Sometime back, when I was with my friend in Mumbai, I had met his son who had completed his B.Tech (Mechanical) from IIT, Powai. I asked him what his plans were. His answer woke me up to the widening gap between me and those of his generation. He was clear that he had to make enough money so that he could retire by 40. When asked, thereafter what, he thoughtfully replied that he would like to live his dream. “And what would it be?” I asked, to which he replied that he would like to ply a taxi and see the by lanes and gullies of the bewildering city and observe ordinary people go through life, with their encounters with the underbelly of the city. That conversation with the youngster made me realise that, essentially, retirement is freedom, if not liberation. It is that moment when you choose to indulge your passion in life, since your money (investment) has started earning enough and you don’t have to ceaselessly, worry about earning your keep. “Look at the birds of the air: they neither sow nor reap nor gather into barns…….”

But for most us, retirement would mean, that phase of life, in which we aspire to walk through the evening of our life with a modicum of income security and possibly contentment. This has two dimensions. At the level of the society, it calls for social infrastructure and policy framework to ensure income security to seniors and at the individual level, careful investment planning.

Global retirement systems comprise a social contract covering social security, workplace retirement benefits and personal savings. At present only 7.4% of the working age population in India is covered under pension plan and our pension system currently ranks 32nd out of 37 countries on the Global Pension System Ranking.

The introduction of the National Pension System in 2004, however, marked a radical shift from a government enabled pension programme to employee oriented one, wherein employees contribute towards their own retirement funds while being employed, with attractive tax breaks. Further, the draft policy 2020 for senior citizens has identified four key steps to build a strong senior care ecosystem in India. They focus on integrated (bundled) insurance and special savings schemes, senior friendly tax structures covering among others, those who live with and take care of parents and other dependent senior citizens, creating opportunities for a “second innings” and recognition of the transition from the once “sacrifice all population” to one that is now having its own aspirations and the financial means to fulfil their wants and consequent changes in policy to enable such a change.

But even comprehensive societal support system does not absolve an individual from planning for retirement. True that retirement is freedom to play a second innings of your choice and the possibilities are immense. You could choose to travel and explore, take consultancy assignments in an expanding gig economy, be a social activist and start something like a “Pani Panchayat” a la Anna Hazare, work for an NGO whose cause you wish to champion, indulge your passion for nature photography and per chance eke out more than a living by doing what you enjoy! But before you do that the following essential steps need to be taken.

- Determine the time left for retirement and the corpus required to fund post retirement expenses. Remember inflation is a serious threat that every retiree faces. Thus if your current expenses are, say, Rs 50,000/- a month and time left for retirement is 30 years, then reckoning with annual inflation of 6% you will require over Rs 2.87 lacs per month, 30 years from now! To generate this level of income you will require a corpus of Rs 4.31 crores yielding an annual return of 8%. This might look daunting, but a monthly investment of just Rs 12,325/- at 12% rate of return over the next 30 years will achieve this goal. If you want to minimise your risk and settle for a lower return of 10%, the monthly savings required would be Rs 19050/-

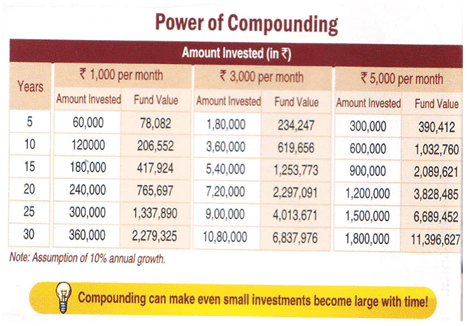

- Start planning early, preferably with your first paycheque/profits. The three golden rules of successful investment are: Start early, invest regularly and invest over long term. The table below illustrates how this disciplined investment approach harnesses the power of compounding where the assumed rate of return is 10% per annum.

3. Choice of investment vehicles and asset allocation is of utmost importance. If the time left for retirement is 15 years or more, equity should form a major part of your investment portfolio while constructing retirement corpus. If you are young and have opted to invest in the tax efficient and flexible National Pension System (NPS), ensure that at least 50% of your contribution is invested in equities. Inflation and interest rate changes can ruin any retirement plan if not properly hedged. So part of the corpus could be used to purchase an annuity, deferred or immediate from a reliable insurer. Such an annuity could be with or without return of purchase price, depending on individual circumstances. In a few difficult cases, reverse mortgage with built-in annuity could also be considered. Annuity is particularly recommended to those who invest in business or risky assets, since it provides a safety net should everything go wrong. Courts generally do not allow attachment of annuity flows by creditors, bankers etc.

4. Do not hesitate to seek expert advice as there will be situations where you will need it when it comes to choice of investment vehicle, tax planning or structuring your portfolio. For example, suppose you decide to set up your own business on retirement and raise part of the initial capital by selling one of your residential properties. To save on long term capital gains tax, you could invest up to 50 lacs in a financial year in Section 54EC bonds, which would lock your capital for five years. But now, since 2016, Section 54GB of the Income Tax Act allows investment of long-term property gains in eligible business by individuals and Hindu Undivided Families (HUFs). Ensuring compliance with the minutiae of this provision may require expert guidance. Similarly, there are parents who when faced with the need to raise funds to finance foreign education of their child, find liquidation of their retirement corpus as a convenient and only option. In such cases, an education loan could be a better option which apart from providing tax breaks, would enhance child’s self esteem and encourage her to save as soon as she starts earning. More importantly it will not compromise your financial security after retirement. Remember, the best way to help your child in your sunset years is to be financially independent and not to allow her to be your ATM in your old age