For 5,000 years, gold’s combination of luster, malleability, density and scarcity have captivated humankind like no other metal. According to Peter Bernstein’s book The Power of Gold: The History of Obsession, gold is so dense that one ton of it can be packed into a cubic foot.

At the start of this obsession, gold was solely used for worship, Today, gold’s most popular use is in the manufacturing of jewelry.

Around 700 B.C., gold was made into coins for the first time, enhancing its usability as a monetary unit. Before this, gold had to be weighed and checked for purity when settling trades.

With the rise and dominance of the US economy in the 20th century, it became the main provider of liquidity for international trade and its massive gold reserves underpinned the gold standard that governed the international currency sysytem

But by 1970 when inflation was starting to rise and the US was running its first trade deficit of the 20th century, the global financial markets essentially began a run on the dollar. In 1971, Richard Nixon, the then US president, unilaterally ended the gold convertibility of $35 per troy ounce, bringing an end to the Bretton Woods system of managed currecies and ushering in a period of floating exchange rates. Many an investment analyst were then writing the obituary for the precious metal. But investors’ fascination for gold did not diminish and it peaked during the global financial crisis of 2008-09. Since then, however, investors were switching loyalty to equity, due the metal’s diappointing returns of 1.5 percent over the last ten years. Gold ETFs globally witnessed persistent sell-off and even in India the sovereign gold bonds – by far the best avenue for gold investment – elicited only muted response. But over the last three months, gold has staged a resurrection of sorts. On 9th of August gold touched a high of $ 1509. The year to date returns for gold is 17 per cent. The price of gold has surged in India too. On 22nd August 2019, the price of gold hit a record high of Rs 38,970 per 10 grammes in the national capital according to All India Sarafa Association.

There is a confluence of many factors that have brought about this change. The US – China trade war is morphing into a currency war. After the latest round of tariff incrcrease by Trump on $ 300 billion worth of Chinese imports, Beiging allowed the Renminbi to weaken to 7 against the dollar to blunt the impact of tariffs. With the US promptly labelling China a currency manipulator the world feared onset of currency war and three cetral banks, namely, of Newzealand, Thailand and India dropped rates to support their domestic industries. If China weakens its currency further, other central banks may also be prompted to drop rates which might fuel inflation thereby enhancing the safe-haven appeal of gold in the face competitive devaluation of fiat currencies. Secondly, the IMF in July has highlihted the problems the global economy faces in the wake of escalating US-China trade dispute and has revised global growth outlook from 3.3 to 3.2 per cent for the current year. This has led to easy money policy and even negative interest rates in the leading economies of EU. With declining bond yeilds, markets are expecting a recession and that has pushed investors to find a stable asset whcih has increased Gold’s appeal for investors. Thirdly, apart from gold, US dollar is regarded as safe haven asset. But if trade tensions escalate and US growth slackens, US dollar may not be able to retain its current strength and gold could turn out to be preferred choice of investors.

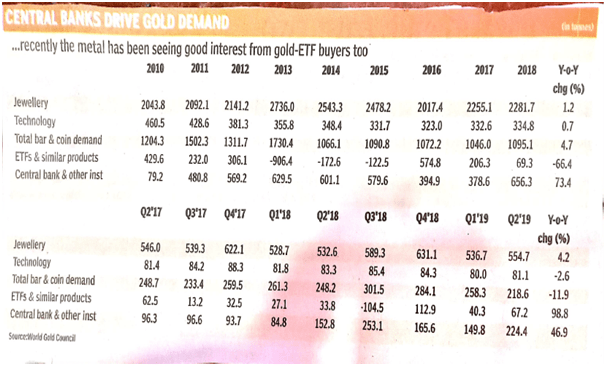

With the equity markets weakening, bond yields plummeting and the mighty dollar under a cloud, investors have flocked to Gold ETFs. As per report from WCG (World Gold Council), the demand for Gold ETFs has totalled to 67.2 tonnes in April-June quarter, double of what it was in the same quarter last year. As if to reinforce this trend, Central Banks are found to add to their stocks of Gold in recent times. Central Banks bought 224.4 tonnes of gold in April-June quarter of 2019. The total buying by Central Banks rose to 374.3 tonnes in the first half of the year; the largest net half yearly increase in their global reserves in WCGs 19 year quarterly data series (See Table below). Large buyers included Poland, Russia and China (up 74 tonnes in first half of 2019 to 1926.5 tonnes). India’s RBI too was in the list of Central Banks along with Turkey and Kazakhstan. RBI bought 17.7 tonnes of gold between January and June this year. Although, heightened gold price levels dampen consumer demand for gold and over the last month Indian jewellery demand has been weak, sustained increase in price level, eventually brings the consumer back. Moreover, in India bulk of the demand for gold comes from festivals and weddings and is largely price inelastic.

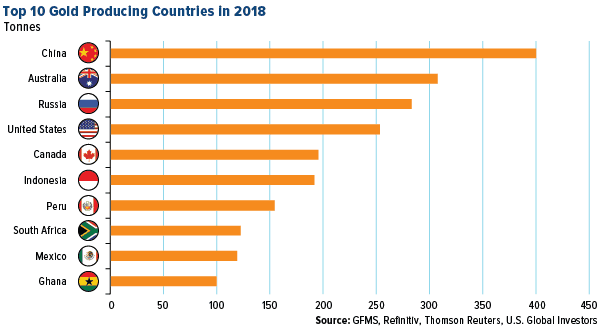

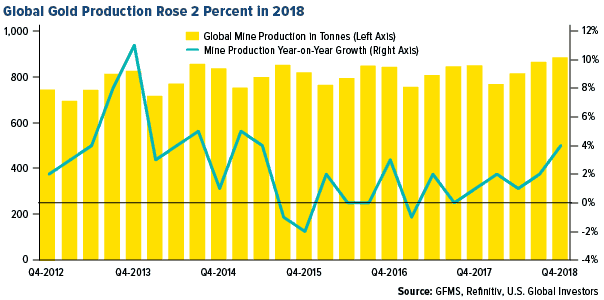

With rising gold prices the supply of gold that comes for recycling has increased to about 314 tonnes, in June 2019 quarter, up 9 per cent from the corresponding period last year. Further, supply of gold from global mines has increased 2 per cent year-on-year in june quarter to 882.6 tonnes (see Chart I) with key miners being Australia,Russia and Ghana (See Chart II). But interestingly, important gold markets, investment and consuming centres are anywhere but in the mining countries. Important gold trading centres are the following:

- London Bullion Market is the global hub of OTC precious metals and is the largest spot market for gold. The Loco London Spot Price is the basis for virtually all transactions in gold and silver in London and is followed as a universal spot price all over the world.

- New York is the home to the largest gold futuress trading through its commodity exchange “COMEX” which is a division of NYMEX.

- After London, the second principal centre for spot or physical gold trading is Zurich whcih headquarters some of the major banks in the world. It importance is likely to grow after Brexit.

- TOCOM, Tokyo Commodities Market in Japan is the second largest futures trading centre for Gold.

- India, Dubai, Istambul and Singapore are the ‘gateways’ to high consuming regions.

- SPDR Gold Trust, headquartred in the US is the largest gold backed ETF.

The foregoing discussion points to the following investment functions of gold.

- Historical data indicates that gold is an effctive hedge against inflation and over time has maintained its purchasing power.

- Returns on gold are inversely correlated with the dollar, equities and real estate, thus making it a natural diversifier in a multi asset portfolio.

- Experience shows that in extreme situations – such as a finacial meltdown- when most assets depreciate, gold maitains its purchasing power thus providing some protection to the wealth of individuals.

- Gold is a low risk and secure asset and can be used to genrate liquidity (cash) without much trouble.

- Gold is nobody’s liability as its value does not depend on someone’s ability to pay. Contrast gold with equities and bonds whose value hinges on the issuers’ future ability to honour their obligations. Even sovereign (fiat) currencies are vulnerable to abuse by governments strapped for resources or caught in a recession or, political upheavals.

- In India in particular, gold has become a subtle instruement of women empowerment, since, gold once bought is generally forgotten by menfolk in the family except the lady of the house!

Having sung virtues of gold how does the average investor approach investments in gold? Well, the first step is not to get carried away by the ongoing bull run in gold. It is essential to bear in mind, over the long term, that is, over ten years, equities and even real estate have beaten gold comprehensively in terms of total returns. Equities are still the most tax efficient investment avenue, in spite of myopic finance ministers disincentivising investments in risk capital, even as a sluggish economy is desperately crying for such capital. As the old adage goes, just as every dog has its day, every asset class has its moment under the sun. So a prudent thumb rule could be to limit one’s exposure to gold to not more than 10 per cent of one’s investment portfolio to provide a modicum of counter cyclical balance to the portfolio. This could, preferably be achieved by systematic investment in a gold ETF, or better still, by investing in Sovereign Gold Bonds (SGBs).

SGBs bonds are issued by RBI, in denomination of one gram and in multiples thereof. Maximum investment in a year is capped at 4 kgs for individuals. The biggest advantage of SGBs is that they pay a coupon of 2.5 per cent on the face value of the bond. The investment tenure of these bonds is 8 years. Premature exit is allowed from the end of the fifth year. Investors wanting to exit earlier can sell them on the stock exchange where they are listed. The fourth issue of SGBs for 2019-20 is open from September 9 to 13. These bonds are sold among others, through stock exchanges in d-mat form, so the investor doesn’t have to worry about safe keeping.

R R Tolkien in Fellowship of the Ring (first volume of Lord of the Ring) has some prescient advice for gold hunters, as also for all wealth seekers:

All that is gold does not glitter

Not all those who wander are lost;

The old that is strong does not wither,

Deep roots are not reached by the frost.

From the ashes, a fire shall be woken,

A light from the shadows shall spring;

Renewed shall be blade that was broken,

The crownless again shall be king.

Table

Chart I

Chart II