The latest Interim Budget of the NDA government, presented by its stand–in Finance Minister Piyush Goyal, has given quite a few lollipops to the middle class tax paying constituency, by way of carefully crafted tax breaks, without unduly affecting the fisc. Now, persons who earn as much as Rs 10 lacs in a financial year, can so manage their investments and expenditure, as to bring down their taxable income to Rs 5 lacs and completely escape the tax net. While there is no change in the slab/rate of income tax, the rebate system has been tweaked. From the financial year 2019-20 beginning April 1, the rebate is available for those with a taxable income between Rs 2.5 and Rs 5 lacs. This group of assesses, till now would have had to pay tax up to Rs 13000 (including 4% cess). In the new mechanism, this liability will be zero. For this, tax payer has to be under the TDS (Tax Deducted at Source) regime, and must file IT returns and claim rebate. According to Government, the new proposal will provide tax benefit of Rs 18500 crores to some 3 crore self-employed, small businessmen/traders, pensioners and senior citizens.

Section 80CMake sure you claim Rs 1.5 lacs by investing/spending on specified items under the section. There is a wide choice here: Home loan principal repayment, tuition fees, premium on insurance plans and host of investments such as equity linked savings schemes of mutual funds, EPF, PPF and long term bank deposits. This could bring down your taxable income from Rs 10 lacs to Rs 8.5 lacs.In addition to Rs 1.5 lacs under Section 80C, you can invest Rs 50,000 in NPS-Tier I which will bring down your taxable income to Rs 8 lacs.

Health CoverHeath insurance premium iseligible for deduction under Section 80D upto Rs 25,000 a year. Besides, if you pay the health insurance premium to cover your parents, you get an additional deduction of Rs 25,000 a year, which goes upto Rs 50,000 if either of your parents is a senior citizen. So, even if your parents are not senior citizens, you still could get a deduction of Rs 50,000onpremiumpaid on health cover, which brings down your taxable income to Rs 7.5 lacs. But that still leaves Rs 2.5lacs in excess of Rs 5 lacs.

Interest on Housing LoanThe Government incentivizes investment in housing by providing for deduction of interest on housing loan from taxable income under Section 24 upto Rs 2 lacs a year in respect of self occupied homes. For properties deemed to be let-out, the overall loss from house property cannot exceed Rs 2 lacs a year. So with Rs 2 lacs deduction, the taxable income is now down to Rs 5.5 lacs.

Education LoanUnder Section 80E, deduction can be claimed of the interest paid on loans to fund your education or that of your spouse and children. The loans must be in respect of a government recognized course of study. There is no limit on the maximum amount that is allowed as deduction. The deduction for the interest on loan starts from the year in which you start repaying the loan and it is available only for 8 years starting from the year in which you start repaying the loan or until the interest is fully repaid, whichever is earlier. So if you are paying an interest of say, Rs 30,000 a year on the education loan, then your taxable income comes down to Rs 5.2 lacs, just a touching distance away from the magic figure of Rs 5 lacs !

Interest IncomeUnder section 80TTA, interest earned on Savings Bank accounts is eligible for deduction upto Rs 10,000 a year. For senior citizens, this deduction under Section 80TTB goes upto Rs 50,000 and includes interest from fixed deposits. So if your income includes interest element, your can claim deduction as above. Assuming a deduction of Rs 10,000 your taxable income can be brought down to Rs 5.10 lacs.

Donations Well, you still have got Rs 10,000 which needs to be deducted to bring down yours taxable income to Rs 5 lacs. The government seems to say, “Loosen your purse strings and be generous”. Donations to institutions and funds approved by the government are eligible for deduction under Section 80G. While what you give to many government run entitiesmay be entirely tax deductible, the deduction is limited to 50% of the donation to most non-government entities.

Other DeductionsAnd there are other deductions as well. Standard deduction on salary income, for instance, has been increased from Rs 40,000 to Rs 50,000 in the latest budget. There are also tax breaks on HRA if you pay rent, leave travel allowance if you submit travel bills, medical expenses incurred for specified illnesses and, of course, contribution to political parties.

So you see, even if your annual gross income is Rs 10 lacs plus, it is not a big deal to bring it down to a taxable income of Rs 5 lacs and completely escape income tax! Why complain about elections?

Megatrend in the Making

We constantly hear of consumption, and financials as mega-trends…but not of defense. If we were to talk about stocks that that have been multibaggers, we, in all probability, will recall names like HDFC Bank, Page Industries and Eicher Motors, and rightly so. But concentrating on the recent past might result in failure to notice the shifting sands right under our feet. Consider Bharath Electonics (BEL), whose price performance has been disappointing on the bourses in the recent past, in spite of the company posting a return on capital employed of 25%, boasting of an almost debt free balance sheet and with reserves and surplus of over Rs 7500 croes against a paid up capital of only around Rs 240 crores. And it is not that it has not rewarded the shareholders. In 2015 it issued bonus shares in the ratio of 2:1 and effected a 10:1 split January 2017 and declared one more bonus in the ratio 1:10 in August 2017. This means for every one share held at the beginning of 2015 in the company, the investor would be holding 33 shares of the company now. In short, this PSU stock from the defense sector has beaten the returns by HDFC Bank over the last 18 years! Yet the defense sector is hardly spoken about.But the potential for the sector is huge.

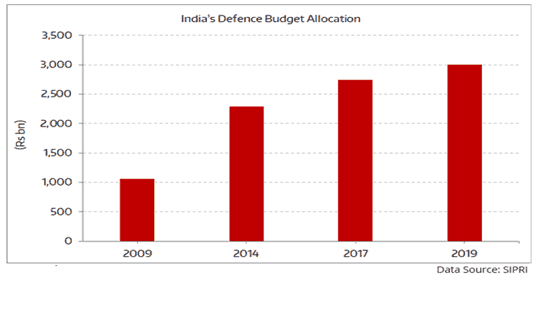

India has the third largest military in the world. It is also the fifth largest spender on defense. But as of 2017, India’s military spending was just 10% of the US and 28% of China. In fact, India’s military spending as a percentage of gross domestic product (GDP) is only 2.5%. This is much lower than countries like US and Russia at 3.1% and 4.3% respectively. Even our neighbor Pakistan spends 3.5% of its GDP of defense.

As India is moving towards becoming a 10 trillion dollar economy, defense sector provides huge untapped opportunity. After the announcement that under Mission Shakti, India tested its first anti-satellite weapon as It shot down a satellite in low earth orbit, thus becoming the fourth nation after the US, China, and Russia to demonstrate this capability, investors have taken note of the possibilities in the sector. Currently, 35% of the country’s total defence requirement is met through manufacture within the country. The rest is met through imports. Events like Mission Shakti have shown what India can do in-house, thus suggesting a huge opportunity that lies in wait for India’s defense manufacturers and service providers. Well, much of India’s defense budget for the last decade has been manpower related which means salaries and pensions. India needs a big push towards modernizing its weapons and systems. However government’s recent policies are aimed at rectifying two major issues; reducing India’s over dependence on imports and expanding the defense budget to modernise existing equipment.

India’s recent tensions with its neighboring countries are likely to accelerate these initiatives. The players most likely to benefit are India’s private sector defense manufacturers and with the burgeoning defense budget of 3 lac crores (See the chart below) it is possibly time to take a look, of course, with due diligence, at companies with defense related operations, such as BEL, Honeywell Automation, Dynamatic Tecnologies as also the defense wings of L&T, Bharath Forge, Tatas and the Mahindras