Will, Probate, Succession Certificate & Letter of Administration

- October 29, 2023

- Posted by: Arunanjali Securities

- Category: Business

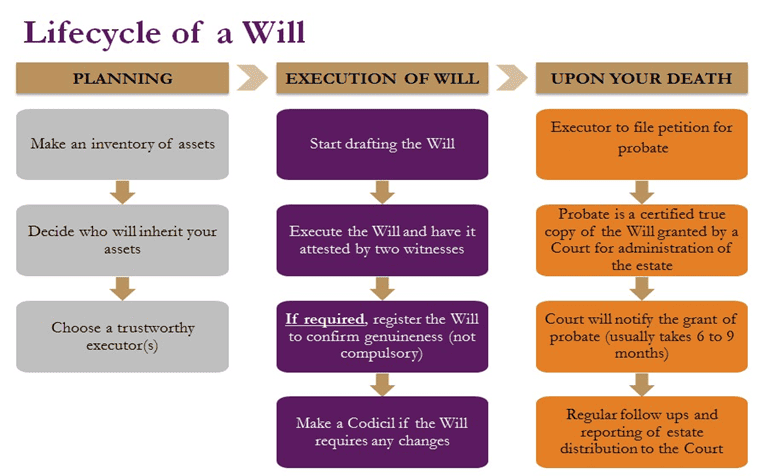

Although reliable statistics are hard to come by, experts estimate that an overwhelming majority of Indians die intestate. It is not that only ordinary Indians die intestate. Even industry doyens are afflicted by this fairly pervasive reluctance to execute a will, or put a succession plan in place as exemplified by the egregious public spat between the Ambani siblings squabbling over the intestate estate of their deceased father. The following chart summarizes the stages in the making and execution of the will.

While there are financial advisors and also some legal practitioners who discount the importance of a probate, there are situations when probated will becomes essential, as when companies insist on submission of the same for transfer of shares exceeding a particular value. It is important to understand the distinction between a will, a succession certificate and letter of administration. The steps in making a will are already described above. A succession certificate is a document that proves the right of a person to inherit the property of a deceased individual. A letter of administration is a document issued by a court, giving authority to administer the estate of a person who has died intestate. Generally speaking, if there is a will, then a probate is required before a succession certificate or a letter administration is issued. However, if there is no will, then a succession certificate or letter of administration can be obtained without a probate. What then are the situations where a succession certificate or a letter of administrations may become necessary? They are both legal documents issued by court. However, they are used in different situations. A succession certificate is used when there is no will and the deceased person’s property is to be transferred to legal heirs. On the other hand, a letter of administration is generally used when there is a will, but the executor of the will is unable or, unwilling to carry out his/her duties.

How does one probate the will? Under the Indian Succession Act, probate means will which is certified under the seal of the court. It is the process through which the judiciary establishes the authenticity of the will, including, inter alia, the testamentary capacity of the person making the will. For instance, mental capacity of the testator and/or if there was undue pressure to write the will as presented to the court, would be verified. Probate may be necessary or advisable under certain conditions. One example could be where there is likelihood of the will being challenged on any ground by anybody.

Needless to say that the will is probated after the death of the testator. A petition must be filed in the appropriate court with the names and addresses of the deceased’s legal heirs. The jurisdiction is typically the district court, but it could be higher court in some cases. Quite a few documents are required to be submitted by the petitioner. Death certificate of the testator is a key document which is required along with the original will. Identity proof, such as Aadhaar, of the beneficiaries mentioned in the will is needed. Additionally, documents to establish the ownership rights of the testator over the properties mentioned in the will are needed. For example, if the property was self acquired, the original purchase deed, or if it was inherited, documents that prove the legality of the inheritance are required to be submitted. The court fee varies from state to state, generally with a cap on the maximum fee payable. For instance, in Maharashtra the court fee varies from 2 to 7.5 per cent depending on the asset value covered in the will. The process takes typically six to nine months and could take much longer if the will is disputed resulting court hearings. Other complications like demise of the witness or any of the beneficiaries could also delay the process. One more issue that complicates issue of probate is when the will does not specify the executor of the will. Probate can be granted only to the executor and if the executor is not mentioned before starting probate process, an application must be made to appoint one to the court. Hence drafting the will has to be done with great care, preferably with help from an expert, because as the courts say, “a will has to speak from the grave”.