Budget Dialectics

- March 10, 2023

- Posted by: Arunanjali Securities

- Category: Business

It is a moot point if the Finance Minister is subscribing to Hegelian dialectics of thesis, antithesis and synthesis. But in Budget 2023, she has given us the old tax regime with tax breaks and the new (default) tax regime without tax breaks, with likely eventual synthesis being the new tax regime with a few more tweaks to make it more acceptable.

The budget also provides revenue impact of tax incentives, which in the latest budget is estimated at Rs 2.11 lac crores. But despite the much flaunted transparency in budget making, repeated queries made under the RTI Act, seeking the methodology adopted to compute the revenue impact of 100% tax exemption under Section 80GGC of the IT Act (contribution to political parties) have been conveniently forwarded to Central Processing Centre (CPC) for processing IT Returns. But alas! CPC has found it expedient to hide behind the fig leaf of technical mumbo jumbo! The excuse for not providing the required information is that, given legacy software which governs the end to end automation of IT return processing, providing data in the required form would require the intervention of an expert team and even then it may not be feasible to download the information in a manually readable form. Quite a tale indeed! When it comes to safeguarding the “Sarkari” secret surrounding the electoral bonds, the mandarins in CBDT bureaucracy seem to be at their creative best in weaving a convoluted story.

Be that as it may, the question that the tax payer needs to answer is which tax regime would be beneficial to her/him. The main features of the new tax regime are:

- Tax free threshold raised from Rs 2.5 lacs to 3 lacs.

- Income Tax slabs reduced from 6 to 5 with 25% slab scrapped.

- Standard Deduction of Rs 50000 is allowed for salaried employees and pensioners.

- Rebate under Section 87A increased for taxable incomes up to Rs 7 lacs.

- Surcharge on incomes above Rs 5 crores reduced from 37% to 25%

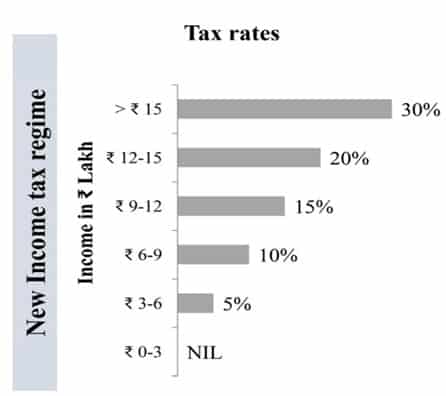

- Tax rates under the new regime are as given below:

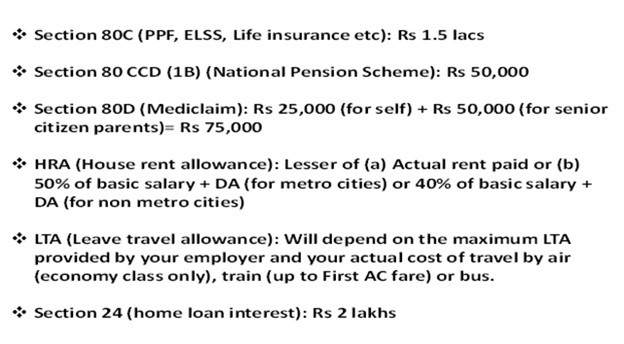

Some of the common deductions available under the old tax regime are as follows:

Choosing the beneficial tax regime would depend on tax payer’s level of income and the tax breaks that are availed. Following examples might help in choosing the beneficial tax system.

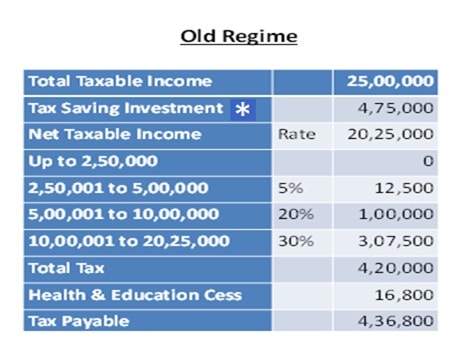

*80C investments 1.5 lacs, health cover 0.75 lacs, NPS 0.5 lacs, housing loan interest 2 lacs

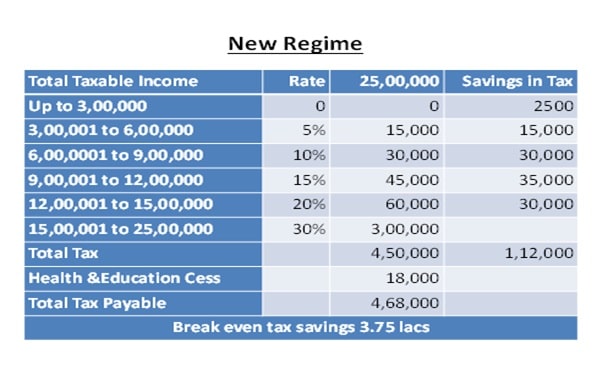

It can be seen that the tax rates coalesce at the income level of Rs 15 lac onwards. Without reckoning with any tax breaks and the reduced surcharge level of 25% for incomes above Rs 5 crores, a tax payer under the new regime with income of Rs 15 lacs or more will save Rs 1.12 lacs vis-à-vis old tax regime, which means that a person with income of 15 lacs or more will have to have investments/expense in tax saving instruments to the tune of Rs 3.75 lacs under the old regime to be on par with the new regime. Manipulation of data on simple spread sheet would help in choosing the beneficial regime. But there is no need to despair if you do not want to calculate the trade off between the old and new regime. The CBDT website provides a calculator to help tax payers choose between the two systems. Well, some of the times the tax man does try to be helpful to the tax payer.