Travails of the Indian Rupee

- August 24, 2022

- Posted by: Arunanjali Securities

- Category: Business

Of late the rupee has been hogging the headlines, most of them for the wrong reasons. To date in 2022 alone, the rupee has lost nearly 8 per cent against the US dollar and is dangerously flirting with 80 to a dollar mark. To appreciate broad implications of a falling currency one doesn’t have to revisit esoteric concepts of international trade and finance, such as REER (real effective exchange rate), LOOP (law of one price) based on PPP (purchasing power parity) or the “asset market approach”. A plain reading of the Financial Stability Report by RBI suggests that things could get worse for the rupee. As per the report, nearly 44 per cent of External Commercial Borrowings (ECBs), that is about $79 billion, is unhedged. With the relentless slide of the rupee, the cost of repaying these unhedged loans has been soaring resulting in higher hedging premiums which is likely to further push down the rupee. But the moot point is who is affected by the slide in the rupee?

Exporters are benefitted from the rupee decline, particularly software service exporters and pharma companies supplying generics mainly to the US. Also Non-resident Indians and those who would have invested abroad will see their rupee balances/value swelling with their remittances/conversions fetching them more rupees than before the slide. But all of us who depend on imported goods and services, such as petrol/diesel, edible oils, gold, electronics, cars, overseas education and travel will have to pay more to consume the same. Hence imported inflation has been a major contributor to the price rise as represented by the CPI (Consumer Price Index). Even where the commodities imported by India cool down a bit in the international markets, the decline in the rupee has offset such softening in prices. Given the import intensity of a growing economy like India, the concern now is what can the RBI and Government do to arrest this slide and control the resultant inflation.

Imported inflation has to be tackled mainly by supply side management, which means by Government of India (GOI). GOI has taken several measures, including: a) reduction in excise duty on petrol and diesel in May, b) cut in import duty on certain key raw materials and inputs, c) export duty on certain steel products to improve availability at home, d) duty free import of crude soybean and sunflower oil till next year, e) limit on sugar exports f) temporary ban on wheat exports and g) windfall tax on export of refined crude oil products. GOI has also hiked import duty on gold to disincentivise its imports and reduce the trade gap.

RBI, on the other hand has sought to improve the inflow of foreign exchange through quite a few measures. It has sought to tame inflation by hiking interest rates to dampen demand and at the same time slowing down the slide in the rupee by making investment in rupee securities a little more attractive. It has removed interest rate restrictions on FCNR(B) and NRE deposits up to October 31, 2022 and also exempted from cash reserve ratio (CRR) and statutory liquidity ratio (SLR), all incremental FCNR(B) and NRE deposits up to November 4, 2022. Restrictions on Foreign Portfolio Investments in debt instruments have been relaxed till October end and Authorised Dealers (ADs) have been permitted to utilize overseas foreign borrowings for lending to domestic borrowers for multiple purposes till end October 2022. The limit of $ 750 million for ECB under the automatic route has been increased to $ 1.5 billion and the “all cost interest rate” ceiling on ECBs has been increased by 100 basis points till December 31, 2022.

While the above are essentially short term fixes, RBI’s initiative to internationalize the rupee, vide its notification of July 11, 2022, if successful may have a more lasting impact on strengthening the rupee. Under this the RBI has allowed ADs, to open special rupee vostro accounts for invoicing, payments and settlement of exports/imports in rupees. The exchange rate between trading partners shall be market determined. The surplus balance in such accounts can be invested in government treasury bills and dated GOI securities. Sale proceeds of such investments can be repatriated, but subject to the prevailing capital account regulations. This measure, if successful, would result in a multilateral trade system based on mutual agreement among trading partners. Under this arrangement, RBI’s dollar sales will be lower to the extent to which international trade is settled in rupees by reducing dollar demand correspondingly. While this may immediately facilitate Indo-Russian trade by getting around sanctions on Russia, its wider adoption across geographies and its long term viability hinges on the behavior of a number of variables which warrants a separate discussion.

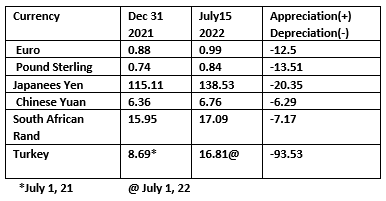

Where does the rupee go from here? It is important to remember that with inflation in the US still at 40 year high, one can expect the Fed to effect more rate hikes and resort to further quantitative tightening resulting in flight of capital, particularly, from emerging markets to the US dollar. But rupee is not the only currency that is adversely affected. It is not even the worst affected currency as can be seen from the data on movement of major currencies.

Exchange Rate of Major Currencies per US $

Although RBI Governor Shri. Shaktikantha Das claims that they are adequate for RBI to intervene in the foreign exchange market to stem the tide against the rupee, for how long can such interventions be effective if the fundamentals underpinning the rupee, like trade deficit keep getting worse? Even if the reserves were adequate, there are other constraints to such intervention. It is important to note that every time RBI sells dollars to shore up the rupee, it sucks rupee funds out of the market, tightening liquidity which is likely to result in hike in bond rates, adversely affecting both growth and borrowing costs for the GOI, industry and retail borrowers. Needless to say, that the trade-off between interest rate hike and growth is a difficult dilemma to resolve, if at all. Unfortunately, in economics there are no straight forward answers to many questions and policies dictated by conventional economic logic throw up contradicting outcomes. For instance, one talks of looming recession in the US and yet US $ index is at record high levels, because dollar being the dominant global reserve currency, is regarded as safe haven for footloose capital when world goes into turmoil! Alas! Indian Rupee doesn’t have the luxury (or challenge) of being a reserve currency. RBI truly is on the horns of a dilemma!