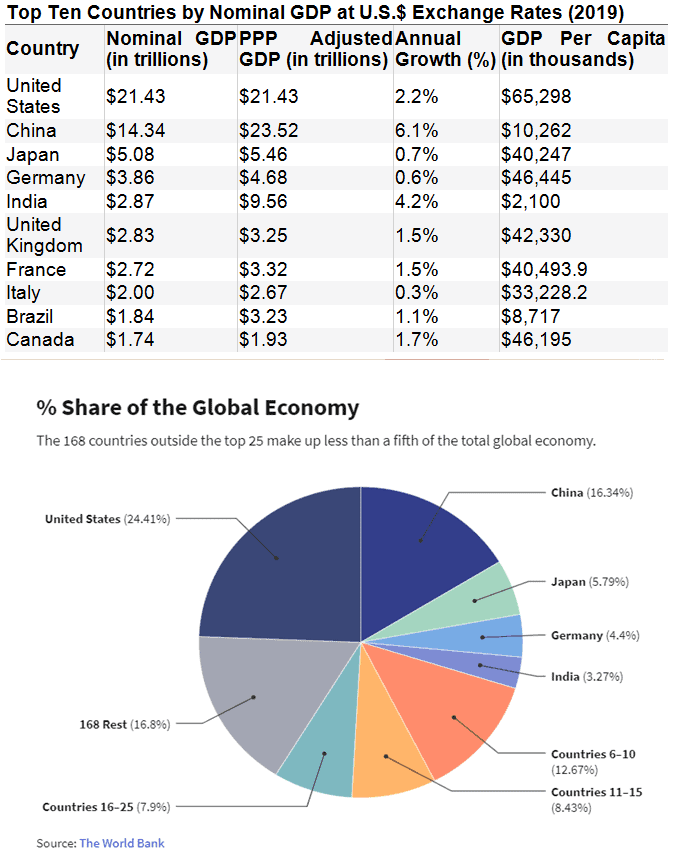

During early 2000s, economies of China and Brazil were growing at breakneck speed. Between 2003 to 2013, China’s GDP per person grew by more than five times, from $1,288 to $7,050. Brazil’s GDP per person also quadrupled during the same period, from $3,070 to $12,300. But by 2019, while China recorded a per capita GDP of $10262, Brazil regressed to a per capita GDP of $ 8717. Where does India stand in the GDP pecking order? As per data put out by the World Bank for 2019, India was the 5th largest economy in the world.

Points to Ponder. Will India’s Turn Ever Come?

- August 9, 2021

- Posted by: Arunanjali Securities

- Category: Business

But in terms of per capita GDP, India’s ranking was a dismal 144 out of 194 countries, which implies entrenched inequality in distribution of income and unsustainable population. Yet, we are given to flaunting many a claim to fame and proclaiming that we are a super power in the making even as people die in hundreds of thousands with a clueless government scrambling for vaccines to fight the pandemic.Notwithstanding the dissembling commitment to free speech, our state feels threatened by a feeble 84yearold Stan Swamy who died incarcerated, without recourse to any legal remedy and timely & adequate medical care.

The hypocrisy, or to put it more charitably, the schizophrenia of the ruling dispensation has spawned Orwellian “double speak”. Babus and Nethas alike, led by the PMO are tom-toming the improvement in India’s ranking in the mythical “ease of doing business” index and ostensibly resultant surge in foreign investments, even as Cairn Energy, a midget multinational from Scotland embarrasses the Government of India (GOI) with a court order, permitting it to seize GOI properties in France. The signalling, it appears, is deliberately garbled and polemical, with the GOI actions still not making it clear if foreign investments are welcome or not. On the one hand we brandish schemes like PLI (Production Linked Incentive) to attract foreign investment and on the other we seem to hate it. What else would explain hanging on to theinfamous retrospective amendment to the tax laws explicitly targeting global businesses which had invested billions of dollars in India, and in compliance with the rules of the land at the time the investments were made?

Despite being the 5th largest economy in the world, India accounts for about 30.8% of world’s stunted children. One in five children in India is also wasted and underweight. Undernourished children struggle to stay healthy and find it hard to catch up with their peers in classrooms and at workplace.India is one of the most unequal countries in the world with the top 10% controlling 55% of the total wealth against 31% in 1980, according to the 2018 World Inequality report. The bottom 50% control only 15.3% of the total wealth. The report shows that while the wealth of top 1% has been increasing since 1980s, the wealth of bottom 50% has been sliding. Gender inequality is even more pronounced.

Consider this: There were 919 girls born for every 1,000 boys in the last five years–the numbers are worse for urban areas (899) than rural areas (925)–which shows a male preference, as per National Family Health Survey (NFHS-4) 2015-16.India needs to increase its rate of employment growth and create 90 million non-farm jobs between 2023 and 2030’s, for productivity and economic growth according to McKinsey Global Institute. Net employment rate needs to grow by 1.5% per year from 2023 to 2030 to achieve 8-8.5% GDP growth between 2023 and 2030.

But despite a political class that is clueless on the effective management of a crisis ridden economy, India’s diversity along with itseducated youth and their entrepreneurial spirit, offer hope. The startup ecosystem is thriving notwithstandingthe bureaucratic rigmarole that is stifling it.India is the fourth-largest unicorn base in the world with over 21 unicorns collectively valued at US$ 73.2 billion, as per the Hurun Global Unicorn List. By 2025, India is expected to have nearly100 unicorns that will create approximately1.1 million direct jobs according to the Nasscom-Zinnov report. Indian Tech Start-upZomato the latest tech startup to list on the bourses has crossed a market cap of Rs 1 lac crores on listing day!

And markets are on a roll, shrugging off all the negative indicators the real economy is throwing up. Just the first week of July has witnessed raising of Rs 24000 crores through Initial Public Offers, with many more waiting to hit the market. Markets probably believe that after every crisis India has emerged stronger. Thirty years ago, after decades of misrule which despite its socialist pretensions had allowed regulatory capture by crony capitalists, India faced a massive crisis. But it took an “outsider” Prime Minister Shri. Narasimha Rao, to hand pick an economist rather than a politician, to turn the country around. The growth that followed the dismantling of the license & inspector raj, led to the creation of giants like ICICI Bank, Larsen & Toubro, Titan and many others. In a span of 30 years, these companies have offered returns of 5000 to 20000%, with Rs 1 lac invested in ICICI Bank yielding Rs 53 lacs, the same amount returning Rs 1.03 crores in the case of L&T and in the case of Titan an amount of Rs 2.01 crores. This has made quite a few patient investors wealthy indeed.

Hopefully, Covid crisis will lead to greater investment in health and education infrastructure including digital outreach and teleservices, which will lay better foundation for a healthy and skilled workforce. In fact the incipient economic recovery has resulted in companies in sectors like steel and cement realising accelerated demand. In just the past one year, the stocks of 5 top steel producers in the county have gained around 300%.Even a PSU like SAIL gained 356% after languishing for a decade.

Well, hope springs eternal. India, in spite of our political masters, has the potential to be a world economic power before long. But one thing is certain; India will not be able to develop sustainably unless it reduces gender and income inequality.