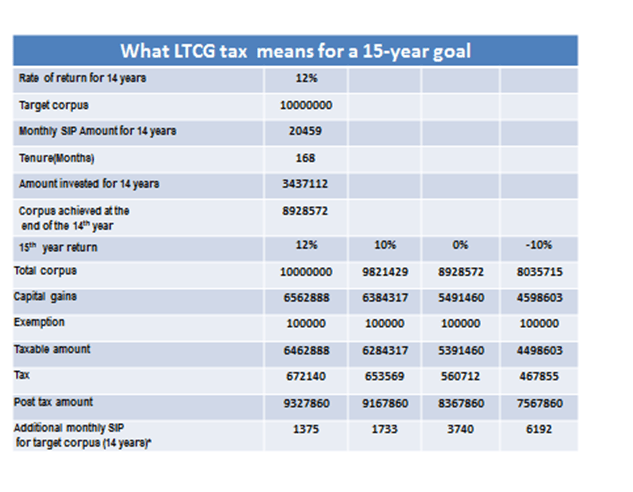

Tax is one aspect that permeates all aspects of financial planning. A basic understanding of the tax provisions is essential to save and invest in a tax efficient manner. However, it is important that our decisions are not clouded by tax considerations alone. What is required is to chase goals rather than returns. Nevertheless, one has to carefully study the effects of various tax provisions on one’s investments and achievement of goals. It is essential to bear in mind that tax framework is anything but stable. Every Finance Act either modifies the existing provisions or introduces new ones. Thus FY 2018-19 saw the introduction of of long term capital gains on equities and equity oriented investments while the interim budget of 2019, effectively increased the tax free threshold to Rs 5 lacs and also providing relief to those owning residential properties. Again budget for 2020-21 ushered in dual tax regimes while budget 2021-22 has introduced certain caps on investments that can be made in ULIPs and Provident Funds to avail of tax benefits on maturity proceeds, which were hither to tax free. We would advice investors to go through the monthly newsletter “Point to Ponder” which is under Blog sectionto obtain more information on such changes.

The following example illustrates the how it affects a goal that is to be achieved 15 years from now.