Inflation & Investments

- June 20, 2022

- Posted by: Arunanjali Securities

- Category: Business

Inflation is a many headed Hydra. Both electronic and print media are awash with headlines regarding inflation these days. Retail inflation based on the Consumer Price Index (CPI) surged to near 8 year high in April this year to 7.79 per cent. Producers’ inflation based on the wholesale price index (WPI) has hit 15.08 per cent in April, up from 14.55 per cent in March. This is the highest ever level since 2011-12 when the series came into force. Mind you, these are official figures, which most of us would agree, have to be taken with more than a pinch of salt. And then the economists and statisticians talk about cost push or demand pull inflation, or inflation being transitory or structural in nature. For the aam admi, inflation is the rise in prices of goods and services. With “growth” and population increase, inflation is inevitable. Even the US, the pre-eminent global economy, has not been immune from inflation. In August 1971, when President Nixon pulled the US out of the gold standard, one Troy ounce of gold was $ 35. At present it is around $ 1840, which implies that vis-à-vis gold, the compounded annual growth rate (CAGR) in price rise has been slightly over 8 per cent in the US.

Inflation affects every one of us. As consumers we have to spend more to buy the same amount of goods and services. As savers we suffer reduction in the purchasing power of savings, unless the return on savings is higher than inflation (Alas! After adjusting for tax). Hence in an inflationary situation it is essential that savers graduate to being investors, so as to ensure that the returns on their investments are adequate to achieve their goals.

By way of illustration consider the following situation.

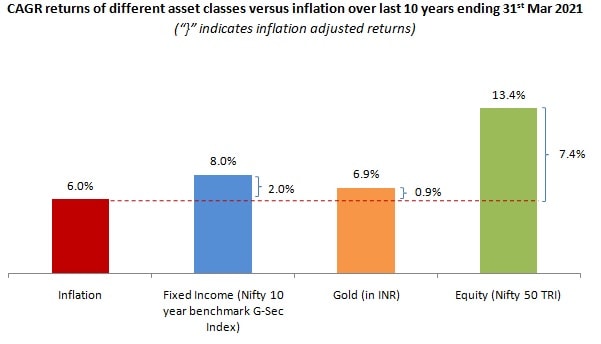

Let us say that your current monthly expenses are Rs 50,000/-. You have 30 years to retire and the average annual inflation is likely to be 8 per cent. You will then require Rs 5.03 lacs to meet your monthly expenses to maintain the same standard of living thirty years from now! Hence while choosing to invest for achieving any goal, you need to carefully assess the return record of the asset class, the associated risk over the chosen/available time horizon and your saving capacity. The CAGR of different asset classes available for investment to most of us is indicated in the chart below

One other important asset class for long term investment is real estate. But given its lumpy nature, it does not lend itself to gradual accumulation, unless you are an ultra HNI. Of course, one can take a loan to acquire real estate and the EMI could be regarded as a reverse SIP. But interest outgo will add to the cost of acquisition. Indian bourses, however, are evolving and it is now possible to conveniently and gradually add this asset class to one’s investment basket by buying real estate “units” of the Real Estate Investment Trusts (REITs) listed on the stock exchanges.

Systematic Investment Plans (SIPs) for investment in equity mutual funds are well suited to ride out the volatility caused by bouts of inflation and the consequent interest rate hikes, provided such systematic investments are carried out over long term (at least over five years).

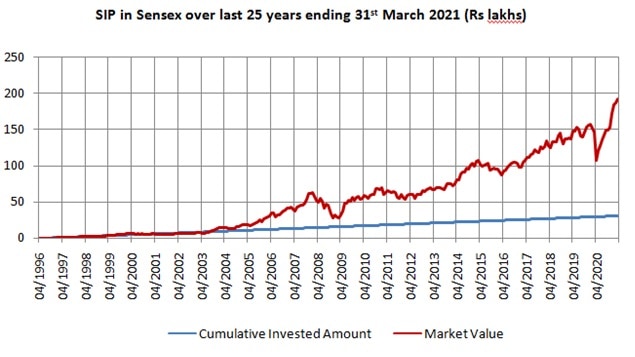

The chart below shows returns on Rs 10,000 monthly Systematic Investment Plan in the BSE Sensex over the last 25 years (1st April 1996 to 31st March 2021). With a cumulative investment of Rs 30 lakhs you could have accumulated a corpus of Rs 1.90 Crores through systematic investing. The annualized returns (XIRR) of monthly SIP in BSE Sensex over the last 25 years would have been over 12.7%. This is higher than Sensex return (11% CAGR over the same period) and clearly demonstrates the benefits of Rupee Cost Averaging.