Infosys, which until recently was touted as the poster boy of good corporate governance is now in the news for

alleged governance lapses! The complaint to SEBI, SEC and the Infosys Board by whistle

blowers, who call themselves ‘Ethical Employees’, have accused the top

management of wrongdoing.

But then Infosys is no stranger to controversies ever since Vishal Sikka

tendered tendered his resignation after the founders, in particulae N R Murthy,

kept raising, what they regarded as governance lapses in the company. But if

one scours the history of the company, one can not but be amazed by its rise to

eminence.

Infosys was established by NR

Narayana Murthy and six engineers in Pune with an initial capital of $250. It

made an initial public offer in February 1993 and its shares were listed on

Indian stock exchanges on June 14, 1993. Trading opened with a huge

premium of Rs 145 per share, compared to its issue price of Rs

95 per share. In March 1999, it issued 20,70,000 American depository shares

(equivalent to 10,35,000 equity shares of par value Rs 10 each) at $34 per

ADS. The same was listed on the NASDAQ National Market.

But once market

realised that the regulators are considering the latest complaint seriously,

the shares of IT bellwether Infosys opened with

a massive gap down of over 16% on 22nd October 2019, and shaved off

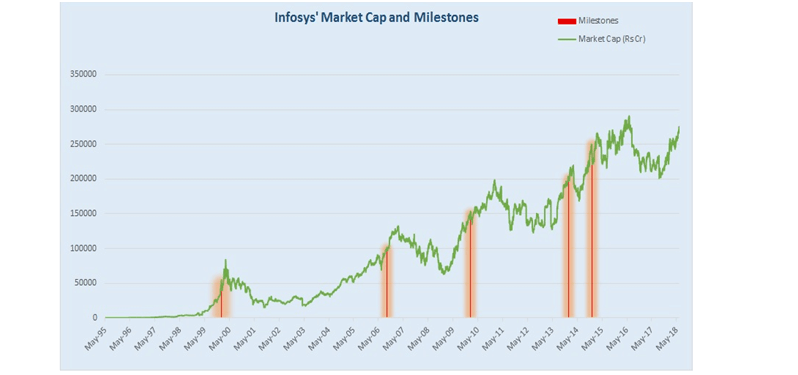

nearly Rs 46 thousand crores of investors wealth. The chart below provides the market

capitalisation of Infosys through many mile stones

But the billion dollar question is will Infosys rise from the ashes and

should investors consider fresh exposure to the scrip given the lower valuation

post the meltdown in the share price. A look at the company’s past performance

would indicate some answers to the above questions

Back of the envelope calculations suggests that

if one had invested Rs 9500 or bought nearly 100 shares of Infosys back in

1993, it would be worth over Rs 3.3 crores as on October 22nd this

year, that is CAGR of over 35% despite the fall and without reckoning with

generous dividends, buybacks and attractive conversion into ADRs!

The management has been generous in granting

bonus since its listing. It has offered 1:1 bonus shares in 10 out of 11 years

in which it declared a bonus issue. In 2005, it announced a 3:1 bonus issue. It

had split the face value of its shares from Rs 10 to Rs 5 in 1999 (2:1). The

share has been quoting on an ex-split basis since January 24, 2000. Given below

are details of bonus and splits given by the company

• In 1994, company declared 1:1 bonus

= Investor receives 200 shares

• In 1997, company declared 1:1 bonus = Investor receives 400 shares

• In 1999, company declared 1:1 bonus = Investor receives 800 shares

• In 1999, company split the share of face value Rs 10 to Rs 5 = Investor

receives 1,600 shares

• In 2004, company declared 3:1 bonus = Investor receives 6,400 shares

• In 2006, company declared 1:1 bonus = Investor receives 12,800 shares

• In 2014, company declared 1:1 bonus = Investor receives 25,600 shares

• In 2015, company declared 1:1 bonus = Investor

receives 51,200 shares

Total worth as of 22nd October 2019 = Total number of shares 51,200 x 643.55

= 3,29,47,760

Moreover, the price action in the

counter suggests that every time Infosys has seen a sharp fall it has bounce

back as per data given below.

| Date | Biggest 1 Day Fall | 1 Year Return |

|---|---|---|

| 17.05.04 | -11.20% | 88% |

| 19.05.09 | -13.40% | 70% |

| 13.04.12 | -12.70% | 21% |

| 12.04.13 | -21.30% | 45% |

| 22.10. 19 | -16.20% | ?? |

And if you are a believer in technical analysis,

the charts indicate, as per “experts”, that 600 is a strong support level!

India’s Digital Future

Away from the public glare a quiet battle is raging for control of the global digital business. At the core is the US quest to continue its dominance of digital business. Today, US technology firms dominate the digital business. But continued dominance would require the free flow of data across countries. The US and its allies are doing everything to ensure this. The outcome of this battle would decide the fate of the digital business in most countries. The US firms Google, Facebook, Amazon, Airbnb, Visa/Mastercard, Uber, Netflix and Instagram may appear to be doing different activities. But, their main currency is data. They track our digital transactions, chats, roads we travel, countries we visit, hotels we stay in, restaurants we eat in, food we order, medicines we buy, and bars we frequent. The game is in collecting extensive data free of charge and selling value-added services created from this data.

Some of the uses to which such data is put threaten even functioning of democracies. The massive data breach at Facebook in 2018 not only opened a can of worms on potential misuse of social media platforms for influencing a nation’s political destiny, but also sent out a warning on the perils lurking in the digital world. And now we have the alarming disclosure made by WhatsApp that several jounalists and civil rights activists in India, particularly those who may not be aligned with the current political dispensation, have been under surveillance through a spyware called Pegasus, developed by an Israeli tech company called NSO Group. The government is yet to come clean on this issue and this raises concern, particularly under a regime which in spite of its cant on ‘transparency’ has gone about systematically diluting the Right To Information (RTI) Act. The concern is, that the present government has been slow to put in place laws to protect users, particularly vulnerable citizens, not just from private entities that mine data without consent but also from state actors who misuse surveillance powers.

Data has another significant use. With the advent of IOT

(Internet of Things), digital “Personal Assistants” like Siri or Alexa are

becoming inreasingly popular. They depend on ‘Artificial Intelligence’ (AI).

Developing such AI tools requires scanning terabytes of unstructured data to

identify patterns of our thoughts, actions, behaviour and create applications

for all conceivable uses. Most of the data, however, are generated in China and

India. India produces more data than the US and the EU put together. China does

not share data with US firms. So if India also restricts data flow, it will hit

the US-AI strategy. Today the US is collecting data freely from all countries,

except China. But the US knows this will change soon. Technology and business

models are easy to replicate at low cost. Soon as India and other countries

develop similar tools, they may regulate data flows preferring local firms over

the US firms. Or these countries may decide to charge for data. Any of this

will kill the US business model. The US is putting in all its might to stop

this from happening.

It is true that India has a long term strategic relation

with the second latgest democracy. But given President Trump’s ‘America First’

regime and above denouement, the unequivocal articualtion by Piyush Goyal,

India’s Commerce Minister at the G20 Ministerial at Tsukuba, Japan, on June 8

and 9, that India will not join the e-commerce negotiations at the WTO until

issues like data flow and welfare of the poor are resolved, was timely and

appropriate. To secure its digital future, India, among other things, needs to

adopt the following measures:

- Put in place

a robust legal framework for regulating e-commerce, data protection, data

localisation, cyber security and unauthorised use of data for surveillance by

private and state entities. New draft e-commerce policy is a welcome step.

Clear laws with proper regulations on data flow will encourage global and local firms to invest in India. - India’s

weakness is that we do not yet have global brands in the digital space. We need

to set up free email service and create an India focussed search engine, invest

in high capacity cloud servers and make them available at low prices. Hosting

on Indian servers must be attractive for local businesses. NIC has the

expertise and has already developed many platforms for government use. The

government may revive NIC, hiring the best talent for AI research and other

vital areas. - Many countries

still do not grasp the significance of data flow, server localisation, etc.

India could collaborate with them given the talent at its command. Once our

laws and platforms are ready, we may take the call to join any international

negotiations. - India needs to be aware of the

consequences of not joining the negotiations and have a plan ‘B’ ready. Today,

only 73 of the 164 WTO members support negotiations on e-commerce. If India,

viewed as a software giant joins, all remaining countries will participate.

This will soon ensure that the de facto dominance of the US in digital business

becomes de jure.

Digital business accounts

for a third of global GDP now, and its share will only increase. Reclaiming our

lost digital space should be our

priority as best jobs and high growth would flow from this. An important

enough issue to deliberate and decide on with due care , but urgently.