Tax Tantrums

- March 15, 2022

- Posted by: Arunanjali Securities

- Category: Business

It is that time of the year when many of us would be anxious to meet advance tax payment obligations and see if we can minimize our tax outgo. Although Finance Act 2021 has sought to simplify tax computation by, among other things, reducing the tax rates for those opting to forgo exemptions/deductions under various provisions of the Income Tax Act, there would still be many who may want to take advantage of these exemptions/deductions. Before we discuss Section 80C, the best known provision for availing tax deduction, it is useful to know other provisions of the Act that might help in reducing the tax outgo for an individual. A list of such provisions is given below

80CCD Contribution made to NPS or Atal Pension Yojana.

80G Donations to approved institutions & funds

80D Health Insurance & preventive check-ups

80DDD Medical expenditure for disabled dependent

80DDB Medical expenditure on specified illnesses

80E Interest payable on education loans

24 Interest payable on home loans

80TTA Interest on savings deposit

80TTB Interest on deposits for senior citizens

80GGC Contribution to political parties

Section 80C of Income Tax Act of 1961 allows investors to claim deduction of up to Rs 150,000 from their taxable incomes by investing in certain schemes which are eligible u/s 80C. These schemes include Employee and Voluntary Provident Fund (EPF and VPF), Public Provident Fund (PPF), National Savings Certificates (NSC), 5 year tax saver bank fixed deposits, life insurance policies (both traditional and unit linked) and mutual fund Equity Linked Savings Schemes (ELSS). On most counts, ELSS offers the best avenue for wealth creation while getting tax deduction under the Section. However, the following considerations have to be born in mind while saving under Section 80C.

- If you are a salaried investor and contributing to EPF, your contribution to EPF will be included in 80C deduction.

- If you are paying home loan EMIs, then the principal component of the EMI payments for the year will also be included.

- If you have life insurance policies, the premium for the year will be included.

- Calculate how much deductions you can claim from the above and how much investment you need in order to claim the full benefit u/s 80C

- Select the suitable 80C scheme to make your tax saving investments depending on your risk appetite and financial goals.

Equity linked savings schemes (ELSS) are equity mutual fund schemes. Investments in ELSS are eligible for deductions from your taxable income under Section 80C of Income Tax Act. There is no upper limit on investments in ELSS, but maximum deduction allowed u/s 80C is capped at Rs 150,000. ELSS funds have a lock-in period of 3 years. No redemption or withdrawal is allowed in the lock-in period. If you are investing in ELSS through Systematic Investment Plan (SIP), each SIP installment will be locked in for 3 years. ELSS invests in equity and equity related instruments. ELSS funds usually diversify across market cap segments and industry sectors; there are no SEBI mandated limits on market cap allocations for ELSS. Since ELSS funds are market linked investments, they are subject to market risks. But over the long term they score better than other investment avenues under Section 80C.

- Interest rates of Government small savings schemes eligible for 80C deductions e.g. PPF, NSC etc are steadily coming down over the last several years. Interest rate of PPF and NSC as on 31st December 2021 are 7.1% and 6.8% respectively. 5 year tax saver Bank FD rates have also come down to around 5.5% p.a..

- ELSS provides superior liquidity compared to other 80C investment options. ELSS has lock-in period of just 3 years. Other 80C investments do not provide any liquidity before a minimum period of 5 years. Liquidity is always an important consideration in investments.

- Tax planning should not be just about tax savings; it should also help you in your long term financial goals. ELSS investments have the potential to create wealth over long investment tenures.

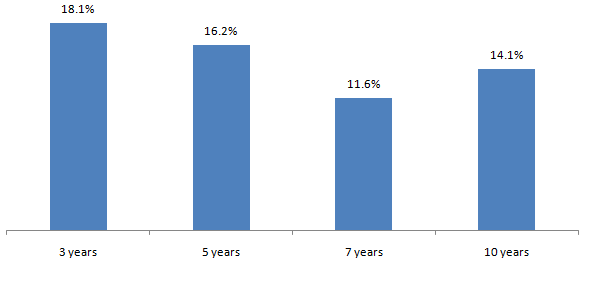

The chart below shows the CAGR (annualized) returns of Nifty 50 TRI (taken as a surrogate for ELSS) over different investment tenures ending 31st January 2022.

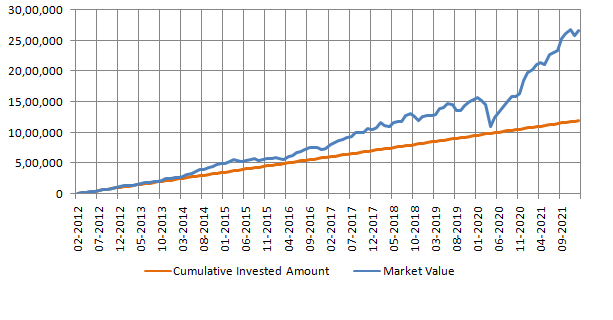

The chart below shows the growth of Rs 10,000 monthly investments in Nifty 50 TRI. With a cumulative investment of just Rs 12 lakhs in 10 years, you could have accumulated a corpus of more than Rs 26 lakhs. Please note that Nifty 50 TRI has been taken as a proxy for equity as an asset class. Since ELSS invests across equity market cap segments, there is potential of higher alphas and wealth creation.

But it is important to remember that while there is a surfeit of schemes to choose from, over 80 of them, there have been schemes which have given negative returns over three years. So it is important to realize that there is no substitute for home work. As a class ELSS may look attractive, but that is not an excuse for the investor not to do due diligence on the scheme chosen for investment. Caveat emptor!