Common Man & Games Policymakers Play

- May 15, 2023

- Posted by: Arunanjali Securities

- Category: Business

Inflation, interest rates, Investments and taxation. These are some of the variables that policy wonks assiduously keep tracking, while those in authority try to manipulate them to get the economy to behave. But such actions by the government and bureaucrats, more often than not, fly on a wing and a prayer. One might as well fine tune a tsunami! No wonder, when an RBI Governor was asked how he decided to change interest rates, he reportedly answered that if the morning tea tasted good, he cut the policy rate, otherwise, he hiked it. Well, now the MPC (Monetary Policy Committee), appears to have brought some method in the madness. But all markets, the money market, foreign exchange market and the capital market, dance to the tune called by these hallowed personae, as was seen, when markets heaved a sigh of relief after RBI declared a pause in the hike in repo rate at the conclusion of the April MPC meeting. Both the bond and the equity markets, closed on the positive side with financiers and a whole lot of youngsters, borrowing to buy homes and cars welcoming the pause. But given the stubborn inflation, savers, essentially senior citizens, may find the value of their savings being increasingly eroded.

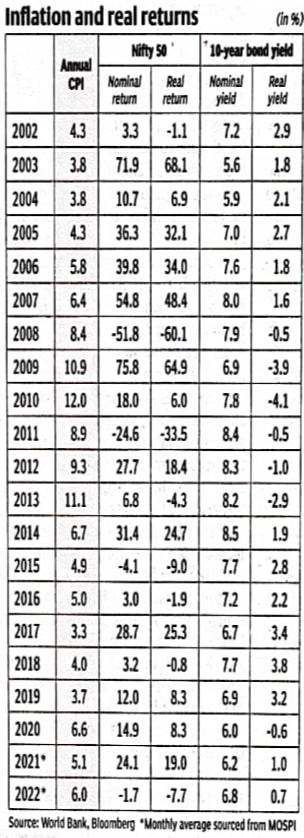

Data presented in the table below, tells the story of real returns over the recent period of 20 years. Reckoning with an average inflation of 6% per annum over the last 20 years, a saver’s investment portfolio would have to yield, at least 6.5% CAGR (Compounded Annual Growth Rate) to provide returns that cover inflation. But the situation has turned worse for savers, since the latest budget has done away with

indexation benefit that was hitherto available to long term investors in debt mutual funds. REITs (Real Estate investment Trusts), provided one more inflation hedging investment avenue. These entities which are traded on recognized Stock Exchanges, own, operate and finance, income generating real estate properties. Investors who acquire a stake in these Trusts are expected enjoy capital appreciation. The rental income from these properties is also given to investors as dividends/payback of debt. With rents moving in tandem with inflation, the dividends from REITs would generally move higher with rising inflation. And REITs were tax efficient too, since only the distributions under the interest and rental income heads were taxable and payouts under “repayment of debt/dividends” were not taxable. Embassy and Mindspace.

REITs distributed 80-92% of their surplus under the tax free heads, while for Brookfield the figure was a little over 52%. But after the Finance Act 2023, dividends/repayment of debt would be taxable once the cumulative distribution of such payouts exceeds the issue price (as distinct from cost of acquisition). Capital gains calculation has also been tweaked for tax purposes. If you sell a unit of REITs, say, at Rs 400 and the cost of acquisition was Rs 300, then the capital gains would be increased by the loan repayment made during the holding period of the investment.

Hence equities offer themselves as a preferred asset class whose net yield could comfortably beat the combined impact of inflation and taxation over the long term. But as Keynes says, “in the long run we are all dead”! And equities are notoriously volatile even over extended periods of time. Consider this: Since 1980, Sensex has made new all time highs less than 7% of all days, which means an investor in the market was likely to be under water 93% of the time! A dismal picture indeed; or is it? The reality is that during this period Sensex was up 49548% (absolute) or giving a return of 15.5% CAGR! But along the way there would have been many imponderables to reckon with. For instance, on Jan 3, 2008, the ten year government bond yield was at 7.77% and the Sensex closed at 20345. The yield plunged to 5.4% on January 1, 2009 and Sensex dropped by 51% to 9903. This put the conventional economic “wisdom”, which says that interest rates and equity returns are inversely co-related, on its head.

The trouble is that in real life there is no ‘ceteris paribus’ and there could be many more variables that determine economic outcomes, than economists and policy makers generally factor in. And finally, in the world of finance even when a pattern discerned in past outcomes is repeatedly validated by empirical evidence, such behaviour may not always repeat itself despite ‘experts’ proclaiming otherwise. Consider this: On January 1, 2008, the Sensex was at 20301 and gold (10 gms) was at Rs 10631. On February 28, 2023 the Sensex was at 58962 and gold (10 gms) was at Rs 55320 (at present it is over Rs 60000). Even on a 15 year time scale, gold beat the Sensex (historically the most rewarding asset class) hands down! Well, one shouldn’t be taken in entirely by such cherry picked examples. “What they reveal is interesting, but what they conceal is even more significant”. Quite often the trick is to so choose the time period as to prove what the proponent wants. But ultimately, one cannot rule out the possibility of an unfancied asset class doing better than the fancied asset class, even over the long term. One way to deal with of such a conundrum, is to structure a multi asset portfolio having regard to the investor’s priorities and risk profile and not to be swamped by the fulminations of the so called “experts” infesting the corridors of power. Remember R K Laxman and his “common man”?