“They commanded no armies, sent no men to their death, ruled no empires, took little part in history making decisions. Yet what they did was more decisive for history than many acts of statesmen, often more profoundly disturbing than shuttling of armies across continents, more powerful for good and bad than the edicts of kings and legislatures. They left in their train shattered empires and exploded continents.Not because they plotted mischief,but because of the extraordinary power of their ideas”. This is how Robert Heilbroner describes economists in his book “The Worldly Philosophers”.

Points to Ponder. Of Economists, Growth and Inequality

- June 10, 2021

- Posted by: Arunanjali Securities

- Category: Business

In the wake of pervasive trail of death and devastation caused by the pandemic, policy makers, backed by economists of all shades are throwing up a surfeit of analysis, delineating the extent and duration of the adverse impact on growth of economies both developed and emerging. But there are some who question the significance of growth as represented by a country’s GDP (Gross Domestic Product), defined as the sum of consumption, investment, government spending and net exports. This magic number gives the misleading impression of precision and simplicity and there would be many an expert who might find such over simplification expedient, since settling some of their arcane arguments would be contingent on such schtick! Japan which has seen a stagnant GDP since the 1980s, has, nevertheless, seen individual incomes and wealth going up, as citizens and companies invest abroad resulting in increasing inward cash flows by way of dividends and interest. Mortality rates have fallen by a third and life expectancy is now in the eighties. Its cities are fresh and clean and the economy is considered more environmentally sensitive than most others, notwithstanding its excellence in harnessing technology and manufacturing. This seems to suggest that GDP does not adequately measure wellbeing of citizens.

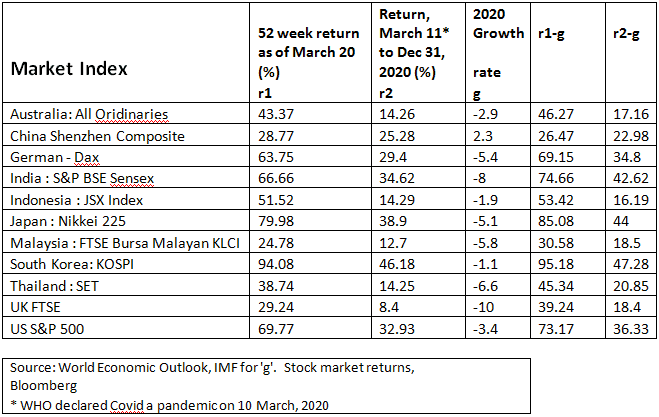

What other contradictions would GDP be hiding? In economies of the US and India, among others, the exuberance in the financial markets in the midst of Covid induced economic slowdown, is a riddle that cries out for resolution. It is true that relatively large corporates, constituting market indices, have weathered covid crisis better and have even become more profitable at the expense of small and medium firms and the informal sector. Alsoinfusion of massive liquidity across geographies arising out of monetary and fiscal stimuli has inflated asset prices. The moot point, however, is what happens when wealth largely represented byfinancial assets, generates far higher returns than GDP growth. Thomas Picketty’s magnum opus, ‘Capital in the 21st Century’ concludes that inequality, particularly wealth inequality, is determined by the difference between the returns on wealth (r) and growth (g) in the national income and avers that prevalence of r>g as the central contradiction of capitalist economies. Has this contradiction gotten worse in the wake of the pandemic? Available data seems to suggest that indeed is the case. The data below indicate that despite a contraction of the US economy by 3.4% in 2020, the return from S&P500 was as high as 70%. Many other countries including India exhibited a similar trend during the same period. This implies that asset rich citizens earned much higher income at the expense of productive agents like the average wage earner or small/medium entrepreneur. Does the risk-reward trade-off justify this skewed income accrual?

GDP GROWTH & STOCK MARKET RETURNS

A likely consequence of skewed income distribution is indicated in IMF’s World Economic Outlook (April 2021) which states that cumulative per capita income losses over 2020-22 compared to pre pandemic projections are equivalent to 20% of 2019 per capita GDP in emerging and developing economies. This percentage is much lower at 11% for developed countries. This reduction in income would have pushed an additional 95 million people in to extreme poverty in 2020. Another dimension of this inequality is what economists call K-shaped recovery, wherein one part of the economy grows while the other shrinks, when technology and large cap firms make significant gains at the expense of small and medium enterprises and some traditional industries. For example, in October 2020, market capitalization of Zoom, the video conference company, was more than the market capitalization of the 15 largest airlines in the world.

There is yet another economist, a Nobel Laureate, who is blamed for hollowing out capitalist economies, particularly the US and the menacing rise of China. He is Milton Friedman, whose erudite analysis influenced policy makers since 1970s. His basic conclusion is that businesses should have no further responsibility than accumulating profit. Race for profits and quick gains pushed firms more towards financial engineering than production of goods and services in situ. So top leadership was busy with interest arbitrage, stock markets, derivatives and credit default swaps. With share prices becoming the most crucial parameter to measure and reward performance, managements found that share buy backs even with borrowed money in a low interest milieu would improve their EPS (Earnings Per Share) and consequently the share price, even as productivity remained stagnant. Ordinary citizen learnt to overspend with credit cards and easy loans. This changed the US from a nation known for its products to a country obsessed with financial “innovation” which spawned a new class of wheeler-dealers. Rising wages made local production expensive and big US firms sought to increase profits by shifting production to low cost (wage) countries. This supported China’s party sponsored, dirigiste, rapid industrialization, the pace and import of which, the West failed to appreciate for quite some time. In fact, it was the US which facilitated China’s entry into the WTO in 2008. The economic development pursued by Western democracies has only increased the concentration of wealth and consequent inequality and environmental damage, while the resource guzzling Chinese model has created a privileged class of rent seekers in the form of party officials resulting in concentration of power and has been equally damaging to the environment. Even as economists talk of social justice through progressive taxes on capital gains, wealth and estate along with well designed infrastructure spending and universal basic income, may be we need to listen to non-economists, someone outside the system, for alternatives. In a poignant essay that appeared recently in The Guardian, NemonteNenquimo of the Waorani tribe in the Amazon writes, “……..the less you know about something, the less value it has to you and easier it is to destroy.And by easy, I mean guiltlessly, remorselessly, foolishly and even righteously” and “……our elders are dying from corona virus, while you are planning to cut up our lands to stimulate an economy that has never benefited us”. Time to revisit Mahathma’s philosophy of material minima for ethical maxima?