US President Donald Trump proclaims, “We are waging war on Corona virus using every financial, scientific, medical, pharmaceutical and military resource, to halt its spread and protect our citizens”. Yet, the world’s economic and technological superpower is rattled by the virus with 123498 confirmed cases of infections and 2211 deaths as of 29th March! Indeed, US has now the dubious distinction as the country with the highest number of Corona virus infections. Undoubtedly we’ve got a crisis on our hands which we do not fully comprehend. At the moment it seems to be an unknown unknown and we don’t even know when India will see the worst of it, on what scale and if our political leadership along with the bureaucracy and medical infrastructure can cope with it? As in Greek mythology, like the captains of ships passing through the Straits of Messina, who were faced with Scylla & Charybdis, the two sea monsters on opposite sides of the Strait, we in the context of Covid-19, are faced with “Lockdowns” necessitated medically on the one hand and ruinous economic emergency on the other hand. This has prompted Professor Jayathi Ghosh of JNU to predict that the Indian economy is going to fall off the cliff before long!

Notwithstanding such dystopian prognosis, it is worth recalling Benjamin Graham’s time tested insight, that Price is what you pay, value is what you get. Look at the stock markets over the last few weeks. Covid–19 has brought them to their knees. The prices of once sought after companies are melting like a pack of ice under peak summer heat destroying lacs of crores of rupees worth of wealth! While their prices have crashed, has their value changed over the last few weeks? Hardly. If you reckon that value should be equal to or greater than the book value of a company with steadily growing free cash flows, then the ongoing market meltdown has thrown up a surfeit of such companies. Hence once the market crash is long done, what one remembers is not the losses but the missed opportunities. Yet the exaggerated anxiety that future earnings of companies will be severely and permanently impaired has frozen many into inaction, or worse, propelled them into panic selling mode.

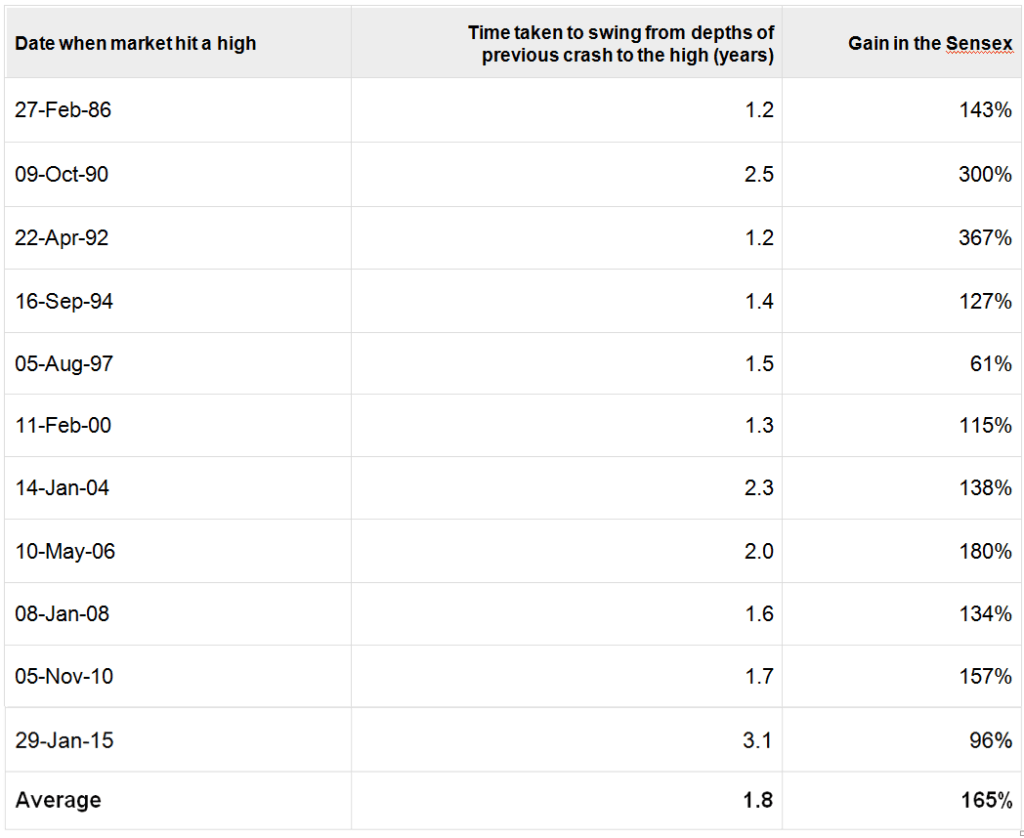

But then fortune favours the brave and some of the wealthiest men on the planet have built their fortunes with some smart trades during times of crisis. For instance, there’s John Paulson who made a fortune from the US subprime lending crisis, or even Jesse Livermore who made over $ 100 million from the 1929 market crash in the US. The list could go on to give you a host of names of men who’ve been able to make huge profits even during the worst crises. But the point is, right now we’re smack in the middle of another crisis. Could that be played for huge profits? Optimism at this point in time may even look vulgar. Nevertheless, if past is any guide, just look at the possibilities. Guess what you will find if you research stock prices on the Indian bourses, going back to 1985 and all the market crashes since then? Over the last three decades or so, on average it has taken only 1.8 years to go from the dreadful depths of a stock market crash to the lofty pinnacle of a market high! And this is not the time taken to get out of a crash. This is actually the average time it has taken to get from the depths of a market crash to the next market high. And there is more! The BSE Sensex’s average gain during such periods has been 165%!That’s more than two and a half times your investments in less than two years! The following numbers tell the story

And that’s not all. Small caps, notorious for their volatility, tend to see

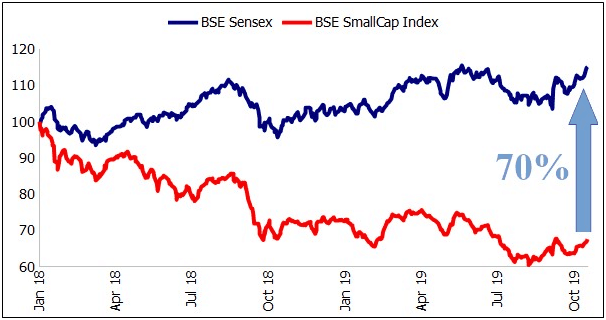

exaggerated price moves on both the upside and the downside. What this means is that their moves from market crash to market high tend to be even more dramatic! While data for the BSE Small Cap index are not available for as long a period as the Sensex, the small cap outperformance is more than evident from even a cursory look at comparable numbers for the Small Cap index. For example, as you can see in the table above, the gain in the BSE Sensex when it swung from the bottom of the previous crash to its high in Nov 2010 over a span of 1 year and 8 months was 157%. What was the gain in the BSE Small Cap Index over this same period? A massive 254%.

Small cap stocks have been hammered hard since they peaked at the start of 2018. Even if they were to just catch up with the Sensex, we’re talking about 70% profit potential.

The great economist John Maynard Keynes had observed that in the long run we are all dead. But he missed the point. Many of us could kick the bucket even in the short run. So why worry about the long term? Why let the present spoil the future?