Wealth & Women

- April 15, 2023

- Posted by: Arunanjali Securities

- Category: Business

Every year, the ritual of celebrating International Women’s day goes on with a lot of fanfare! And we see , mainly men, waxing eloquent about empowering women! Celebrations for the day are generally organized by men and we also hear of awards specially reserved for women, like outstanding woman leader or outstanding business woman of the year, etc. Alas, the jury for such awards is almost always dominated by men. Implicit in all this is the patriarchal mindset that conveys that women on their own may not be able compete with men and win these awards on equal terms. In my view, this condescension is an insult to women and only perpetuates the status quo ante! Aren’t we men experts at tokenism?

But thanks to education, the traditional paradigm of women taking care of homes and men taking care of money has changed over the last few decades with increasing participation of women in the workforce and many of them emerging as entrepreneurs in their own right. In the early 50s, the percentage of working women in urban female population was around 12% and it rose to around 16% in 2018-19 (source: NSSO). While the growth in percentage terms may seem modest, if we take into account the population growth over the last 7 decades, then it will be evident that many more women are working today compared to previous generations. Even among women who do not have formal employment e.g. homemakers, there is increasing involvement of women in personal finances of the household. This is an encouraging development for the well being of the families and our society as a whole. However, we still have a long way to go as far as women’s involvement in investments and personal finance planning is concerned.

Misconceptions about women and money

- The perception that women are bigger spenders than men is wrong. Women usually make smaller ticket purchases, while men tend to make big ticket purchases e.g. property, cars etc.

- The perception that men are more fiscally responsible than women is also incorrect. It has been seen that men are likely to take on more debt compared to women (source: bankrate.com, November 2022).

- Many men consider themselves to be better money savers than women. However, their perception is usually wrong. Women usually suffer more from a sense of insecurity than men and therefore, tend to save more than men across different income groups. Also, women feel more responsible towards their children and are ready to make sacrifices for the sake of their children’s future. A survey conducted by Bank of Baroda, shows that average balances of women in Jan Dhan Yojana is more than average balances of men (source: Times of India, August 2021).

- There is a perception that men are better investors than women. Studies in the US have shown men are likely to take more risks than women; women are more conservative. Women usually think more long term, whereas men tend to trade more (short term). Trading is risky and can harm your financial interests (source: Motley Fool, March 2023).

- Women are not interested in investing. This is not entirely true. While in India, many women leave investment decisions to their spouses or fathers, women are equally concerned, if not more, about the family’s financial security and life-stage financial goals. With societal changes taking place in India e.g. shift from joint to nuclear families, women choosing to remain single, greater career growth opportunities for women, more and more women are seeking financial independence. Since the COVID-19 pandemic women are saving and investing more than men (source: Outlook India, November 2022).

Common mistake made by women in relation with money and investments

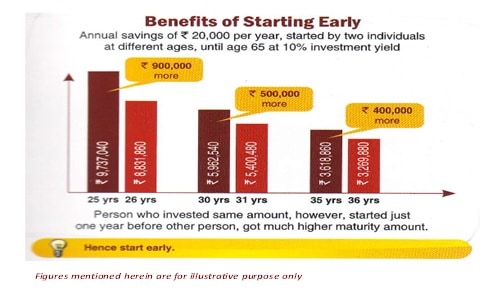

- Start investing late. Women often want to settle down in their careers or lives before they start investing. While many men may also want to do the same, women usually start their investment journey later e.g. when kids start going to school. This delay results in opportunity lost. The earlier you start investing, the more wealth you can create through the power of compounding. Compounding is profits earned on profits; the longer your investment tenure, higher is the power of compounding (see the chart below).

Not take sufficient risks. Important to remember that risk and return are directly related. Higher the risk, higher the potential return over sufficiently long investment tenure. Since the sense of insecurity is higher in women, they usually tend to avoid risks. Too much risk aversion may hamper you in achieving your long term financial goals. Historical data over the last two decades have shown that risk-free returns (e.g. Bank FD interest) have failed to beat inflation on a post tax basis. You should take the right amount of risk, based on your risk capacity and financial goals. You should understand that your risk taking ability is different from risk appetite. You should consult with a financial advisor, if you want to help in understanding your risk profile.

Make compromises to balance priorities. Women have to balance many priorities e.g. career, taking care of children, spouse, parents, in-laws etc. In this difficult juggling act, they may have to make compromises that harm their long term financial goals. It is important for both working women and homemakers to have a financial plan. Financial plan can help you balance multiple priorities and achieve your financial goals. Financial planning is the process of defining different goals, quantifying these goals after factoring in inflation and your income and expenses. The outcome of financial planning is an investment plan to meet your financial goals having due regard to your constraints / priorities. Financial planning also prepares you for risks like untimely death, serious illnesses, work life interruptions like childbirth, child care, taking care of ailing relatives etc. You could take the help of a financial planner is making your financial plan.

Afraid of making mistakes. This comes from the sense of insecurity and this often prevents women from making investment decisions or delay making investments. You should understand that you do not have to be an investment expert or know everything to start investing. You can invest in mutual funds, which are managed by professional fund managers with sufficient expertise and experience, who will make investment decisions on your behalf to achieve your investment objectives over sufficiently long investment horizons. There are different types of mutual funds for different investment needs and risk appetites.

Embrace equity for your long term financial goals and wealth creation

#EmbraceEquity is the theme for the international women’s day, 2023 (March 8 2023) where the world celebrates the achievements of women, raises awareness of diversity and collectively forge women’s equality and gender parity.

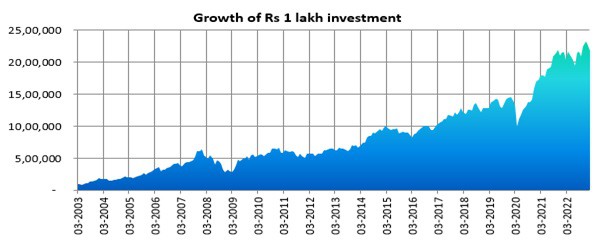

Equity is an asset class, referring to shares of companies which trade in stock exchanges. Many women may think of equities as very risky investments. While equities are volatile, historical data shows that equity as an asset class has the highest wealth creation potential over long term. The chart below shows the growth of Rs 1 lakh invested in Nifty 50 TRI (the leading equity market benchmark index) over the last 20 years (as on 28th February 2023). Your investment would have multiplied more than 20 times in the last 20 years at a CAGR of 16.6%. Equity as an asset class is suitable for your long term financial goals like children’s education, children’s marriage, retirement planning, etc.

How to start investing for financial security and aspirations?

- Start with defining the financial goals for you and your family in quantifiable terms. You should prioritize your goals and factor inflation in your financial goals.

- Prepare an expense budget to optimize your savings by eliminating inessential expenses.

- It is not enough to save, you should invest your savings to get adequate returns to achieve your financial goals at different stages of your life.

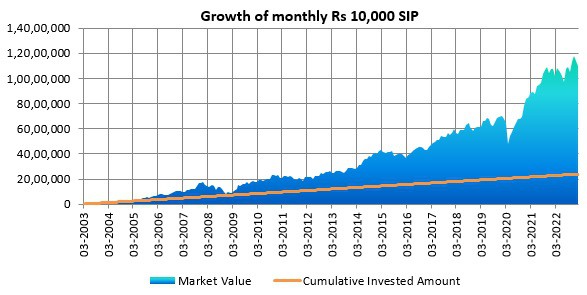

- Start investing from your regular savings and choose appropriate investment vehicle to suit the time horizon of your goals. Mutual funds provide required diversity, spanning different time periods (covering fixed income, equity, hybrid and multi assets) and bespoke investment options. They lend themselves admirably to disciplined investment process, namely, systematic investment plan (SIP). Through SIP, you can invest fixed amounts every month (or any other interval). The chart below shows the wealth creation through a monthly SIP of Rs 10,000 in Nifty 50 TRI over the last 20 years. With a recurring, cumulative investment of just Rs 24 lakhs over 20 years, you could have accumulated a corpus of nearly Rs 1.1 crores. You can see the wealth creation potential of SIP over long investment horizon.

In the ultimate analysis the rules for successful investment are the same for men and women,

except that many a woman might, after centuries of temperamental conditioning and hard to jettison biases of a patriarchal society, feel tethered even when education and economic independence have set them free.

The rules for successful investment are simple: Start early, save (invest) regularly and continue over long term