Points to Ponder, News for the New Year

- January 25, 2022

- Posted by: Arunanjali Securities

- Category: Business

No Comments

- Deposit Insurance:

- Now that the Deposit Insurance & Credit Guarantee Corporation (DICGC), Amendment Bill 2021 has been promulgated, DICGC becomes liable to pay bank depositors when any direction, order or scheme is passed which prohibits the depositors of the insured bank from accessing their deposits. DICGC is required to pay the depositors the insured amount (of up to Rs 5 lacs – inclusive of principal and interest, as against Rs 1 lac earlier) within 90 days from the date from which such direction/order/scheme takes effect. Earlier the liability of DICGC to pay was triggered only when the order of liquidation was passed against a bank.

- Before the promulgation of DICGC (Amendment) Act 2021, DICGC was required to settle the dues to the liquidator, who in turn would ensure that the distribution to each depositor. Now DICGC is required to pay the depositor either directly or get the amount credited in the account of the depositor through the insured bank.

- All commercial banks (including branches of foreign banks operating in India), local area banks, all state, central and primary co-operative banks (which are known as Urban Co-operative banks) are insured by DICGC. However, primary co-operative societies are not covered.

- Insurance cover is available for up to a maximum of Rs 5 lacs, covering balances in savings, current, fixed/recurring deposits in all branches of the insured bank. The name/s capacity in which they are held should be the same while computing the cover. If there is a change in the order of names of a joint account, such balances will be treated as different deposits for the purposes of considering insurance cover. So it may be advisable to have multiple joint accounts, with different order of names or to add a family member as an additional joint account holder, since the cover of Rs. 5 lacs will be separately available for each such account/s.

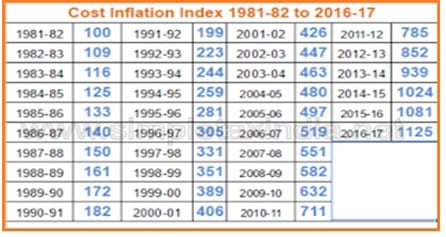

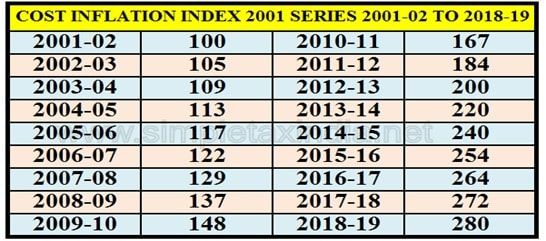

- Cost Inflation Index (CII)

- The Government of India, Ministry of Finance (Department of Revenue), Central Board of Direct Taxes published in the Gazette of India, Extraordinary Notification No. 42 /2016/F.No.142/5/2016-TPL dated 02-06-2016 the Cost Inflation Index (CII) for Financial Year 2016-17.

- CII is required to calculate Long term capital gain under Income Tax Act. Long Term Capital Gain (LTCG) is calculated when the Capital asset is held for more than 2 years (one year in case of Shares/equity and 3 years in case of investments in debt)

- LTCG is computed as below:

- LTCG = Full value of consideration received or accruing – (indexed cost of acquisition + indexed cost of improvement + cost of transfer)

- Where, Indexed cost of acquisition =Cost of acquisition x CII of year of transfer /CII of year of acquisition

- Indexed cost of improvement =Cost of improvement x CII of year of transfer /CII of year of improvement

- The Finance Act 2016 shifted the base year for giving the tax payer the option to get the market value of the property to April 1, 2001, instead of the earlier date of April 1, 1981. This provision has given some benefit to the tax payers, as the market price of immovable property has increased more during the period, as compared to the increase in the cost inflation index announced by the government from time to time. So if property has been acquired before 01.04.2001 then capital appreciation before 01.04.2001 has been exempted from income tax. For capital assets acquired before 01.04.2001, market price or cost price as on 01.04.2001 is to be considered as cost price for calculation of Capital gain.

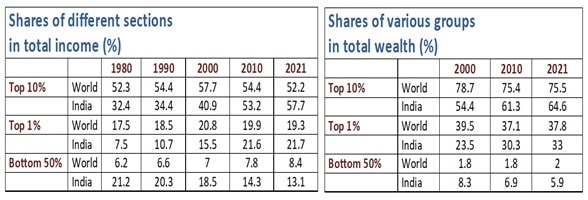

- Economic Disparity

- Year 2021 has been a tumultuous year by any reckoning. World was ravaged by the pandemic, climate change which manifested itself in numerous ways with cyclones, floods, unseasonal rains, heat waves, forest fires, melting glaciers and alarming pollution levels. But official statistics would have us believe that Indian economy is bouncing back. But India still remains a land of contradictions, with superstition vying with technology and financial centres and superhighways masking the poor infrastructure in the hinterland. But more disturbing aspect is masking of the debilitating inequality in incomes and wealth by the grandiose macro aggregates. The following figures narrate the lamentable story hidden behind the mainstream economic narrative.