Active or Passive Investing?

- February 20, 2023

- Posted by: Arunanjali Securities

- Category: Business

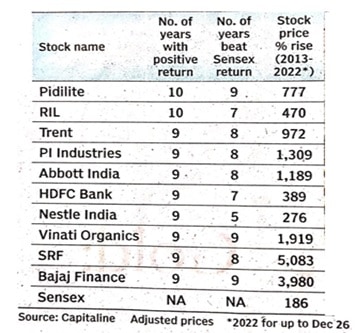

Union Budget is almost on us with the mandarins in the finance ministry and sundry politicians along with policy wonks of various hues looking forward to their day under the arc lights, while they sanctimoniously offer their expert opinion for what it is worth. The fact, however is that the State Budgets and GST, which account for 60 per cent of the public spending, matter more for the average Indian. But the stock markets, at least the traders, wait with bated breath for the Union Budget, notwithstanding Warren Buffet’s time tested dictum that capital markets are a voting machine in the short run but are a weighing machine in the long run, which means that real wealth always resides with the discerning and disciplined investor. But even with investors who keep chasing multibaggers, success stories are few and far between. That is because spotting multibaggers before their big moves and holding on to them through their ups and downs and exiting them when the original story doesn’t hold up as expected, requires not only uncommon grit and prescience but also more luck than skill. As per a recent report by Business Line, only 4 per cent of stocks in the BSE 500 universe have generated positive returns 90 per cent of the time in the last ten years. If the goal was to beat the market (Sensex) in each of these 10 years, then less than 1 per cent of the stocks did it. Table 1 below gives the list of most consistent stocks over the last 10 years.

means that an investment of Rs 1 lac in each of these stocks would have yielded at least Rs. 1 crore in ten years. There were others like HLE Glasscoats, Uno Minda, Navin Fluoro, APL Apollo, etc., which have posted returns between 5000 and 9000 per cent. Well in hindsight it appears that markets offer opportunities galore to land multibaggers. But as already pointed out, it is easier said than done!

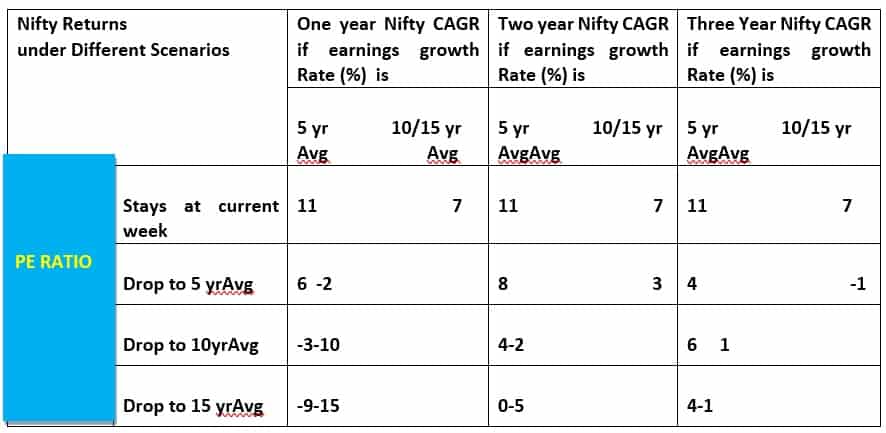

What then can the investor expect in 2023? The important thing to bear in mind is that markets are essentially driven by just two variables: earnings and multiples (PE Ratio). While earnings are real, PE multiples are more often than not, a function of sentiment. PE multiple for Nifty, at present is 21.56 (Jan 10, 2023) which is at a premium of 5, 15 and 23 per cent to the average PE for 5, 10 and 15 years. It is estimated that 14 per cent would be earnings growth going forward. As against this, Nifty CAGR (Compounded Annual Growth Rate) over the last 5, 10 and 15 years has been at 11, 7 and 7 per cent, respectively. What will be the returns going forward if these two variables were to mean revert? Table 2 below indicates the probable outcomes.