When the current crop of senior citizens were toddlers, their grandparents presumably, would herd them into a familiar corner of the corridor and as the evening shadows lengthened, conjure up a rich humid world of spirits and dreams made real by buzzing mosquitoes, prehistoric reptiles (which even Steven Spielberg wouldn’t have dreamed of), marsh rabbits and musty old tomes about heroes and spells. These tales helped us grow up with hope that all darkness has an answering lightness. But now, with children scattered around the globe, senior citizens may not have their grandchildren around to listen to their arcane stories. But they seem to be active nevertheless. Only recently I met one, who would explain to me how one could get decent returns by lending on P2P (Peer to Peer) platforms by exercising due caution and diligence. He was the one who told me to check the site https://tinyurl.com/p2prbilist, to ascertain if the P2P platform is registered with the RBI. However, the model senior citizen may not be as finance/tech savvy as the one above. But by adopting simple rules and making use of easily available information in the public domain, ordinary senior citizens would be quite successful in managing their financial affairs without much sweat and still be able to enjoy the gentle glow of sunset years.

Points to Ponder. Finance & Senior Citizens

- October 5, 2021

- Posted by: Arunanjali Securities

- Category: Business

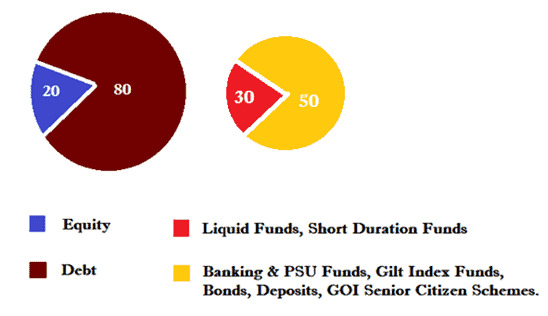

The first step is to have a proper mix of investments to secure fairly stable income stream while ensuring safety of capital invested. Without tweaking for individual risk profile, a broad thumb rule for asset allocation for senior citizens is delineated below:

Investors wanting regular income can opt for Systematic Withdrawal Plan (SWP) in the growth option of equity/debt funds. For tax efficient returns, investors can go for SWP after holding the units of debt funds for 36 months (which qualifies for indexation benefit). Passive debt ETFs that invest in government securities could also be a suitable option for those who could stay invested for 5 to 7 years. IDFC Gilt 2027 Index Fund, IDFC 2028 Index Fund and Nippon5 Year Gilt ETF are some of the funds that provide fairly predictable returns by target date.

Allocation to debt need not be limited to debt funds alone. LICs PM Vaya Vandana Yojana allows senior citizens to invest a maximum of Rs 15 lacs for 10 years with an annual return of 7.4% payable monthly. Senior citizens are also eligible to invest a maximum of Rs 15 lacs in Post Office Senior Citizens Saving Scheme for 5 years which offers annual interest of 7.4% payable quarterly.Both these schemes are safe as they are backed by the Central Government. There are some other safe fixed income investment options which seniors could consider. GOI Floating Rate Savings Bond sold by RBI through leading banks, at present offers an interest rate of 7.15%. One could also consider bank deposits, particularly those eligible for Section 80 C deduction. But the return on bank deposits, at present, is quite modest and hardly covers the prevailing inflation.

Those senior citizens who are in a position to take some extra risk, could further diversify their investments by taking exposure to Real Estate Investment Trusts (REITs).REITs are a good proxy for commercial real estate investments through a regulated, divisible and liquid vehicle. SEBI regulations require that REITs invest at least 80 per cent of the corpus in income generating assets and further stipulates distribution of 90 per cent of their net distributable cash flows to unit holders, at least once every 6 months. With Sensex flirting with 60000 level, the ongoing stock market rally would have resulted in hefty equity gains and if you desire to rebalance your portfolio to bring it in alignment with your pre-decided asset allocation plan, REITs do offer a less volatile alternative, yielding regular income.

Senior citizens also need an assured, lifelong safety net. It is essential to appreciate that living long also is a risk, since one can run out of accumulated savings over longer than expected life span! This is particularly true of NRIs who return home for good. Most of them do not enjoy superannuation benefit. For instance, an NRI who returns home for retirement with accumulated savings of say, Rs 20 crores would be well advised to invest 10 per cent, that is, Rs 2 crores in an annuity which will provide regular, lifelong income, with return of purchase price on death. This along with a suitable health cover would provide him a basic safety anchor which would enable him to deploy his remaining savings into more rewarding, albeit riskier ventures if he wishes.

While it is true that Yamaraj may not have any age-related preferences while dishing out his invitations, it is time that senior citizens give some thought to estate planning. The easiest and most cost-effective way of doing this is through a will. But trust could be an effective alternative or a supplement. Trust, for instance could be a useful supplement to the will, when one wishes to set up a perpetual charity or ensure the care of differently abled child or prevent fragmentation of family assets. A will takes effect after the life of the person, whereas a trust can be created and can take effect during the life of the author of the trust and continue to pass through after the author’s lifetime.

Even the tax authorities, it appears, are waking up to the fact that senior citizens deserve better. Senior citizens now enjoy quite a few concessions under the income tax provisions.

- They need not file returns from FY 22, if their income comprises just pension and interest on account balances maintained with the bank which is receiving the pension.

- Resident seniors aged 60 and above who do not earn any income under the head “profits and gains from business or profession” are exempt from the requirement of having to pay their taxes in advance.

- Under Section 80D of the IT Act, resident senior citizens are entitled to higher deduction of up to Rs 50000/- in respect of payment of health insurance premium.

- Seniors also enjoy higher, TDS free limit of Rs 50000/- in respect of interest income earned from banks, cooperative societies and post office.

- Under Section 80 DDB of the IT Act, resident senior citizens can claim a higher deduction of up to Rs 1 lac on medical expenses for certain specified diseases.

- Under Section 80 TTB, seniors are allowed a higher deduction of up to Rs 50000/- on interest earned on deposits (savings, fixed, recurring) with banks, cooperative societies or post office. Such deduction is allowed only on interest earned on savings account up to a maximum of Rs 10000/- for other individuals.

- For seniors aged 60 years or above income up to Rs 3 lacs is free from tax while for those aged 80 and above, income up to 5 lacs is tax free.

So you see, getting old is not such a terrible thing after all.

“The woods are lovely, dark and deep,

But I have promises to keep

And miles to go before I sleep”.

Why not enjoy our evening walk before the night sets in?