Over the last couple of years, investors, particularly in mutual funds, have been a disappointed lot. Since the egregious IL&FS debt default, many a debt fund had to resort to “side pocketing” and some even to “winding up”. As regards equity funds the story is no better. There are 44, AMFI (Association of Mutual Funds of India) registered fund houses offering over 2500 mutual funds schemes and the average investor is not only spoiled for choice, but possibly overwhelmed and confused by the bewildering variety of schemes. Further, when it comes to performance, only a handful have been able to give returns better than those of the market index, namely Sensex or Nifty, over the last 5 years. Their performance has been particularly dismal over the past 2 to 3 years despite the Sensex scaling new highs and currently flirting with 50000! While some blame this divergence in fund and market performance, on the disruption caused by SEBI’s classification rules and ‘true to label’ compliance requirements, it is quite likely that it is because, during the last 3 years or so, the rise in the index is driven by a handful of stocks, while the broader market, in particular the mid and small cap companies have seen severe value erosion for a variety of reasons. While long term investors who have made their investments after due diligence, are sure to recover more than the cost of their investments after what seems to be protracted economic sluggishness, the more risk averse investor would find it reasonably rewarding to pursue passive investing.

Just as the convenience ofmodern day anonymity of high rise buildings has smudged the quaint charm of independent houses, the shift in investor preference from direct equity investments to actively managed mutual funds to passive funds is unmistakable. In the US, which accounts for 68% ofglobal Assets under Management (AUM) ofpassive funds,actively managed AUM was overtaken by passive AUM, in August 2019 as per Bloomberg.In India passive investment is at an inflection point with the AUM of passive funds vaulting to Rs 2.5 lac crores from Rs 70000 crores in the last three years. Employees Provident Fund Organisation has taken the Exchange Traded Fund (ETF) route to dip its toes into equities to avoid high cost of active funds. This probably has prompted the regulator SEBI to put out a consultation paper, which moots new compliance standards for index providers.

Passive mutual funds invest in a basket of stocks which replicate a market index e.g. Sensex, Nifty, etc. Weights of stocks in a passive fund mirror the weights of the constituents in a market index. Unlike actively managed mutual funds, the fund manager of a passive mutual fund does not aim to beat the market. The fund manager simply aims to give index returns to investors and reduce tracking error. Tracking error is deviation of fund returns from the index returns.Though AUM of passive funds (ETFs & index funds) have clocked dramatic growth rates in recent years, the share of passive funds is only 7.5% of the mutual fund industry AUM as on December 2019 (source: etfgi.com), which is substantially lower compared to developed markets.

The main benefits of passive investment are the following:

- Low cost: Expense ratios of passive funds are much lower than actively managed funds. For the similar underlying fund portfolio performance, passive mutual fundswill provide higher returns to investors compared to active funds. Let us try to understand the impact of cost on returns with the help of an example. Let us assume that Total Expense Ratio (TER) of an active fund is 2.25%, while that of a passive fund with the same benchmark index is 1.1%. This means the manager of the active fund has to beat the benchmark index by 1.15% (alpha) just to match the performance of the passive funds.

- No unsystematic risk: In order to beat the index (create alpha), the fund manager will have to be overweight or underweight on certain stocks in the index. This will result in unsystematic i.e. stock or sector specific risks in addition to market risk. Sometimes the fund manager’s strategy may pay off and the fund will beat the benchmark, but sometimes, it may not pay off and the fund will underperform the benchmark.There is no unsystematic risk in passive mutual funds. Passive mutual fundsonly have market risks and you will get market returns subject to tracking error.

- Underperformers have lower weights: Market benchmark index constituents are usually weighted based on their market cap. Higher the market cap of a stock, higher will be its weight in the index. This method of index construction automatically gives higher weights to outperformers and lower weights to underperformers. By extension, passive funds which track the index will also have higher weights for outperformers and lower weights for underperformers.

- Simpler investment: In passive funds you do not have to check the performance track record of the fund manager across different market conditions, how long has she / he been managing the fund, understand her / his stock selection strategy, etc. You simply have to decide which market index you want to invest in and then select a fund which has low cost and tracking error. Often higher cost is the source of higher tracking error. So if the cost of a passive fund is low, then the tracking error is likely to be low.

There are essentially two types of passive funds, namely, Exchange Traded Funds (ETFs)and Index Funds. In terms of investment objectives ETFs and index funds are exactly the same. Both aim to track / replicate a specific market index. Often investors and financial advisors use the terms ETFs and index funds interchangeably. However, there are important differences between the two which investors would well to understand.

Many online blogs on this topic suggest that if you have a demat account or are willing to open a demat account then you should invest in ETFs. Otherwise, Index Funds are more appropriate. But the differences between the two run deeper than just based on demat accounts. Here are some factors that investors could consider when deciding between the two.

- Cost: Cost of ETFs including the transaction costs like brokerage, STT, GST, stamp duty etc. are lower than Index Funds. Purely from a cost viewpoint, ETFs have an advantage over Index Funds.

- Liquidity: This is a very important consideration because when you sell ETF units, you need to find a buyer for the quantity you want to sell. Some ETFs are quite liquid, while others may be illiquid. You have to look at average daily trading volumes of your ETF to get a sense of its liquidity. Liquidity also depends on market conditions. This may require some investment experience. Liquidity is not an issue with index funds because you can redeem with the AMC.

- Experience: If you have investment experience in the stock market buying and selling stocks, then investing in ETFs will be easier for you because ETFs are very similar to stocks. You should know what price to buy, sell, look at trading volumes and know what to do with dividends. Index funds, on the other hand, are mutual funds. As such, they have all the advantages that are associated with mutual funds e.g. convenience, flexibility, investing through SIP / STP etc.

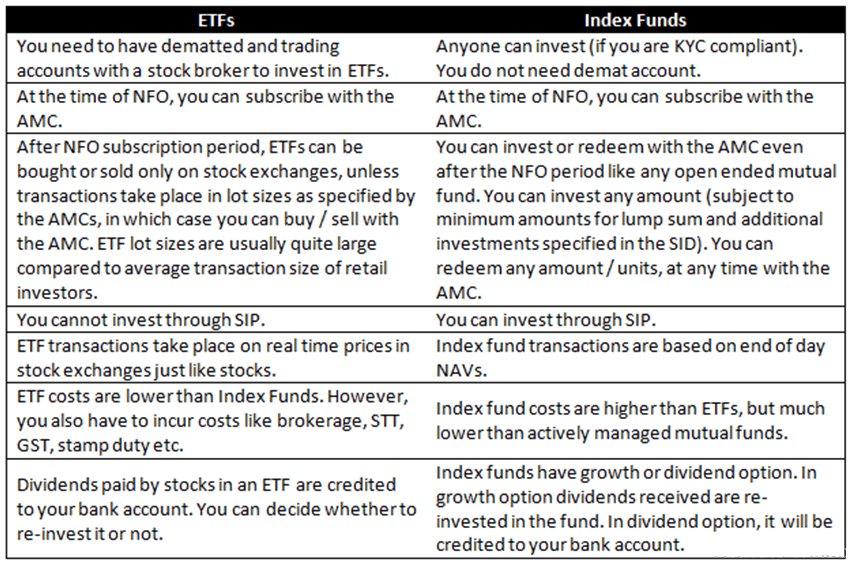

The table below compares main features of ETFs and Index Funds