Patience pays and no less a person than Charlie Munger, who happens to be the alter ego of the legendary investment wizard Warren Buffet, demonstrates this!

Turns out, that Charlie Munger waited for 50 long years for a perfect stock.

Yes, you read that right.

Munger fought off temptations and kept emotions at bay for as long as 50 years. Why? Well, to find a stock that ticked all the boxes. Here is the story:

Charlie Munger says that he’s been reading Barron’s for fifty years. And in 2003, after fifty years of reading Barron’s he got a stock tip. Each issue of Barron’s has probably ten stock tips, and so you’re getting about fifty issues a year, over fifty years that’s 2,500 issues – 25,000 stock tips. So he goes through all the 25,000 stock tips – picks one, after fifty years, a company called Tenneco, making auto parts and & setting up service centers. He puts $10 million into Tenneco in 2003. By 2006 it’s worth $80 million.

Certainly to go through 25,000 stocks without compromising on principles would call for extraordinary discipline and the strenth to adhere to the same in the face of temptations and distractions. And if this kind of discipline doesn’t bring success in investing then one wonders what will. It certainly brought for Munger. The stock went on to be an 8-bagger in mere 3 years.

But what works for Munger may not work for the rest of us. The biggest stumbling block could be to play the waiting game for so long. Of course, 50 years is an extreme case. But to wait for something as short as say 5 years may be a lot to ask of most investors.

For us, lesser mortals there is a way out of this dilemma.

Munger must have certainly seen something in the stock that made him feel it was undervalued. After all, this is what investing is all about. You buy a stock because you feel its trading at a significant discount to the value of the underlying business.

A simple approach could be that the value of a decent business should at least equal to its book value if not more. The book value of a company by the way is its net worth. It is what remains after you subtract total liabilities from the total assets.

Thus, buying a group of such stocks at a discount to its book value is pretty much like Munger buying Tenneco. It means, you are trying to buy a 100-rupee note for Rs 80 or lower. After all, the underlying principle is the same – Buying an asset at a discount to its approximate value.

But you need a handful of other parameters to ensure you are getting into the right stock. And unlike in Munger’s case, you don’t need the patience and discipline to wait for 50 years. You only need the patience and discipline to buy below a suitable discount to book value and patiently wait for the value to manifest itself. And, the discipline to sell at a pre-defined sell limit.

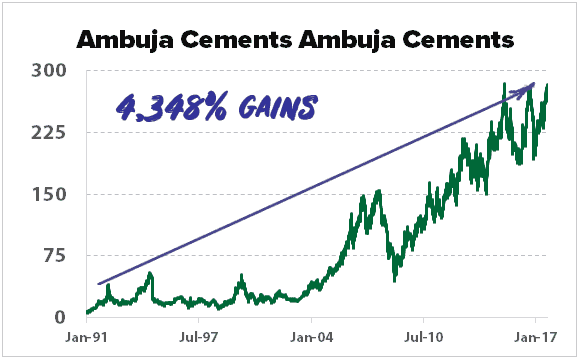

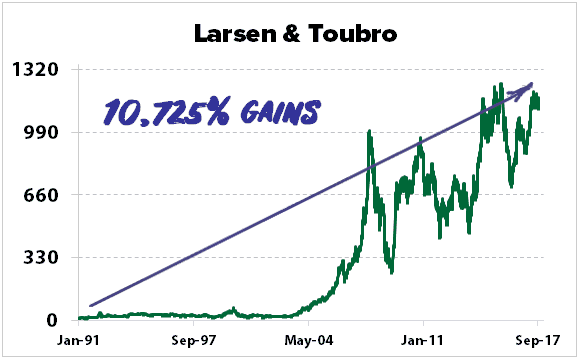

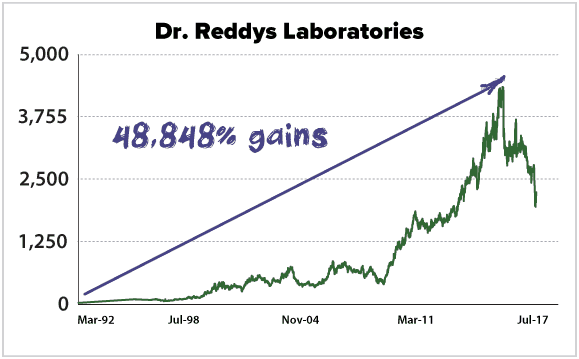

There are many examples of how sitting patiently on good investments has yielded copious wealth. But given below are just 3 examples to drive home the point.

Major cement manufacturer, Ambuja Cements, saw its stock multiply 3 times in just 1 year post 1991! But it didn’t stop there. It went up a whopping 4,348% in 26 years till 2017.

Meaning that investing just Rs 100,000 in Ambuja Cements in 1991 would have given Rs 44,48,000 in 2017.

Then we have L&T… L&T grew 10,725% in 26 years from 1991 to 2017.

Again, investing just Rs 100,000 in L&T in 1991 would have given Rs 1,08,25,000 or Rs 1.08 crores in 2017.

After this, there was Dr Reddy’s Lab too…This company grew 48,848% in 22 years between 1992 and 2014.

So if a person had invested just Rs 100,000 in Dr. Reddy’s Labs in 1992, it would have given him a whopping Rs 4,89,48,000 or 4.89 crores in 2014!

Last Word: Grace Groner, died in 2010 at the age of 100. She was orphaned at a young age and was raised by kind neighbors. She later lived in a tiny one-bedroom cottage in Lake Forest, Illinois. She shopped at rummage sales, loved to walk everywhere so never needed a car and worked most of her life as a secretary. She never married and had no children yet had many friends who loved her for the happy person that she was. So it was surprising to her alma mater, Lake Forest College, to learn that upon her death she left a gift of $7.2 million to the institution to start a scholarship program for students with big dreams but little money.

Grace did not inherit her wealth, nor did she scrimp and save for decades while denying herself the comforts that she really needed. In 1935, at age 25 and in the depths of the Great Depression, she secured a job as a secretary at Abbott Pharmaceuticals and worked there for the next 43 years. In her first year at Abbott, she bought three, yes three, shares of Abbott stock for a total investment of $180. She held onto the stock for the next 75 years and reinvested all dividend payments. Her Abbott stock split many times over the next 75 years, and together with her dividend reinvestment in shares, she died with over 100,000 shares of Abbott stock. No one knew that the unassuming elderly woman had amassed a fortune, until after her passing!

Small & Midcap Dilemma

The smallcap index is down 34% from its recent highs. The midcap index is down 23%. In this situation what could investors do? Do they commence bottom fishing or, avoid catching falling knives?

When was the last time we faced such severe correction, especially in mid and smallcaps? Between 2010 and 2011, the smallcap index fell more than 50%. Again, in 2013, it fell 33%. But what about the returns once the market resumed its normal course. The smallcap index rose 36% and 98% after those falls.

It is not about timing the market exactly at the bottom and calculating gains after one year. That’s not the point. The point is… during a period of sharp corrections, stocks get hammered like there’s no tomorrow. Even if the company shows strong growth, has a strong order pipeline or revenue visibility and even if the management is consistent in delivering performance and profitability the herd will follow blindly the fear mongers.

But then why are we witnessing such a severe correction? There are several reasons that might be clouding our long term vision.

A weak economic outlook, trade wars, geopolitical tensions, industry-related pressures, the government’s difficult rules and regulations, sluggish corporate earnings, a slowdown in consumption, a weak monsoon, corporate governance issues and frauds… and of course, the steep market valuations.

Due to all this, the pressure falls at the bottom of the pyramid i.e. smallcap stocks. Then it comes to midcaps and finally to large caps. No doubt, large caps offer stability. They tend to be less volatile compared to mid and smallcaps. In terms of portfolio weight, companies from the largecap space lead the chart. This is why, whenever mid and smallcap stocks fall, investors rush to sell them and turn to largecap stocks. But once the largecap index starts correcting, investors exit the market altogether. This is a typical case of selling at the bottom. Once the stock market recovers, investors get greedy and invest near the top. Sadly, this behaviour repeats in every cycle.

During such times, it’s important to consider the risk as well as the reward when you bet on a company.

Time to ponder if now, the risk-reward equation is tilted in favour of the contrarian investor in small and midcaps. But every bet on a small cap company has to be backed by diligent homework, or else you will catch a lot of falling knives. You must carefully assess management quality. You need to check if the company can scale up in a profitable manner. You need to see how the company responds to competition and the threats of disruption. In short, stick to high-quality companies. May be it is best to leave the job to the experts and not get stuck with companies like Rcom, DHFL and PC Jewellers! The average investor may find the mutual fund route safer when it comes to investing in small and midcaps.