Navigating the Market Meltdown

- April 15, 2025

- Posted by: Arunanjali Securities

- Category: Business

Since 2020 stock markets were running up more on hopes than performance. It is worthwhile to remember that the market is essentially driven by two variables; earnings and multiples. But over the last four years it was driven mainly by multiples while earnings growth did not warrant such frenetic increase in share prices and Indian markets turned out to be the costliest in the world in terms of valuation. As usual, there were “experts” of all hues trotting out reasons why such valuations were justified in the case of India. Well, the music has now stopped and Indian markets are the worst hit over the last five months. The relentless decline in the Indian stock market since last September is causing concern all around. But such declines are needed to drain out the speculative froth created by the preceding bull run and provide profitable entry points to the serious and patient investor who may now see value emerging in quite a few beaten down stocks which have a credible growth story to look forward to. Some of these stocks are:

L&T, Siemens, Adani Ports, Ultratech (Infra)

Coforge, Persisitent, TCS (Software)

Dr. Reddy’s, KIMS (Pharma, Healthcare)

Lumax, ITC, ITC Hotels (FMCG, Hospitality)

Grasim, Reliance (Diversified)

BEL, Data Patterns (Defence)

Coal India (Commodity)

BEL & Coal India are also good dividend plays with dividend yield at the prevailing price level working out to around 5 to 6%.

Slightly riskier but potentially more rewarding bets would be Pidilite, Poly Cab, Shivalik Bimetals, HG Infra Engineering and Balu Forge.

One could also consider staggered investments through Mutual Fund route. This is because, although during the last 5 plus months the stock markets have seen the longest stretch of decline in the last 19 years, bellwether indices of SENSEX and Nifty have declined about 16 to 17% in this period. The magnitude of correctio seems as yet limited when compared with decline in 2008 of 64% or the Covid induced crash in 2020 when the decline was 40%. Other corrections in the Indian market such as those in 2010 and 2015 had also dragged the indices more than 20% from their peaks.

The rally over the last three years has been led by the seven crore plus individual investors, who entered the stock market during or after the pandemic. Penny stocks, stocks with questionable fundamentals, stocks on SME platform and IPOs witnessed feverish activity as the new investors looked for avenues to make money quickly. Turnover in equity futures and options has been doubling every year since 2020-21. With inflows swelling, the domestic funds were compelled to chase stocks in the mid, small and micro cap space and India became one of the most expensive equity markets globally. While the ongoing correction has pulled the price earnings multiple of Nifty 50 down from 24 in September 2024 to slightly less than 20 now, it is still trading at a significant premium to other emerging market indices. The valuations in pockets like FMCG, MNCs and consumer non-durables sectors continue to be at elevated levels. Hence further decline in the indices can not be ruled out. That is why the suggestion for staggered investment makes sense. One could consider investing 50% of the earmarked funds at the current levels and the remaining 50% when the market corrects by another 5%. Mutual Funds not only offer appropriate vehicle for staggered investments, but also provide an effective and hassle free route to diversification. Following 3 funds could be considered for entry in the prevailing turmoil in the markets.

- Bandhan Nifty 100 Index Fund

- ICICI Pru Multi Asset Fund

- HDFC Flexi Cap Fund

For a good mix of debt and equity, an aggressive hybrid fund, such as ICICI Pru Equity & Debt Fund could be considered.

Five per cent of the earmarked amount could also be invested in Medium Duration Fund, now that the interest rates are expected to see a calibrated staggered reduction. Birla Medium Term Fund, which has yielded more than 13% over the last five years could be considered in this regard. After Budget 2024, the tax treatment of all the above funds converges after 2 years.

Under the New Tax Regime, where the income of the investor exceeds Rs 12 lacs due to interest income from bonds and FDs, or where the investor suffers the highest tax incidence of 39%, investment in tax free bonds could be preferred.

For those who cross the tax-free threshold of Rs 12 lacs under the New Tax Regime because of interest income, tax free bonds (which are issued by central government undertakings) offer a significant advantage, as the interest income from these bonds is tax free and is not included in the taxable income.

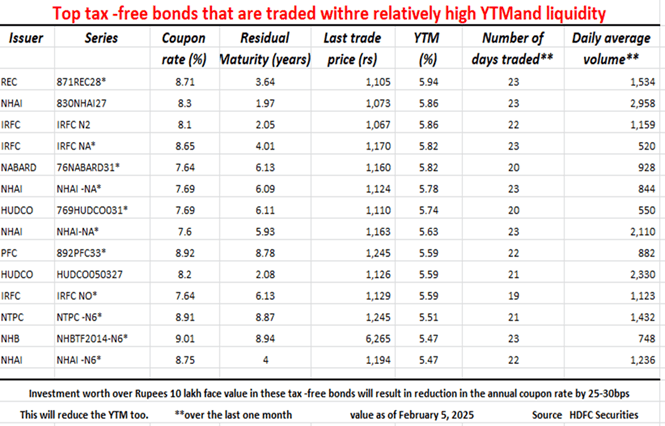

For those suffering highest incidence of tax of 39%, even a triple A rated bond or an FD with a coupon of 8% will mean a post tax yield of only around 4.8%. But there are enough bonds traded on the bourses offering YTM (Yield To Maturity) of 5.5 to 5.9% post tax as can be seen from the table below.

Savvy HNI investors could also adopt a win-win strategy of selling ATM (At the Money) or modestly OTM (Out of The Money) put options on shares selected for investment.

This is in fact the time for the diligent investor to enter the market after due homework and go all the way laughing to the bank after some years.