It might not have been an act of political chicanery. It was, nevertheless, a pathetic sight to see our finance minister desperately trying to defend the functioning of a dismal economy, even if by indulging in a charade, reluctantly conceding that there is an economic slowdown but not a recession. While the discussion on distinction between slowdown and recession could wait for another day, what brooks no delay is addressing the economic disarray. No matter how expertly data is packaged to conjure up a dissembling aura of economic robustness, the ground realities belie such pretentions. Private investment is moribund, consumption is declining and even in an economy that is often touted for its demographic dividend the job market remains desolate.

But the stock markets are behaving as if they have nothing to do with the underlying economy. They are dancing to their own sweet music. Despite jogging my memory I am hard put to recall a situation where Indian economy and the stock markets have taken such divergent paths for so long. Since 2014, the stock market has more than doubled. Most of this doubling has happened in a not so friendly macro-economic environment. Despite scaling mount 40,000 and flaunting a PE multiple of 28 plus, the Sensex doesn’t look tired at all from the effort. It is as if it can continue to go on and on and won’t mind a few more milestones even as the growth in earnings per share (EPS), the main fulcrum on which markets turn (or, at least supposed to), remains disappointing. The index gains however, has offered little comfort to investors at large. An analysis put out by BusinessLine shows that while Sensex has gained 15% in 2019, 80% of the listed stocks have made losses, with half of them sinking over 25%.

Forget India, the global economy is itself is flawed. The effete economies of the world demand a higher Incremental Capital Output Ratio (ICOR), that is, the amount of money needed to produce an extra unit of GDP, whcih means that these economies have to somehow get that ever larger quantum of funds to produce growth. Much of the extra investment is borrowed, resulting in humougous amount of global debt. Global debt is around $250 trillion, 3 times the global income. Interest rates are pushed down (particularly in the developed world) so that the rising debt can be serviced. This has beggared pension funds and other legacy endowments funding health care and education. Imagine, at present, some $17 trillion is invested in negative interest instruments. There is a Belgian bank lending money to a citizen to buy a house and paying him interest (not charging him) on the loan! And investors are guzzling German Bonds with negative returns, while non-financial US firms have quadrupled their Euro debt, dubbed the ‘Reverse Yankee’, to $ 103 billion in 2019 as compared to 2018. Further cheap money in the US, EU and Japan has accentuated ‘carry trade’ which is chasing assets with even a remote chance of above average returns, everyehre in the world, particularly in emerging markets. This has resulted in inflated asset prices without much regard for the underlying economy. Even in the US where stock markets have performed better than other developed markets, experts feel that such performance is not sustainable as it is driven by rampant buyback of shares by companies which are able to borrow funds at very low cost.

This divergence between stock market performance and the economy, is making things very difficult for the retail investor. Although the money coming into the Indian Mutual Funds has decelerated, the equity SIP book is still growing. The fund manager getting the funds has no choice, under the regulatory framework, but to invest in the stock market. This, along with Foreign Portfolio Investments (FPIs), pushes up select group of just 100 -150 large cap stocks including SENSEX and Nifty stocks, even as majority of small and midcap stocks keep stagnating or falling. This is also because the gains, if any, remain trapped in the unlisted space, because the IPO pipeline which is supposed expand and renew listed universe has seen only a trickle, with deep pocketed private equity investors supplying exciting unlisted firms (aka startups) with ample capital.

If you follow the indices and stay invested, the sluggish earnings and the concomitant correction could erode a big chunk of your wealth. It is not uncommon to see the entire benchmark index tank by 40% to 50% in a matter of few months. So, imagine the kind of wealth destruction in store for someone who decides to stay put in the market when it starts moving in tandem with the economy and falls. On the other hand, past has also shown us that sheer “irrational exuberance” can push up the indices by 100% within a year. Therefore, if you decide to follow the slowing economy and exit at current levels, you could be giving up some mouth watering profits.

Is there a way out of what seems like a Hobson’s choice? One way to tackle the puzzle is to carefully track the valuations and not to worry too much about what the stock market or the economy is going to do. Do not be blinded by the headline index. Look out for pockets where certain sectors or scrips are gripped by unwarranted fear and are beaten down so badly that they do offer bottom fishing opportunities. The mid and small cap stocks are quite plausibly a case in point at the moment. Midcap stocks, for instance, have been battered for two consecutive years (2018 and 2019). The Nifty Midcap 100, after registering it’s peak in early 2018, crashed 30 per cent by October this 2019. However, since then, the index is showing some stability. Historical data indicates that the under-performance of mid-cap indices is always followed by periods of strong out-performance by them. Valuations too look rasonable for this group of companies. The PE ratio of the Nifty Midcap 100 index has corrected from over 54 in January 2018 to the current level of 24.5. At a time when PE ratio of BSE Sensex and Nifty50 are defying gravity, the correction in mid-cap stocks offers opportunity for profitable investments. Another important indicator that points to a likely bounce back in midcap space is the share of B-group stocks in BSE’s overall market capitalisation. Currently, B-group stocks (largely mid-cap stocks), contribute just 5 per cent to the overall market cap. During the hey days of 2016 and 2017, the B-group had contributed over 15 per cent of the market cap. So, a catch up is likely sooner or later. In fact as of November 2019, Mutual Funds were found adding to, or increasing investments in mid and small caps like, Bandhan Bank, Guj Flourochemicals, Eicher Motors, ICICI Lombard, 3M India, Eris Life Sciences, IRCTC and others. Even in the large cap space where PE multiples have come off sharply because of transient reasons, as in the case of cyclicals like Larsen & Toubro, Hindustan Zinc and Maruti, further correction in their prices could provide profitable entry points.

One other option the average investrors could look at is strategic allocation of funds to different asset classes/sectors based on valuations. But then strategic shifting between asset classes/sectors could best be left to the experts given the corporate governance issues and liquidity concerns that affect small and mid cap stocks and debt paper. An average investor, therefore, could take the Mutual Fund route for such investments.

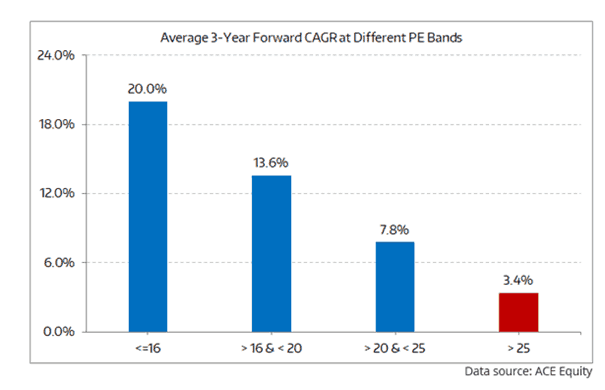

If one wants to make direct investments based on valuations, the chart below, provides a guide post. But it needs to be modified based on one’s special circumstances and overarching financial plan.

As per the chart, historically, returns have ranged from 14% to as high as 20% CAGR over a three year period, at a PE of 16 or lower. And a great way to avoid poor returns or even losses, is to reduce exposure substantially when the Sensex PE crosses 25. But then a long term investor (by long term, I mean 10 years or more) who has has dovetailed his savings/investments with his financial plan doesn’t have to worry about strategic allocation or otherwise churning his portfolio, as long as his initial assessment and analysis underpinning that plan remain valid. But even in such cases it is prudent to reduce or halt incremental equity oriented investments till valuations mean revert.

The Upside of Investing at Low PEs and Downside of Investing at High PEs

As there are no certainties in the stock market the narrative has to shift from what the stock market would do or what the economy would do, to what the investor should do.