Artificial Intelligence (AI) & Investment Opportunities

- July 17, 2023

- Posted by: Arunanjali Securities

- Category: Business

Stock markets around the world have taken note of the AI revolution. The league of trillion-dollar marketcap stocks saw a new member joining it recently.

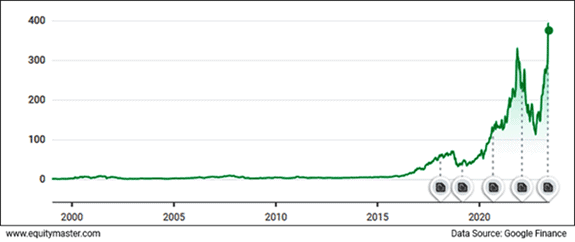

It’s Nvidia, the seventh member to join the trillion-dollar club. The company defines itself as the world leader in AI computing. Here’s how the stock has performed.

For investors, AI isn’t just a tool that can improve their stock-picking universe but an industry in which they can gain broad exposure. On the one hand, there is the potential for capital gains as the AI industry continues to advance and digitalisation initiatives gain momentum. On the other hand, investors can also enjoy passive income through dividends while they wait for their investments to grow. The AI sector in India is rapidly growing and has significant potential. India is home to a large number of technology companies that are investing in AI research and development.

Although picking stocks in a growth industry comes with a lot of uncertainty, the top AI stocks are worth considering. Plenty of companies can profit from AI. There are many opportunities here.

Dalal Street analysts are touting the best artificial intelligence stocks in India amid a surge in investor interest. But if you’re looking for the “best” AI stocks, it’s a good time to be cautious amid the hype. Look for companies using AI to improve products or gain a strategic edge. But be on guard against poorly performing companies suddenly ‘pivoting’ to AI. Broadly the companies in the AI ecosystem can be segmented as follows:

- Chipmakers

- Software firms developing AI tools (some will be direct AI plays)

- Cloud computing firms (infra or software developers)

- Tech companies that are users of AI

- Hardware companies building AI enables devices

Then there are other companies in every industry that uses AI. Indeed they must use AI or lose out to their competitors. You can consider investing directly in companies that develop AI tools. Alternatively, you can consider investing in companies that stand to benefit the most from its wider adoption. The former are direct plays on the actual technology. These investments are suitable for enterprising investors with a modicum of expertise and willing to put in the necessary diligence to study these companies. The later are indirect beneficiaries, “pick and shovel” AI stocks. These investments are suitable for conservative investors. These are stocks of already strong company that stand to benefit from the applications and growth of AI applications.

As per a report put out by Equitymaster the most promising AI focused companies in India are: Coforge, Tata Elxsi, Happiest Minds, Persistent Systems, Saksoft and Affle India. Coming to “pick and shovel” companies, one finds them, among others, in sectors like healthcare and auto industries. For instance Astra Zeneca employs knowledge graph and image analysis for chemistry automation to shorten drug discovery and and identify biomarkers 30% faster than human pathologists,, while Pfizer uses AI to conduct vaccine trials and streamline distribution. Glaxo Smithkline Pharma on the other hand, has invested Pound Sterling 10 million in the UK to establish a AI hub for discovery of new drugs to treat cancer and other diseases. Then there are start-ups like Netmeds, 1MG, Pharmeasy and others which are effectively deploying AI to improve operations.

In the auto industry AI has made huge strides in improving manufacturing, supply chain management, predictive maintenance, driver assistance, autonomous cars etc. Tata Motors is leveraging Tata Elxis’s technology to remagine its products while Mahindra and Mahindra has replaced physical testing of engines with virtual testing utilising AI technology. Hero Motocorp which deployed cloud computing 9 years ago has come to appreciate the significance of responding quickly to service demands. It also carried out a remote support solution using smart glasses and AI innovation in its plants.

Just as computer applications and software solutions came to rule our daily lives, AI has now begun to be a part of everything that companies and people do. Investors would do well to closely watch the developments in the field to spot early on, profitable opportunities, keeping in mind that investing in an emerging sector could be replete with pitfalls, particularly when the hype could be exaggerated.

Caveat emptor.