It has the lowest density of all metals. It reacts vigorously with water. Though not as rare as precious metals like gold, silver, and platinum, it’s set to have a dominant industrial usage in an increasingly electronic world. No wonder, lithium is being called the 21st century oil!Australia, Chile, China and Argentina are the top lithium producers at present.

Points to Ponder. Lithium; Problems & Prospects

- June 11, 2021

- Posted by: Arunanjali Securities

- Category: Business

Although lithium is crucial for the transition to renewables, mining it has been environmentally costly. In addition, toxic chemicals are needed to process lithium. The release of such chemicals through leaching, spills or air emissions can harm communities, ecosystems and food production. Moreover, lithium extraction inevitably harms the soil and also causes air contamination. In Argentina’s Salar de Hombre Muerto, residents believe that lithium operations contaminated streams used by humans and livestock and for crop irrigation. Prolonged exposure to lithium can cause fluid to build-up in the lungs, leading to pulmonary oedema. The metal itself is a handling hazard because of the caustic hydroxide produced when it is in contact with water causing an explosion.

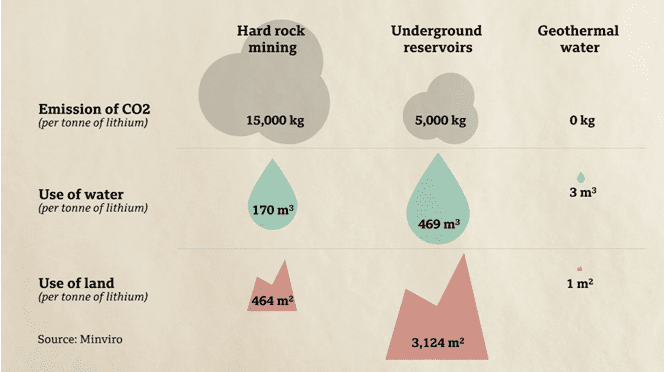

Lithium is currently sourced mainly from hard rock mines, such as those in Australia, or underground brine reservoirs below the surface of dried lake beds, mostly in Chile and Argentina. Hard rock mining – where the mineral is extracted from open pit mines and then roasted using fossil fuels – leaves scars in the landscape, requires a large amount of water and releases 15 tonnes of CO2 for every tonne of lithium, according to an analysis by the raw materials experts Minviro for the lithium and geothermal energy firm Vulcan Energy Resources. The other conventional option, extracting lithium from underground reservoirs, relies on even more water to extract the lithium – and it takes place in typically very water-scarce parts of the world, leading to indigenous communities questioning its sustainability.

But a promising development is extraction of lithium from geothermal waters – found not just in Cornwall in the UK, but Germany and the US as well, which has a tiny environmental footprint in comparison to conventional methods, including very low carbon emissions. The following chart clearly shows the benefits of this new source of lithium.

The most important use of lithium is in rechargeable batteries for mobile phones, laptops, digital cameras, and electric vehicles (EV).

It’s well known that batteries are the most valuable part of an electric vehicle. In fact, it often differentiates the frontrunners from the rest. So, most EV companies are rightly focussed on building giga-factories to anchor the battery to the EV value chain.Tesla the EV pioneer is stepping up efforts to increase battery efficiency.On 22 September, Tesla announced a package of innovations to be implemented over the next 2-3 years that are designed to:

- reduce the cost of batteries by 56% (measured in $/kWh),

- increase range (per kg of battery) by 54%

- reduce the investment cost per kWh of manufacturing capacity by 69%

Companies like Amara Raja Batteries and Exide, which were the only assemblers of lithium-ion batteries until a few years back, now find themselves a part of the crowd. Entities like Tata Chemicals are working on battery capacities that integrate ISRO’s cutting edge lithium-ion cell technology.Ola plans to produce an electric scooter every two seconds in the world’s largest e-mobility factory. Initially lithium batteries would be sourced from South Korea. Eventually they will be manufactured in Ola’s upcoming integrated plant near Bengaluru.Hero MotoCorp’s subsidiary Ather Energy has already set up capacity to produce 120,000 battery packs annually. Ather Energy is the only EV maker in India to produce its own battery packs. It has already filed 13 patents on the design and manufacturing of the lithium-ion batteries.But the economics of producing the batteries in-house are compelling for large capacities.Lithium-ion batteries account for 35-40% of the cost of an electric vehicle and lithium cells constitute around 70% per cent of the battery cost.

Moreover, under a recent tax incentive (PLI scheme), the government has earmarked an outlay of Rs 18000 crores for incentivising the manufacturing of advanced chemistry cells.Therefore, several players will compete for a share of the lithium-ion battery pie over the next decade.Today, South Korea, China, and Japan account for nearly 85% of the global lithium cell production.But India’s lithium-ion battery capacity could be among the world’s largest in a few years.

This could provide a profitable opportunity to investors with a suitable risk profile, looking to bet on technology before it is ripe.