It appears that the tail events which the ubiquitous bell curve suggests, need not be all that rare. In less than 12 years, our world has seen two such events: The sub-prime crisis of 2008-09 and the covid induced disruption of 2020. While one was a financial crisis, the other is a health one, but both essentially anthropogenic. Covid-19, however, is sure to leave an indelible mark on the future and change the world as we have known it for most of our lives. Some of these changes will be nothing but hastening and deepening trends that are already underway, while others will be inspired or forced by covid and its aftermath. There could be subtle changes in customs and culture, like the occidental manner of greeting with shake-hands, hug and a kiss making way for the Indian Namaste! While we may croon about Indian soft power extending its reach far beyond its borders, a profitable approach would be to attempt a prognostic assessment of changes that will affect business practices, economic and social structures and prevailing political equations.

- Working Remotely: Working from home will no more be an exception. A study in the US estimates that a third of America’s work force could work online from home. In India that proportion could be much less. But the trend will gather momentum as lockdowns force even ordinary citizens to go online to procure essentials, make digital investments & payments, apply for services and registrations. The nascent fintech sector will get a fillip post covid, which will force banks to strengthen and diversify their online functioning. Now, even the Supreme Court resorts to video conferencing to hear and deliberate on urgent cases. And as corporates are forced to innovate to survive, even manufacturing sector will change. There will be design changes in layout and equipment to enable workers practice social distancing, while increased use of robotics and artificial intelligence will mean reduced work force. It is also likely that in the manufacturing sector, supervisory level will be drastically reduced if not eliminated as monitoring and control is increasingly taken over by networks of CCTVs and two way cameras assisted by internet of things. This will result in huge savings in air and surface travel, commercial space, fuel use and concomitant reduction in emissions & pollutants. Hopefully, there will be more occasions when the snow-clad Dhauladhar mountain range of the Himalayas can be seen from Jalandhar. Or, as Varsha Gowda of Deccan Herald reports, the waters in Bangaluru’s only river, the Vrishabhavathi are now free from the deadly white froth, though they are still black and smelly. Even the denizens of Mangaluru can now enjoy some small mercies, like the increased number of birds chirping merrily on whatever trees that are left and dogs happily lounging in the middle of, once busy, thoroughfares and regarding with doleful glance their one time masters caged securely under lockdowns. Some vicarious justice this!

A related trend that is likely to gather pace post covid-19, is the growth of the gig economy. It will not be confined only to much sought after doctors or lawyers, but will encompass much larger and fast growing pool of highly skilled and talented men and women (among them working mothers) who would choose to work on free lance basis on assignments that meet their interests and pursuits. Companies will increasingly seek out such domain experts, even though such talent will come at a high cost relative to regular employment. Before long we will have platforms, a la Uber or Airbnb providing a market place to those who need such niche expertise.

- Distance Education: Wherever possible education systems will move online. This will substantially reduce costs, both for providing and acquiring education. With virtual classrooms, education can be broad based and widespread without the costly constraints of physical infrastructure. In India, in many fields, high quality online education can replace substandard education dished out by dubious colleges and schools. This will give rise to a set of accredited entities that will have to develop expertise and execution capabilities to conduct online examinations as prescribed by UGC and other educational regulators. Governments and regulators will have to realize sooner than later, that distance education, not only enables social distancing but also overcome the limitations imposed by protracted lockdowns. Investors could certainly prospect for companies in the listed space, offering online educational tools with appropriate technology, content and efficient delivery and monitoring software.

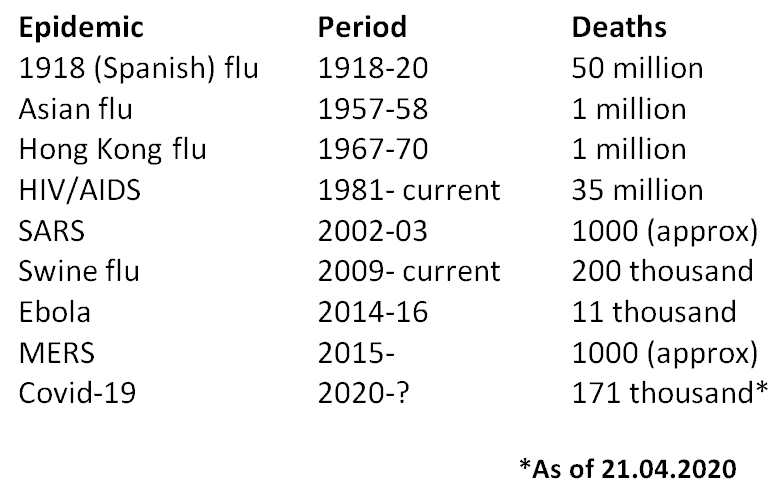

- Healthcare System & Infrastructure: As already stated, tail end events are not so rare. So the first lesson is how to better prepare for the next pandemic. The tablebelow gives the list of epidemics that have ravaged mankind since the beginning of 20th century.

The contours of a more agile and adaptive healthcare system that is capable of dealing with the next pandemic are yet to emerge. In the post covid world countries will need to create healthcare systems that protect and insulate health workers, the frontline fighters in the battle, in foolproof ways. Telemedicine and virtual medicine have been used to a limited extent in quite a few advanced countries. These hopefully, will become universal and will be used even in poor countries that can least afford to suffer a loss of medical staff in the next epidemic. We also need to develop cost-benefit models to evaluate the timing and various types of shutdowns to save lives, without excessive disruption of livelihoods. Healthcare budgets will certainly see an uptick going forward. India which spends less than 1% of its GDP on health will have to make all out efforts to meets its commitment to raise it to 2.5% by 2025. While health data sharing, research and diagnostics will need policy push, public and primary health will warrant greater priority since prevention is better than cure. Once a disease becomes an epidemic any number of hospitals and doctors will seem inadequate as has been the case in the US and elsewhere.The increased healthcare budgets in India and in our export markets as also the realisation that we need to be more self reliant in producing APIs (Active Pharmaceutical Ingredients) will throw up many investment opportunities in the pharma sector. On the healthcare side, we could expect companies to benefit in the long term due to higher awareness and spending towards healthcare in the post covid era, with significant increase in insurance coverage, government spending and discretionary testing aiding the healthcare sector. The sector is also likely to witness accelerated shift from unorganized to organized as several unorganized players will face challenges in the near term with some unlikely to survive the lockdown, consequently benefitting the listed/organized players. Savvy investors could seek out a couple of established candidates in the CRAM (Contract Research And Manufacturing) space within the pharma sector as also efficient service providers within the healthcare sector.

- Trade & Finance – Incremental & Paradigm Shift :

(i). International Trade: A holy cowof the international trade is the Riacardian dogma of comparative advantage. In simple terms, it means that economies of the world will be better off if they concentrate on producing goods & services where they have competitive edge because of cost and efficiency, that is, at lower opportunity cost than their trading partners. Adoption of this principle has increased the pace of globalisation. The “flat world” has made it possible to squeeze extra profits by extending supply chains to distant locations, with China becoming the world’s manufacturing hub. The risks of stretching supply chains, have now been exposed. It has been clear, for instance, that the Indian pharma sector which had come to depend, almost exclusively (given the cost advantage) on Chinese APIs, were severely hamstrung at a crucial time when such supplies were nor forthcoming from China. Notwithstanding the “comparative Advantage” of accessing the cheapest source of supply, the pandemic has taught us that we need to adequately diversify our supplies, even if they don’t come at the cheapest price. Well, we are not the only ones who have learnt this lesson. Japan’s government has offered to pay Japanese companies to leave China and return home. The US companies have also begun to leave China. It appears that Post covid, the world will be a little less flat.

(ii). Debt Vs Equity: A far reaching change that is waiting in the wings in a funds starved post covid world, is the treatment of debt vis-a-vis equity. It was in 1918, when economists were likening the global spread of “extra profit tax” on wartime corporate profits to the deadly outbreak of Spanish flu, that the US relented and allowed all interest paid to be deducted from taxable profit. It was meant to be a temporary measure. But as it eventually turned out, while the extra tax burden went away in 1921, the favourable treatment of interest payment stayed and was copied around the world. This, over the last century, has helped the pro-leverage bias get entrenched. Unlike dividends, which are paid only after the state has taken its share of earnings, interest is deducted from pretax profit, shrinking the pie available to the government. Governments are beginning to recognise this discriminatory treatment and are seeking reform. The 2017 overhaul of the US tax code restricted interest deduction to 30% of earnings before interest, tax, depreciation and amortisation, as an offset for slashing the corporate tax to 21% from 35%. The UK too has put such a limit. In India, for a government that is desperately seeking novel ways of garnering resources to help mitigate the covid induced disruption, treating payment of interest on par with dividends will certainly be tempting. Such a measure, will increase the cost of borrowed funds for firms. If the tax incidence is 25%, treatment of interest on par with dividends will increase the cost of funds for the firm by 33%. This would certainly make firms more frugal borrowers and, ceteris paribus, exert downward pressure on interest rates. This might even lower the cost of borrowing for the government that is struggling to service its humungous debt. But in a country where PSU banks and financial institutions are the dominant providers of debt, most of the interest earned is ploughed back to the government by way of taxes and dividends. However, the move will have to be carefully weighed against its impact on FPI participation in Indian debt, the health of the already shallow debt markets, as also the cost of borrowing for the medium, small and micro enterprises which are perforce highly leveraged. But post covid the preferential treatment of interest expense might see some material change. Such a change worldwide, might, among other things, save capitalism from one of its biggest crisis management flaws, manifested in the socialisations of private loss through bail out of debt defaults caused by “force majeure”, while allowing unbridled private profits.

- Waning US Influence: WHO has turned out to be thelatest whipping boy for the US President Donald Trump. He has stopped US contribution to the organisation calling it an apologist for China and accusing it of being slow in declaring covid a pandemic. But his own initial response to the pandemic was unmistakably casual and tentative. US has now turned its back on climate change talks, the WTO, NATO and shown scant respect to other multilateral forums. Since world War II, world has looked up to the US for leadership in fashioning co-ordinated global response to problems ranging from economic crises to pandemics to human rights abuse, given its pre eminent position as an economic, military and technological superpower. The world therefore is disappointed to see the US helpless in the face of covid pandemic, unable to contain the virus and the toll it is taking of American lives. In fact, the current US penchant of finding scapegoats in the face of crisis, as in the present case blaming China for the spread of covid, accusing WHO for being slow or, threatening India of “retaliation” if US demand for the supply of hydroxychloroquine were not met, betrays complete lack of vision and smacks of petulance of a teenage bully always seeking instant quid pro quo. Now that the rout in crude oil market has shattered the booming US shale oil industry, it seems to be a matter of time before Trump finds another whipping boy in Russia or Iran or even Saudi Arabia. The question is, what will all this mean for the global order that the US has fostered and underwritten so far?