With elections round the corner, Brexit heading for a tortuous denouement and the trade dispute between the world’s two largest economies showing no signs of early resolution, economies and markets are likely to remain volatile for some time. It is in this kind of fluid situation, risk averse savers and investors look for investment vehicles which would protect their capital and generate decent tax efficient returns. The secondary market (NSE/BSE) does provide a few avenues to the retail investors, which on post-tax basis seem to provide a better alternative to the bank and corporate FDs. While there are quite a few such investment vehicles, persons in the 20 to 30 per cent tax bracket could consider Tax free bonds which can be bought on the BSE/NSE like any other listed security. To invest in these instruments which are traded on the market, the investor needs to register with a broker and have a d-mat account.

Most investors consider just the coupon rate and the market price of the bonds while buying in the secondary market. But there are three other parameters that need to be factored in — yield-to-maturity (YTM), credit rating and liquidity.

When a bond is issued, the coupon rate is the annual rate of return. But this rate does not matter in the secondary market as bonds trade below or above their issue price. Investors need to focus on the YTM, which is the internal rate of return earned by an investor, who buys the bond today at the market price, holds till maturity, and enjoys all coupon and principal payments that are made on schedule.

Those who like to play it safe should pay attention to credit ratings. Bonds with AAA rating are considered to have the highest degree of safety in timely payment of principal and interest. Liquidity in a bond ensures that you get a good price while buying or selling.

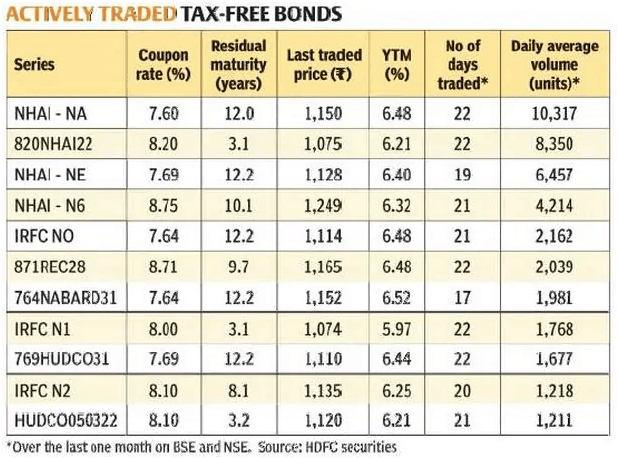

Conservative investors in the highest tax bracket and wanting regular income can consider buying tax-free bonds. Tax-free bonds that were issued by 14 state-run infrastructure financial companies between FY12 and FY16 are listed on the BSE and NSE and traded in the cash segment, along with equity shares. Interest on these instruments is paid annually. The interest income from the tax-free bonds is exempt from tax. There is no upper limit for investing in these bonds. There are 10 series of bonds of fairly good liquidity,trading with YTM of around 6.4 per cent. Since the interest paid by tax-free bonds is exempt from income tax, the average yield of 6.4 per cent translates to 9.2 per cent of pre-tax yield for investors in the 30 per cent bracket. This makes it a more viable option than bank fixed deposits. Currently, public and private sector banks offer 6-8 per cent pre-tax interest rate for five-year FDs.

However, it is important to bear in mind that selling tax-free bonds in the secondary market attracts capital gain tax. If you sell them within 12 months from the purchase date, you will have to pay tax on the gains as per your tax slab. If you sell after 12 months, the tax is a flat 10 per cent. Tax experts differ on the availability of indexation benefit for the listed bonds.

Since these entities are backed by the government, the investments in tax-free bonds enjoy capital safety. Further, the bonds issued by most of these companies are rated ‘AAA’ currently, including NHAI, PFC, IRFC, HUDCO, REC, IIFCL, JNPT, NHPC, NTPC, NHB and Nabard.

Data compiled by HDFC Securities shows that out of the 193 series of listed tax-free bonds, around 30 series are traded at least 15 days in a month (of 20-22 sessions). These bonds are available with a residual maturity of 3 to 12 years. Investors can buy the bonds that match their time horizon.

I Had Picked a 100 Bagger……….

I had purchased Page Industries in January, 2009 for Rs 315 and sold the same in January, 2010 for Rs825! Well, I thought I was smart to have booked over 160 per cent profit on my investment in less than year. But when I saw the price of the share crossing Rs. 36000 in August 2018 I could not but curse myself for being so stupid(impatient)

To have a 100-bagger we must have patience.The truth is, as the market evolves, the opportunities to spot 100 baggers are declining. The search is getting tougher. Why so?

Here are some interesting facts… A 100 bagger implies a return of 9900%. This translates into different CAGR returns for different times: 20% for 25 years… 26% for 20 years… 36% for 15 years… 58% for 10 years… and 151% for 5 years. So how many BSE-listed companies have had such returns?

BSE Listed Stocks That Became Hundred Baggers

| Period (Years) | ber of Hundered-Baggers |

|---|---|

| 5 | Nill |

| 10 | 10 |

| 15 | 66 |

| 20 | 85 |

| 25 | 30 |

Source: Ace Equity (closing date 13.08.18)

The shorter durations are avoided as there is a high chance of penny stocks making it to the list..

BSE has over 5,000 listed stocks, but as the above table indicates the number of hundred baggers constitute less than 2 per cent of the listed universe. In the last five years, not a single stock has multiplied 100 times. To say a 100-bagger is rare would be an understatement. Finding a 100-bagger in the current market is like finding a needle in a haystack. To spot one, you need exceptional foresight; insight into the business; and immense patience. Even if we spot a potential multi-bagger at the right time, chances are slim that we’ll hold on until it becomes a 100-bagger.