, while Uber and Airbnb are 14 and 15 years, respectively.

In India the primary market is witnessing IPOs from diverse sectors. Start-ups like Zomato (Foodtech), Paytm (Fintech) and Freshworks (Software-as-a-Service) have had successful listings. In 2022 a whole lot of defense companies hit the capital market when the sector was much sought after. These companies have so far given decent returns. But noteworthy feature of the IPOs in the latest quarter is the diverse array of sectors from which IPO companies have emerged. These include hospitality, small finance banking, biotechnology and supply chain management, infrastructure, cable manufacturing and as well as apparel & jewellery. There have also been old world, run-of-the-mill companies like Cello World (subscribed over 40 times) making “tiffin” boxes and moulded furniture joining the bandwagon which have benefitted from India’s growth story rather than from writing it. But the big picture indicates a departure from the past when a single sector tended to dominate the primary market when a popular trending theme caught market fancy. Moreover an analysis of IPOs in 2023 on BSE and NSE shows that while issue sizes are shrinking, the industries from where these offers originate are becoming diverse along with geographies from where companies are seeking such funds. Half of the primary offers on the main board of BSE and NSE are from smaller cities like Davangere, Nashik and Jaipur.

Another heartening development is that 88 per cent cited corporate general purposes as the objective of the IPO implying that they will be using the funds for business expansion. It is encouraging to see that now the big corporates also raring to join the party as they hive off maturing innovative segments incubated in-house. TVS Supply Chain Solutions is the first company from the group to hit the capital market in nearly 30 years. The Tata group after nearly 20 years is tapping the tapping the capital market with Tata Technologies, a subsidiary of Tata Motors. Besides plans are afoot for the IPOs of Tata Sons and Tata Play (erstwhile Tata Sky). Investors are also eagerly awaiting offers from NSE, NSDL, Asianet Satellite Communication, Bhart FIH and Fab India.

With development getting widespread and variegated, primary market has got broad based in tandem. Early stage enterprises along with Small and Medium enterprises are also flocking to the capital markets through the dedicated listing boards of the BSE and NSE. After Finance Minister Nirmala Sitharaman in her 2019 budget proposed the idea of Social Stock Exchange (SSE), both BSE and NSE are offering SSE platforms with each of them having onboarded more than 30 entities. SSE is a separate segment that helps social enterprises raise funds from the public. Social enterprises are of two types Not-for-Profit and for profit social enterprises which are governed under specific statutes and rules. It is still a nascent activity but has shown promising growth during the last couple of years.

And there is the trivia spawned by the frenzy in the primary market. As promoters, particularly of start-ups, dilute their holdings through primary market, quite a few of them have quietly walked into the India’s elite billionaire club. Ramesh Kunhikannan who holds 64 per cent stake in the Mysuru based Kaynes Technologies, boasts of a net worth of Rs 8200 crores as the shares of the company recently crossed Rs 2650 as against the issue price of Rs 587 in November 22. Similarly Ranjit Pandurthi’s wealth is estimated at Rs 4700 crores after the successful IPO of Archaen Chemicals while Ajay P Thakker & Family have surpassed a net worth of Rs 3000 crores after the stock market debut of their company Jupiter LifeLine Hospital. Then there are promoters who ran into headwinds after their IPOs but have now made a come back. Deepinder Goyal of Zomato and Yashish Dahiya of PB Fintech for instance, have found their wealth increase by 70 per cent suggesting that the start-up kingpins, with all the hiccups will succeed in wealth creation.

SEBI certainly, has played a constructive role in bringing about the much needed shift in the primary market by making fund raising in the primary market more transparent, cost effective and speedier. By tweaking the ICDR (Issue of Capital and Disclosure Requirements) Regulations, issuers who do not meet specified criteria, are required to make their offers through book-building process wherein 75 per cent of the shares are reserved for QIBs (Qualified Institutional Buyers). If the QIB is quota is not filled, the issue is withdrawn. The idea is to help retail investors in spotting quality IPOs with institutional lead. When it was observed that the range between price bands offered under the book-built route was so narrow that it hardly facilitated competitive bidding and price discovery, SEBI specified a minimum range of 5 per cent between upper and lower price bands. Today there are many issuers who offer price band range of more than five per cent. Also to tackle the information overload SEBI has mandated 5 page abridged prospectus giving key details along with the IPO application. While SEBI has been doing its bit to improve the primary market, in the ultimate analysis, it is the growth in the economy coupled with the sheer energy of growing and variegated class of young entrepreneurs who will provide the vibrancy and range to the new issues which along with the old but rejuvenated business houses will hopefully, expand and deepen capital markets and consequently the economy. But at a time when the investors are engulfed by euphoria, it is prudent not to ignore likely risks. Remember 2007-08 when the markets were at their peak the world over just before the subprime crisis froze the global markets in 2008-09. But the frenzy in 2007 saw a 100 new issues. Sadly though only 11 of them are giving returns of more than CNX 500 Index now. More than 75 per cent of them are delisted, merged with others, or giving negative returns. Alas! There is no escaping the ruthless reality of caveat emptor.