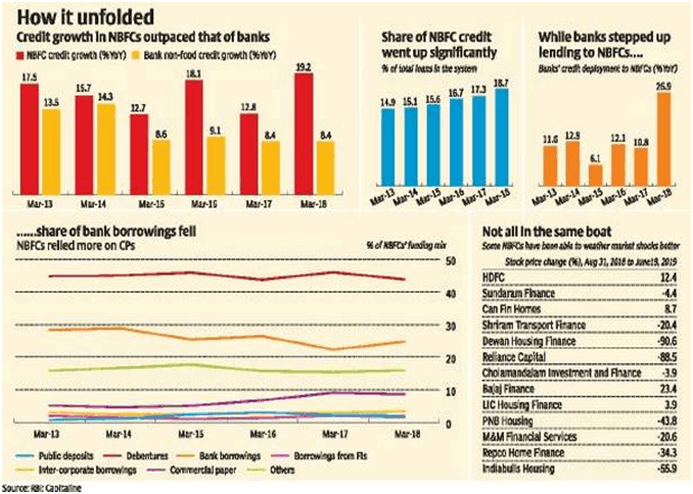

Whole lot of NBFCs (Non Banking Finance Companies) beginning with IL&FS, DHFL, India Bulls Housing Finance et al, are constantly in the news for all the wrong reasons. The crisis ravaging the sector has now spilled over to the banks and mutual funds. So for the lenders, investors and the debt markets, many of them are new untouchables.

So what is ailing the NBFCs? Their troubles spring from many sources. In the case of IL&FS, which has the dubious distinction of (mis)managing over 300 subsidiaries, it was callous disregard of corporate governance and the solution seems to be bankrupcy resolution or liquidation. But troubles could also arise because of lack of liquidity, mainly brought about by asset-liability mismatch. This needs to be tackled through suitable refinancing arrangements for the existing loans and in extreme cases by monetising the assets. If it is a solvency issue, then what is called for is infusion of fresh equity.

In the case of DHFL the troubles have a lot to do with funding. Unlike banks, NBFCs cannot freely raise deposits from the public. So, they have to look at other ways to raise funds. One way in which DHFL did this was by issuing non-convertible debentures (NCDs). The crisis deepened when DHFL missed an interest payment deadline on the debentures. Immediately, its credit rating was downgraded. Indeed, funds are very hard to come by for NBFCs these days. If you have some money put aside in debt mutual funds, you are probably wondering why some of those schemes have lost value. A leading business daily reported that as many as 165 mutual funds had some exposure to DHFL, not to mention others of its ilk, at the end of April.

Also the sector is depending heavily on low-cost, short-term debt financing. This has created a situation where cash inflows from assets (the long-term loans they provide) are not matching cash outflows required to service their liabilities (the short-term debt they raise). Further as the NBFCs are also not regulated the same way as banks are, there is uncertainty in this sector at the moment when it comes to guidelines for infusing fresh capital. While the DHFL crisis may have highlighted the difficulty in raising funds for the beleaguered NBFCs, the bigger, well managed NBFCs like Bajaj Finance, have delivered healthy returns in this period.

Stocks of a lot of the mid and small NBFCs were badly hit when the IL&FS crisis deepened in October 2018. Since then, the recovery in prices of many NBFCs has been pretty decent, clearly indicating that not all NBFCs are in the same boat.

Lump Sum Vs Systematic Investment Plan (SIP)

Most of the advice in the public domain, on modes of investment routinely proclaims virtues of SIP. So much so it has almost become an article of faith among financial advisors. But does this method of investing in equities/equity related instruments always trump lump sum investment?

Let us take an example which might at least prompt us to raise some questions on this ‘SIP’ article of faith!

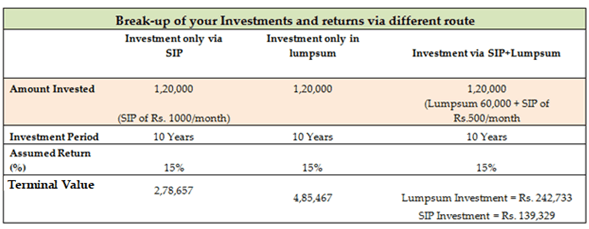

Let us assume the investment period is 120 months or 10 years. We also assume an empirically reasonable growth (CAGR – Compounded Annual Growth Rate) of 15% for the equity investments over 10 years. The total amount of proposed investment is Rs 1,20,000 . Three possible scenarios could be considered: Lump sum, SIP and a combination of Lump sum and SIP. The results are tabulated in the following table.

If the assumptions made above are empirically acceptable, then it is clear that the lump sum invested over a long period of time will have larger investment value than that of an SIP. This is because of the effect of compounding over a period of 10 years. SIP installments are staggered over a period of 10 years and therefore the entire investment did not get equal time to benefit from power of compounding. In the case of third option, Investment via SIP and lumpsum, though the lumpsum benefited by power of compounding, the compounding benefit in SIP part of the investment was only partial due to staggered instalments.

But is the debate settled? Well, hardly. Life is never straightforward. The example given above assumes linear growth of equity investments, which is seldom the case. Markets do go into phases of deep corrections and sharp appreciation. So on many occasions and for many, SIP may still be the preferred route for the following reasons.

Young self emplyoed or salaried persons may not have enough funds to make lump sum investment and can only earmark a part of their recurring cash inflows for investment at intervals that are aligned to their cash inflows.

SIP enables an investor to deal with corrosive behavioural patterns which are driven, among others, by greed and fear.

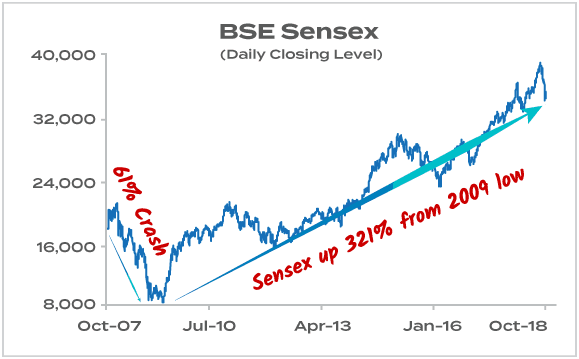

While investor can mitigate risks by diversifying across companies and sectors, SIP helps in further diversifying the investments across time. In fact SIP which essentially depends on cost averaging by spreading investments over time, provides a convinient discipline to exploit volatility by helping the investor to buy less in a ‘costly’ market and more in a ‘cheap’ market. When the markets are richly valued ( For example in the Indian context the Price Earning mulpiple is more than 20) even if an investor has funds for lump sum investment, it may be prudent to to park thsese funds in a liquid fund from where they could be transferred to select equity mutual funds at regular intervals and such regular transfers could be further enhanced when the markets witness sharp corrections. Past experience does offer some some valuable insights. Look at the following chart.

If you had invested in SENSEX at the market peak in 2007-08, you would have made just about 5% returns every year over 10 years! In other words, investors who bought stocks at market peaks and didn’t go bargain hunting in the subsequent crashes didn’t make any money at all – except for a measly 5%. That doesn’t even beat inflation – it’s almost like losing money! But investors may find it difficult, if not impossible, to pick market bottoms consistently. Cost averaging through SIP is the next best thing they could do. Remember G.K. Chestorton: Best is the worst enemy of good; anything good is worth doing, even badly.

It is also pertinent to remember that it is SIP inflows that have brought about a structural change in the Indian markets and lent them a modicum of stability in the face of volatile funds outflow caused by international events. Well, majority may not always be right, but neither is it always wrong!