Enslaved By Biases

- October 15, 2022

- Posted by: Arunanjali Securities

- Category: Business

Biases insidiously control the world and more often than not, we are not even aware of them. In the world of investments, being aware of one’s biases is essential to succeed over time.

A well known but not easily recognized bias is the boundary bias which inhibits thinking “out of the box” because of an unconscious barrier. When Newton came out with his laws of motion, the then observable, finite physical world became far more comprehensible. But then as mankind started poring over the infinite spaces beyond galaxies and celestial objects moving at speed of light, Newton’s laws of motion could not adequately explain all the observed phenomena. It required the genius of Einstein to break the boundaries of Newtonian world with his theory of relativity. But neither Newtonian mechanics nor theory of relativity could explain all the phenomena at the microcosm – the world of infinitesimal particles. We needed altogether new approach to unravel the world of subatomic particles, which was provided by Max Planck’s quantum mechanics and Heisenberg’s uncertainty principle. The above are only examples of how great minds have broken boundaries, but to appreciate how subtle the boundary bias is, consider the following example.

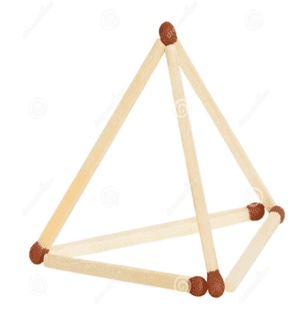

Arrange six identical matchsticks to form four triangles without breaking or crossing any of the matchsticks. Most people try to achieve this by manipulating the matches on a flat surface. The solution lies in freeing yourself from the subliminally perceived two dimensional constraint and to use the third dimension. The adjoining figure shows how this can be done.

One other bias that could wreak financial havoc (It could also destroy interpersonal relationships) is the tendency to jump to conclusions. Imagine a situation where our hunter gatherer ancestor encounters a violent predator, say a tiger, in the wild. He is most likely to flee the scene of danger instantly rather than wait there calculating escape velocity required for successful escape, as per Newton’s laws of motion! This is how the human brain has evolved, with instant intuition dictating most of our actions as danger was ever present and imminent when foraging was the only activity apart from procreation. But today most of us need to use more of the analytical part of our brain although often, we find it easier to depend on intuition when we ought to have depended on analysis. Consider this example: You have a loved one who is suffering from severe arthritis and the existing drugs are not effective. You now are told of a wonder drug that offers definite cure, but the probability of fatal side effect has risen by 100 per cent. Would you still procure this drug? You would certainly hesitate. However, you try to obtain some more information on the drug and you find that earlier probability of fatal side effect was 0.0001 per cent, which in respect of the new drug has increased to 0.0002 per cent, that is by 100 per cent. Now that you clearly see that the probability of fatal side effect is only 0.0002 per cent even after an increase of 100 per cent, you are quite likely to buy the new wonder drug. It is therefore essential to painstakingly obtain relevant information before coming to a conclusion. Many of us do not have adequate information when we invest in a security on the basis of some tip or blithe recommendation. “Serious investors do the math; amateurs listen to stories”.

Well, biases come in all colours and hues. There is the recency bias, anchoring bias, action bias, herd mentality, greed and fear, loss aversion, tendency for instant gratification, blind dependence on heuristics and of course there are myriad illusions to deal with. It will not only be profitable but also entertaining and enlightening to go through works of great minds on the subject. May be a beginning could be made with the following:

Thinking Fast & Slow, by Daniel Kahneman

Chapter on Psychology of Investing in The Four Pillars of Investing by William J. Bernstein.

Value Investing and Behavioral Finance, by Parag Parikh.