Anybody who is somebody has had an opinion on the transfer of “surplus” reserves of the RBI to the Government. But, as the cliche goes, the devil is in the details and an objective assessment of the rationale for the transfer of Rs 1.76 lac crores from RBI to the centre, can be achieved, if at all, only by weighing the relevant facts carefully.

What constitutes the RBI reserves? RBI mainly earns its income from interest on Government securities (G-Secs) and foriegn securities. Net of expenses (which include transfer to various reserves) the net disposable income is transferred to the centre as dividend/surplus every year. RBI maintains the following reserves.

Currency and gold revauation account (CGRA), the investment revaluation account (IRA), the asset development fund (ADF) and contingency fund (CF).

These reserves as of 2018 amounted to Rs 9.59 lac crores. CGRA at Rs 6.91 lac crores accounts for bulk of the total reserves. CGRA essentially comprises unrealised gains (or, losses) on revaluation of forex and gold. IRA is subdivided into IRA – froreign securities (IRA – FS) and IRA – rupee securites (IRA-RS). The former reflects the unrealised, mark-to-market gain (or, loss) on foreign securities, while the latter accounts for such gain (or, loss) on rupee securities. The ADF has been created to meet internal capital expenditure and make investment in subsidiaries and associated institutions. The CF is a specific provision made for meeting unexpected contingencies arising from exchange operations or monetary policy interventions.

Between 2010-11 and 2012-13, the RBI had set aside 32-45 per cent of its gross income to Contingency Fund. Additions to this fund though had ceased since 2013-14 and the entire surplus income of the RBI was being transferred to the Centre, after a gap of three years, the RBI once again started transferring funds to its contingency fund from 2016-17. The balance in the CF is about Rs. 2.32-lakh crore, which is around 6.8 per cent of the RBI’s total assets. This is reportedly much higher than the 2 per cent average that other BRICS nations (Brazil, Russia, China and South Africa) hold, according to a Bank of America Merrill Lynch report.

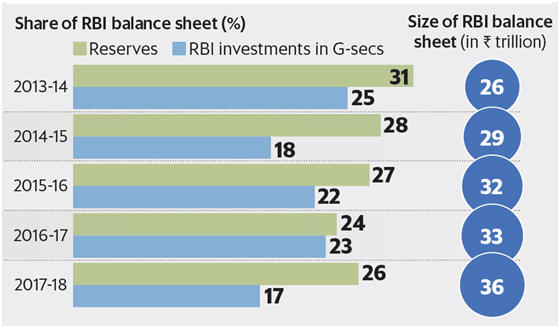

The total reserves of the RBI constituted 26% of its balance sheet in 2017-18. In fact the percentage of reserves during the years 2013-14 to 2017-18 ranged from 31 to 24. (See the chart velow). The committee headed by Bimal Jalan, himself an erstwhile Governor of the RBI, came to the conclusion that such high level of reserves was more than necessary compared to RBI’s global peers (Economic Survey 2015-16 had cited a global median of 16 per cent). Nevertheless, the committee has conceded the need to differentiate RBI’s mandate as a full service central bank, unlike many others, tasked with everything from monetary policy making, regulation of banks and NBFCs to exchange rate management. Hence at the aggregate level, the panel suggested maintaining economic capital – realized equity and revaluation balances – within a range of 20 to 24 per cent of its balance sheet. Since it stood at 23.3 per cent as of June 2019, that is, within the desired range, the entire net income of the RBI of Rs 1,23,414 crore for the fiscal (without transferring to the CF) has been transferred to the Centre as surplus. It is important to note that income during 2018-19 was unusually high due to Open Market Operations (OMOs) to infuse liquidity through bond buying and more than normal repo lending to the banks who approached the cetral bank given the tight liquidity conditions (both of which increased its interest income). Further, due to change in method of computation of exchange gain or loss on the basis of weighted average cost, in 2017-18 and 2018-19, there has been a net gain of Rs 21464 crores in the income over the two years.

As the current CF outstanding stood at 6.8 per cent of the RBI’s balance sheet, there was an excess over the recommended (by the panel) range of 5.5-6.5 per cent. Here, the panel decided to go with the lower threshold of 5.5 per cent and hence the excess Rs 52,637 crore has been written back (to be transferred to the Centre). This many expert feel might rob RBI of any wiggle room in the future.

In conclusion it must be said that in evaluating the excess reserves on the RBI balance sheet, the committee has taken the pragmatic view that only realised equity built from profits must be distributed, while revaluation gains from market fluctuations on foreign currency, gold or other assets (which form bulk of the reserves) must be retained. The committee has thus upheld conservative accounting practise and ensured that the bulk of RBI’s legacy reserves are ring-fenced from dividend demands. Likely market disruptions from RBI liquidating its forex or gold holdings have also been deftly avoided by effecting this transfer through a book entry. Further subjective judgments have been put to rest by pegging the RBI’s Contingent Risk Buffer at 5.5-6.5 per cent and its overall reserves at 20-24.5 per cent of its balance sheet. While this windfall Rs 1.76 lac crores is significantly lower than the Rs 3-4 lac crores that the Centre was angling for, with RBI’s Board accepting the Bimal Jalan committee’s recommendations on prudent economic capital framework, the annual skirmishes between the Bank and the Government on surplus transfers will hopefully cease.

Finally the manner in which the funds are used will be critical. The share of capital expenditure as a per cent of GDP has been falling in recent years. In India, the bulk of government spending is mostly biased towards boosting consumption rather than investments, or is sunk in bottomless pits like Air India and BSNL. This time around, the Centre will need to put the RBI’s surplus funds to productive use, that can have a sustainable multiplier impact on overall growth in the economy. Well, just as the cacophonous debate on transfer of RBI reserves is subsiding, FM Nirmala Sitharaman has uplugged a financial stimulus of Rs 1.45 lac crores mainly by way of path breaking tax cuts to inject new life in a worryingly slowing economy. Whether this will start the virtuous cycle of new investments and hence turn out to be an efficient use of RBI bonanza, time will tell.