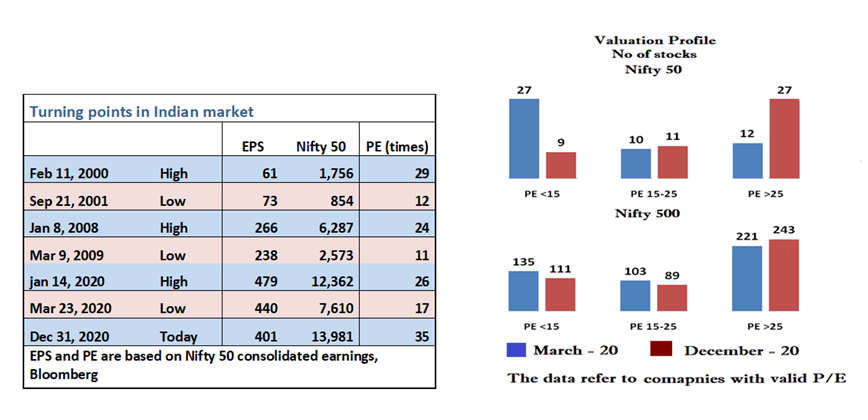

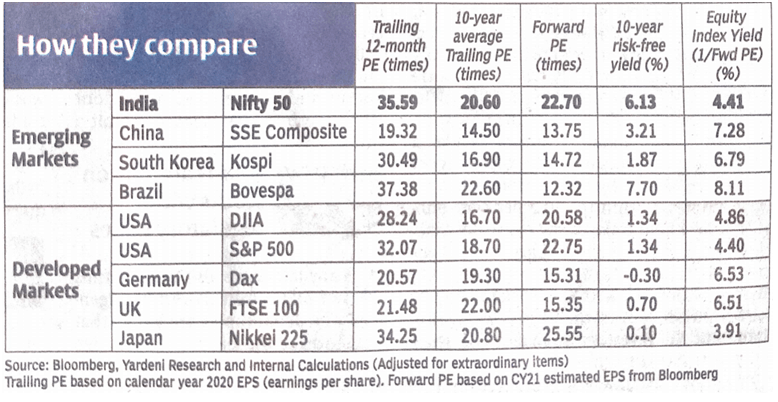

When the markets were melting in March 2020, it appeared that investors had nowhere to hide. Now, in the aftermath of a path-breaking budget, it appears that there is nowhere one can invest. The ongoing quarter has witnessed many positive developments: launch of vaccines against Covid – 19, gush of liquidity, both from the RBI and from across the border, a market friendly budget and better than expected earnings. But one swallow doesn’t make a summer and one quarter doesn’t decide the longterm trajectory of a battered economy. Yet the prevailing irrational exuberance has made the Indian bourses most expensive globally with a PE (Price to Earnings ratio) of over 35 by December 2020. Even if one were to compare the relative attractiveness of equities, based on their forward earnings compared with the risk-free investment option (a valuation tool called the Fed Model) India is the only country where the equity index trades at a premium to the yield on the 10 year risk free government securities. (see Table I).

Table I

Notwithstanding the rich valuations, by February 21 buying frenzy had further pushed up the PE ratio for Nifty 50 to 42 as of 9th February 2021 against its historic average of 18.With the second half of February, however, the much needed correction seems to have commenced. But with President Biden announcing $ 1.9 trillion stimulus and the US economy, the 21 trillion gorilla, spewing forth liquidity all over the world, whether the incipient correction will run its course is anybody’s guess. In the last 20 years, whenever trailing Nifty PE has crossed 24 – 28 range, there has been a sharp fall in the market with PE bottoming out at 11 – 12 times. But since 2017, despite sluggish economy and stagnant earnings, PE remained high at over 24 until March 2020, when it came down to 17. (see Table II)

So where does one look for investing in an overvalued market?

- Well, there is no commandment of the Lord that thou shalt always invest/transact in the market.Buying stocks at their peak valuations extracts a heavy price. Remember that stocks that have performed well in the recent past, such as Reliance Industries and Bharti Airtel, took 10 years to cross their peak levels reached in 2007. Maruti, the most successful passenger vehicle manufacturer, is still over 25% below its all-time high clocked more than three years ago in 2017. May be this is an opportunity to derisk your portfolio. You could book profits on your more expensive holdings or, prune your portfolio by selling scrips of companies that do not have a credible growth story.

- Action suggested above will result in raising cash levels. While raising level of cash and praying for crash might seem comforting, it comes with its own challenges. First, you could miss out on further gains. When Sensex was over 40,000 and earnings far weaker than at present, many felt that the then prevailing valuations were unsustainable. Yet since then Sensex has gone up by a whopping 25% to over 52,000 in less than a year, while the cash would have earned little in the meanwhile. Secondly and more importantly, taking successful cash calls by timing the markets would require one to get the call right twice – once when you get out and once when you get in. Rarely ever, anyone gets the top and the bottom of the market right, particularly when sitting on the sidelines with cash, whichcan be psychologically challenging.

- But again, there is no infallible rule that elevated cash levels have to be deployed in the same set of shares or assets. One could also look at alternative asset classes.Gold though, seems to be receding from its recent peak and the current spike in the US bond yields has cast a shadow on gold. Interest rates are sending mixed signals. In spite of RBI maintaining an accommodative stance, bond market yields are inching up in response to the massive borrowing programme of the Government. So investing in debt also is fraught with risk if interest rate were to go up. But those with appropriate risk appetite may find opportunities to invest in accrual funds. Commodities, of course, like crude and metals are hardening.But the average investor may not be equipped to build and maintain stocks of these commodities, except perhaps taking long term bets on the commodity exchanges. Real estate, however, seems poised for recovery and it may be worthwhile taking exposure to the sector, preferably through REITs

- Irrespective of index levels, market always offers pockets of opportunity for bottom up investors. But this would call for diligent homework and scouring for “value”.

- To begin with investors could go beyond indices and look at the broader market. A breakdown of valuations in terms of PE ratio shows that as of December 2020, while just 9 of the Nifty 50 stocks traded at a PE of below 15, Nifty 500 offered 111 such stocks, suggesting possible bargains. (see Chart).

- Secondly, if a genuine economic recovery takes hold, it is more likely to be led by cyclicals such as utilities, energy, oil & gas, cement and corporate lenders. The recent upturn in commodity cycle suggests a stronger profit outlook for commodity processors and weaker one for users. These are also segments where stocks are still available at reasonable valuations.

- Thirdly, with investors running out of reasonably priced growth options, value and dividend yield styles of investing could turn out to be more prudent. For instance, a Coal India or an Indian Oil Corporation has delivered dividend yields far superior to bank deposits or bond yields.

- Fourthly, investors could also consider owning overseas stocks, especially when domestic markets run out of hand. Under the Liberalised Remittance Scheme of the RBI, a resident individual can remit uptoUS$250,000 in a financial year for a variety of purposes including investment in equities abroad. Hang Seng for instance, is available at much lower valuations than Sensex/Nifty despite a stronger Chinese economy. And if you do not want to go through the hassle of remitting funds abroad, you could buy the same like any other share through an Exchange Traded Fund(ETF – HangSeng Bees) listed on Indian stock markets. Similarly, you can gain exposure to the top100 Nasdaq companies through the listed ETF managed by Motilal Oswal. There are also mutual funds such as Franklin Templeton, ICICI Prudential, Motilal Oswal,etc, providing for investment in foreign companies.

- If you are not comfortable with any of the above proposals, you may, of course, seek comfort of the herd. As per RBI data the average Indian household holds84 per cent of its wealth in real estate and other physical goods,11 per cent in gold and only 5 per cent in financial assets. Of the financial assets over 56 per cent is in bank deposits.

Well then, to each his own!

Table II Chart