3 Rules to Prevent your Portfolio from Sinking

- July 20, 2022

- Posted by: Arunanjali Securities

- Category: Business

There is carnage on the markets across the globe, from Wall Street to Dalal Street. Only recently, one had to just go to sleep and wake up to see one’s wealth swelling. Now, it’s the reverse. Does this volatile world of investments offer any hope, at least for the long term investor? If one were to believe my friend who is a seasoned investor, there are just 3 rules to follow to prevent the investment portfolio from sinking. The trick he says, is not be overwhelmed by the surfeit of data and even information that markets spew out. He cites the example of Charles Darwin, arguably the greatest naturalist who ever lived and had more effect on our thinking than anybody. Darwin spent only four years travelling and the rest of the time thinking. This is a useful insight that can be applied in the sphere of investments. And according to him, you don’t have to reinvent the wheel. Luckily for us, thinking along these lines has already been done before. Among others, it has been undertaken by none other than Benjamin Graham, widely acknowledged as the father of value investing. After spending close to 60 years in the stock market, Ben Graham had to come to the sobering conclusion that he had no confidence in either his ability or anybody else’s, to predict the market. He went further and argued that most stockbrokers, financial analysts, and investment advisers are no doubt above average in intelligence and perhaps in honesty and sincerity as well. But they lack experience and an overall understanding of common stocks. They spend a large part of their time trying valiantly, to do things they can’t do well.

As per Graham, there are 3 main principles you need to follow to earn market beating returns over the long term.

- The individual investor should act consistently as an investor and not as a speculator. In other words, try and figure out what a company is worth and then buy it at some discount to this value.

- The investor should have a definite sell policy for all his common stock commitments.

- Finally, the investor should always have a minimum percentage of his total portfolio in common stocks and a minimum percentage in bonds.

My friend did not blindly accept the above rules, just because they were enunciated by Graham, the guru of value investing. He sought to validate them using back data over the last 10 years. Here is what he did.

The stocks were selected based on the following criteria:

The stock would have to have a revenue of at least Rs 200 crores for the latest financial year, average liquidity of at least Rs 1 m for the past one year, price to book value of 0.8 or lower, and a debt-to-equity ratio of almost zero.

A price to book value ratio of 0.8 or lower ensures that one is acting like an investor and not a speculator in that the stock is being bought below its fair value, which in this case is assumed to be its book value. A low debt to equity ratio of almost zero is to help filter out highly leveraged companies that are often of poor quality and can turn into value traps.

Selling rule was pretty straightforward i.e. liquidate all the positions after two years and create a brand new portfolio with the proceeds.

Last but not the least, allocation of funds between stocks and bonds was in the ratio of 75:25 if the Sensex PE on the date of portfolio creation was less than 25 and vice versa if the Sensex PE was more than 25.

The Sensex has averaged a PE of around 20-21 over the last many years. So a PE of more than 25 makes it significantly overvalued and prone to a market crash. This is why an allocation of only 25% to stocks if PE is 25 or more and 75% if lower.

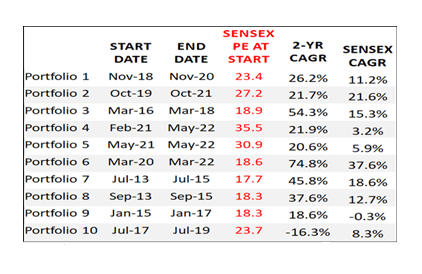

Next step was to pick 10 random dates from Microsoft Excel over the last 10 years, create a 20 stock portfolio on each of these days with a holding period of 2 years. So, if one of the random dates was 5th January 2013, the portfolio was started on that day, was held for two years, and then liquidated on 5th January 2015. Based on the above rules, a database was constructed drawing on historical data from BSE archives to arrive at the portfolio performance vis-à-vis the Sensex. The results are presented below: